Additional Coverages in CNA Insurance Cargo Transport Insurance

Transporting goods is a task that requires a lot of care, isn’t it? You never know what might happen along the way. An accident, theft, or even weather issues can put the products you’re shipping at risk.

Advertisements

That’s where CNA Insurance’s Cargo Transport Insurance comes in—a solution designed to protect your goods and help you avoid financial losses. Let’s walk you through everything about this insurance and how it can make your life easier.

Advertisements

What is CNA Insurance’s Cargo Transport Insurance?

First, let’s understand the basics: what is cargo transport insurance? It’s a protection that ensures you won’t face financial losses if something happens to the products you’re shipping.

This includes coverage for theft, accidents, transport damage, and even natural events, depending on your policy.

Advertisements

Now, speaking of CNA Insurance, it’s one of the largest insurers in the United States, with years of experience in the market. They offer comprehensive and tailored solutions for anyone who needs protection during the transportation of goods.

With CNA Insurance, you can have peace of mind and focus on what really matters: running your operations smoothly.

Benefits of CNA Insurance’s Cargo Transport Insurance

Still wondering if CNA Insurance’s cargo transport insurance is really necessary? Here’s a list of reasons why this choice can be a game-changer for your business. Check out the main benefits:

Comprehensive protection for your cargo

There’s nothing worse than investing in goods only to lose them due to theft or an accident, right? With CNA Insurance, you’re covered against various transportation risks, including theft, damage from accidents, and even natural events (if you choose additional coverage).

It’s the security you need to avoid financial losses.

Flexibility tailored to your business

Every transport operation is unique, and CNA knows that. That’s why you can customize your policy to match your cargo type, routes, and even the mode of transportation you use. Whether domestic, international, perishable, or high-value goods, the insurance is designed to meet your specific needs.

Long-term savings

It might seem like insurance is just another expense, but in reality, it’s a huge long-term saving. A single incident can cause losses far exceeding the cost of insurance. With this protection, you can avoid financial surprises and keep your budget intact.

Expert support always by your side

CNA is not just an insurer—it’s a partner. With a team specializing in cargo transport, you’ll have support at every step: from choosing the right policy to assistance in case of a claim.

It’s the kind of service that makes you feel valued and well cared for.

Additionally, securing your operations builds trust with your clients and partners. This not only strengthens your market reputation but also opens doors to new business opportunities.

After all, who wouldn’t prefer to work with a company that prioritizes safety and avoids unnecessary headaches?

Types of Cargo Transport Insurance Offered by CNA Insurance

CNA Insurance understands that each client has unique needs. After all, transporting goods can vary greatly depending on the type of cargo, the route, and even the mode of transportation used.

That’s why the insurer offers a range of options, ensuring protection for all types of logistics operations. Check out the main options:

Domestic Transport Insurance

If you transport goods within national borders, this is the ideal choice. It covers risks during transportation, whether by truck, train, or plane.

From loading to final delivery, your cargo is protected against common incidents such as theft or accidents.

International Transport Insurance

When your cargo needs to cross borders, the risks can increase. This insurance is perfect for protecting goods sent to other countries, whether by ship, plane, or other means.

It covers from the moment the cargo leaves your warehouse to its final destination, including stops at ports or customs checkpoints.

Perishable Cargo Insurance

Food, medicine, and other items with a short shelf life or specific transportation requirements, such as refrigeration, need special attention.

With this insurance, you’re covered against damages that could compromise the cargo’s integrity, such as failures in the cold chain or delays leading to losses.

High-Value Cargo Insurance

Transporting items like jewelry, electronics, high-tech machinery, or other valuable products requires a higher level of security. This insurance provides enhanced protection, ensuring that any unexpected event doesn’t result in significant financial losses for your business.

With this variety of options, CNA Insurance is prepared to serve small businesses and large logistics operations alike. Whatever your needs, there’s a tailored solution to protect your cargo and give you peace of mind during transportation.

Coverages Offered in Cargo Transport Insurance

Purchasing insurance is one of the best ways to ensure peace of mind when transporting goods. After all, unforeseen events can happen, and having proper protection makes all the difference.

With CNA Insurance’s Cargo Transport Insurance, you can choose between different types of coverage, depending on your needs. Here’s what’s available:

Basic Coverages

These are the most common protections, addressing the majority of situations encountered in cargo transportation:

- Theft during transport: Protects your cargo in case of theft or robbery along the route.

- Damage caused by traffic accidents: Covers losses resulting from collisions, overturns, or other accidents that may damage the goods.

- Fire or explosions: Ensures compensation if the cargo is damaged or destroyed by fire or explosions.

Additional Coverages (Optional)

If your operations require extra protection, you can purchase additional coverages to handle specific risks:

- Natural disasters: Protection against floods, storms, landslides, and other weather-related events.

- Damage caused by vandalism: Coverage for losses intentionally caused by third parties.

- Damage during loading and unloading: Ideal for protection against damage that may occur while handling the cargo.

Note: It’s important to carefully review the policy and understand what’s covered. This way, you can avoid surprises in the event of a claim.

How Does the Quotation and Contracting Process Work?

If you’re considering purchasing CNA Insurance’s cargo transport insurance, rest assured: the process is fast, simple, and hassle-free. Here’s how each step works to ensure your cargo is well-protected:

Step-by-step to purchase:

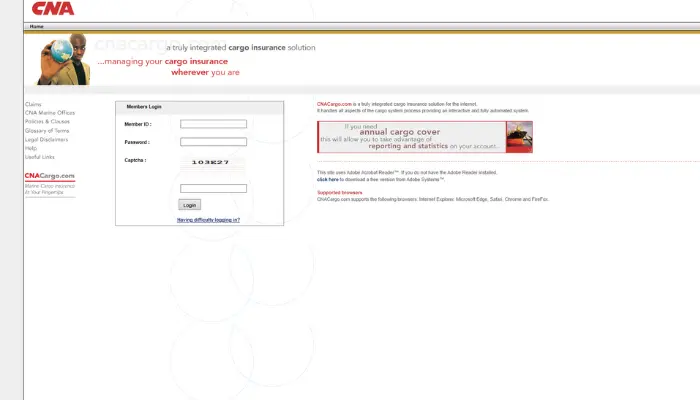

- Contact CNA: You can do this online or over the phone.

- Explain your needs: Provide details about the type of cargo, the route, and the transport frequency.

- Receive a proposal: CNA will create a customized plan for you, with detailed pricing and coverage options.

- Review and approve: Carefully read the contract, clarify any doubts, and when everything is in order, finalize the deal.

This process is quick and straightforward. In no time, your cargo will be fully protected.

Policyholder Responsibilities in Cargo Transport Insurance

Purchasing cargo transport insurance is a crucial step in safeguarding your business. However, it’s important to remember that it doesn’t exempt the policyholder from certain responsibilities.

Insurance is a partnership: while the insurer provides coverage and support in unforeseen events, the policyholder must fulfill specific duties to ensure everything runs smoothly.

These responsibilities are simple but essential to avoid issues when filing a claim. They involve proper documentation, compliance with regulations, and effective communication with the insurer. Here’s what you need to do to keep your protection active and avoid unpleasant surprises:

- Keep your documentation up to date: Always have invoices and transportation records organized and readily available.

- Follow transport regulations: Ensure that vehicles and drivers are properly registered and comply with legal standards.

- Report incidents promptly: If an incident occurs, such as an accident or theft, inform CNA Insurance as quickly as possible.

By adhering to these steps, you not only ensure your insurance functions correctly but also demonstrate professionalism and commitment to the safety of your cargo.

How Does the Claims Process Work?

Unforeseen events can happen, even with the best precautions in place. Whether it’s a traffic accident, theft, or another issue during transportation, knowing exactly how to proceed is crucial to activating your insurance and minimizing losses.

CNA Insurance’s claims process is straightforward and designed to make your life easier. However, it’s important to follow each step carefully:

- Notify the insurer: Contact CNA immediately and report the incident.

- Gather the necessary documents: You’ll need to provide details such as invoices, a police report, and photos of the incident.

- Submit the evidence: This may include reports and other documentation proving the damage or loss.

- Wait for the evaluation: CNA will review your case and, if everything is in order, approve the indemnity payment.

Being prepared and acting quickly is key to resolving the issue smoothly and efficiently.

Why Choose CNA Insurance for Cargo Transport Insurance?

Choosing the right insurer is critical to safeguarding your cargo and avoiding losses. CNA Insurance stands out for its decades of experience, a solid reputation built on satisfied customers, and service that truly understands the needs of your business.

With robust and tailored solutions, CNA is a reliable choice for those seeking peace of mind and efficiency.

- Experience: CNA has decades of expertise in the insurance market and knows the industry inside out.

- Trust: Numerous satisfied customers recommend CNA Insurance.

- Support: The team is always ready to assist, whether during the quotation process or in the event of a claim.

Opting for a dependable insurer ensures your cargo is protected, and you can focus on running your business without worry.

Tips for Choosing the Ideal Cargo Insurance

Selecting the right insurance is crucial to protecting your cargo and avoiding financial setbacks. Each business has its unique needs, and a well-planned insurance policy can make all the difference.

Evaluating your requirements, researching available options, and comparing proposals will help you find the best solution without unnecessary complications. Here are some tips to guide you:

- Understand your needs: What type of cargo do you transport? What are the main risks involved?

- Compare proposals: Request quotes and assess the cost-benefit of each option.

- Consider the coverage: Don’t choose based solely on price; focus on the protection offered.

- Research the insurer: Read reviews and check the company’s reputation in the market.

By following these tips, you’ll ensure your cargo is well-protected and your business stays on track.

Does CNA Insurance Cover Maritime Transport?

Yes! CNA Insurance offers specific insurance policies for maritime transport, covering both domestic and international operations.

This ensures your cargo is protected throughout the journey, regardless of the destination or conditions encountered along the way.

How Does International Transport Insurance Work?

CNA’s international transport insurance provides coverage for risks at every stage of the journey. From the moment your cargo leaves the point of origin to its final destination, you’re fully protected.

This includes unforeseen issues during customs clearance, intermediate stops, and even temporary storage periods.

What Types of Cargo Can Be Insured?

CNA Insurance offers solutions for virtually any type of cargo, including food, medicines, clothing, and high-value items like electronics and heavy machinery.

No matter what you’re transporting, CNA provides a tailored policy to meet your needs.

Now that you know everything about CNA Insurance’s Cargo Transport Insurance, it’s clear that protecting your shipments is not just about saving money—it’s about ensuring your business can keep growing, even when the unexpected happens.

CNA offers a complete and reliable solution with coverage options designed to suit your specific requirements.

If you’re in the business of transporting goods, don’t overlook the importance of this protection. Reach out to CNA Insurance to see how they can assist you. Safety is never too much, and your peace of mind is invaluable!