Everything about the Capital One Spark Cash Plus: benefits, rewards, and how to apply

The Capital One Spark Cash Plus is a financial solution tailored for businesses seeking simplicity and efficiency in their expenses. This business card offers a straightforward and attractive cashback program, ideal for entrepreneurs looking to maximize rewards while managing daily financial operations.

Advertisements

Focusing on the needs of businesses of all sizes, the Capital One Spark Cash Plus removes unnecessary complexities with its transparent policies. It combines practicality with exclusive benefits, becoming an essential tool for business owners who value direct returns on their spending.

Advertisements

Whether covering operational costs or investing in new opportunities, the Capital One Spark Cash Plus provides a simple yet rewarding approach. Its competitive cashback program stands out as a powerful incentive for those looking to make the most of their business expenses.

How to apply for the Capital One Spark Cash Plus Card

Applying for the Capital One Spark Cash Plus Card is a straightforward process designed to accommodate busy entrepreneurs and business owners. Here’s how you can apply through the official Capital One website:

Advertisements

- Visit the Official Capital One Website: Navigate to the Capital One homepage and locate the Spark Cash Plus card under the business credit card section. Click on the “Apply Now” button to begin the process.

- Provide Business Information: Enter essential details about your business, including the legal name, business type, industry, annual revenue, and Tax Identification Number (TIN). Accurate information is key to ensuring your application proceeds smoothly.

- Enter Personal Information: Capital One requires details about the primary cardholder, such as name, date of birth, Social Security Number (SSN), and contact information. These details are needed for identity verification and credit assessment.

- Review and Submit the Application: Double-check all the information you’ve provided for accuracy. Once everything looks correct, submit your application. You should receive an update on your application status shortly after.

- Await Approval: After submitting, Capital One will review your application. If approved, you’ll receive your card in the mail along with instructions on how to activate and start using it.

By having your business and personal information ready, you can complete the application process quickly and start enjoying the cashback rewards and benefits of the Capital One Spark Cash Plus Card.

Eligibility

The Capital One Spark Cash Plus is designed for business owners, whether they manage small, medium, or large enterprises. To qualify, applicants must provide valid business information, such as annual revenue and Tax ID (EIN). Additionally, a good personal credit score, typically above 700, is recommended to improve approval chances.

Capital One Spark Cash Plus Card Benefits and Perks

The Capital One Spark Cash Plus offers an appealing and straightforward rewards program for businesses. Key highlights include:

- 2% unlimited cashback on all eligible purchases, with no complex categories or spending caps.

- 5% cashback on hotel and rental car bookings made through the Capital One Travel portal.

In addition, the card provides exclusive advantages to streamline business management:

- Access to free employee cards, allowing your team to help maximize rewards.

- No annual fees for additional employee cards.

- Features like customizable spending reports and tools to track company expenses.

- Fraud protection and 24/7 support for any issues or concerns.

Minimum Income

To qualify for the Capital One Spark Cash Plus, it is recommended that the business has a minimum annual revenue of $50,000.

Annuity

The Capital One Spark Cash Plus comes with a fixed annual fee of $150, providing benefits and rewards that make this investment worthwhile for businesses looking to maximize their spending returns.

Coverage

International.

Flag

The Capital One Spark Cash Plus operates under the Mastercard network, ensuring wide acceptance both domestically and internationally.

Rates

The Capital One Spark Cash Plus has no preset spending limit, which adjusts based on the business’s payment capacity. It does not have an APR (Annual Percentage Rate) as the balance must be paid in full each month, eliminating interest charges.

Currently, there are no introductory offers, but it provides attractive cashback rewards as its main feature. Additionally, there is a fixed annual fee of $150, and the card does not charge foreign transaction fees.

How to check your bill

Capital One Spark Cash Plus users can easily manage their accounts through the Capital One online portal or mobile app. These platforms enable access to statements, tracking of accrued rewards, and setting up payment alerts. Businesses with multiple employee cards can set customized spending limits and access detailed reports to centrally and efficiently monitor expenses, ensuring complete financial control.

How to Unlock Your Card

Unlocking your Capital One Spark Cash Plus card is a quick and simple process. If your card is temporarily locked, log in to your Capital One account via the mobile app or online portal. Navigate to the card management section, select your Spark Cash Plus card, and choose the “Unlock Card” option. Follow the on-screen prompts, and your card will be reactivated instantly. For further assistance, you can contact Capital One customer support, available 24/7.

Application

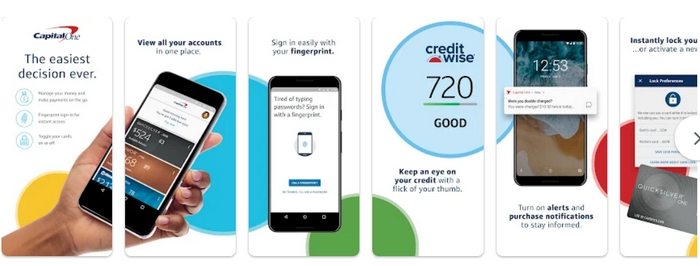

Managing your Capital One Spark Cash Plus has never been easier with the Capital One mobile app. Follow these steps to download and make the most of the app’s features:

- Go to the App Store (iOS) or Google Play Store (Android) and search for “Capital One.” Click “Install” and wait for the download to complete.

- Log In: Open the app and enter your Capital One account credentials (username and password) or create an account if you don’t have one yet.

- Add Your Card: Once logged in, add your

- Spark Cash Plus: card by confirming the card details to link it to the app.

- Manage Your Finances: Use the app to view transactions, track rewards, pay bills, and set up spending alerts. You can also assign limits for employee cards and access detailed financial reports.

- Security and Support: Lock or unlock your card, receive real-time notifications, and contact Capital One support directly through the app.

With the Capital One app, you have full control of your business finances right at your fingertips, ensuring convenience and security.

Contact

Capital One Spark Cash Plus cardholders have access to a variety of customer service options for efficient and reliable support:

- 24/7 Customer Support Hotline: Available via phone for assistance with card-related issues.

- Online Chat: Direct access to support through the Capital One portal or mobile app.

- FAQ and Self-Help Resources: A comprehensive database of frequently asked questions and guides on the official website.

- Email Support: For less urgent inquiries, messages can be sent directly through the online portal.

- International Assistance: Specialized help for cardholders traveling outside the United States.

These options ensure you have the assistance needed to manage your account with ease.