U.S. Bank Cash+®️ Secured Visa®️: Everything You Need to Know

Looking for a smart and secure way to build or rebuild your credit? The U.S. Bank Cash+®️ Secured Visa®️ might be the perfect solution for you. This card offers the flexibility of a traditional credit card, but with the safety of an initial deposit that sets your spending limit. Plus, it allows you to earn rewards in categories you choose, making it a smart choice for those seeking financial control and benefits.

Advertisements

With the U.S. Bank Cash+®️ Secured Visa®️, you not only improve your credit score but also enjoy exclusive perks like cashback on everyday purchases. Perfect for those who want to balance financial responsibility and rewards, this card is a powerful tool to help you achieve your goals. Keep reading to learn how it can transform your financial life!

Advertisements

U.S. Bank Cash+®️ Secured Visa®️ Benefits

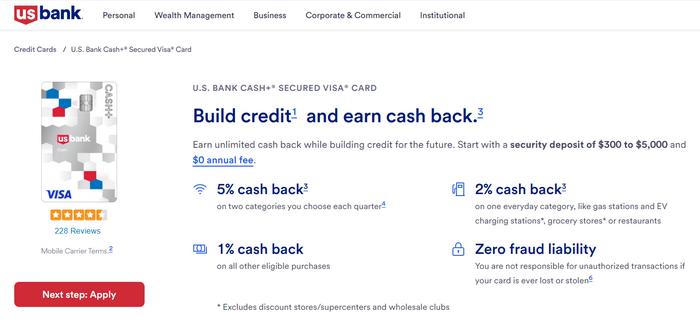

The U.S. Bank Cash+®️ Secured Visa®️ is more than just a secure card: it’s a comprehensive tool for those seeking convenience, rewards, and financial control. With benefits ranging from cashback in categories you choose to the ability to improve your credit score, it becomes an indispensable ally for daily expenses and travel. Check out the key advantages that make this card a smart choice:

- Customizable Cashback: Choose two categories to earn up to 5% cashback, such as dining, groceries, or transportation, and a third category with 2% cashback. Perfect for maximizing savings on everyday expenses.

- Security and Control: As a secured card, it allows you to set your spending limit based on your initial deposit, helping you maintain financial control while building or rebuilding your credit.

- Travel Perks: Accepted worldwide, the card also offers cashback on transportation and lodging, making your trips more economical and rewarding.

- Credit Reporting: Responsible use of the card is reported to credit bureaus, helping you improve your credit score over time.

With these benefits, the U.S. Bank Cash+®️ Secured Visa®️ stands out as a complete option for those seeking convenience, rewards, and a healthier financial life.

Advertisements

How to Apply for the U.S. Bank Cash+®️ Secured Visa®️

Applying for the U.S. Bank Cash+®️ Secured Visa®️ is a simple and quick process, designed to help you start your journey toward building or rebuilding your credit. With clear requirements and well-defined steps, you can ensure your approval and start enjoying the card’s benefits in no time. Check out the complete step-by-step guide to apply:

- Check the Requirements: Before starting the application, make sure you meet the basic criteria, such as minimum age (18 in the U.S.) and the ability to make an initial deposit that will serve as collateral for your credit limit.

- Visit the Official Website: Go to the U.S. Bank website and locate the Cash+®️ Secured Visa®️ page. There, you’ll find the button to start your application.

- Fill Out the Form: Provide your personal information, such as your name, address, Social Security Number (SSN), and financial details. This process is secure and protects your data.

- Set Your Initial Deposit: Choose the deposit amount that will determine your credit limit. The minimum and maximum amounts may vary, so select a value that fits your budget.

- Wait for Approval: After submitting your application, U.S. Bank will review your information. Approval is usually quick, especially since the card is secured by your deposit.

- Receive and Activate Your Card: Once approved, your card will be mailed to you. Follow the instructions to activate it and start enjoying the benefits right away.

With this step-by-step guide, applying for the U.S. Bank Cash+®️ Secured Visa®️ becomes an easy and accessible task. Get ready to take advantage of all the perks it offers!

Fees and Charges

Before applying for the U.S. Bank Cash+®️ Secured Visa®️, it’s important to understand the fees and charges associated with the card. Knowing these costs helps you better plan your finances and avoid unpleasant surprises. Below, we list the main fees and explain how they work:

- Annual Fee: The card has no annual fee, making it an affordable option for those seeking a secured card without recurring costs.

- ATM Withdrawal Fee: Cash advances come with a fee of $5 or 3% of the amount withdrawn (whichever is greater). Additionally, the ATM may charge extra fees.

- Foreign Transaction Fee: For purchases in foreign currencies, a 3% conversion fee is applied to the transaction amount.

- Late Payment Fee: Payments made after the due date may result in a fee of up to $40, depending on your billing amount.

- Over-the-Limit Fee: If a transaction exceeds your credit limit, you may be charged a fee of up to $40.

These fees are standard for secured cards and may vary depending on usage. To avoid extra costs, it’s essential to pay your bill on time and within your credit limit. Understanding these charges allows you to make the most of the U.S. Bank Cash+®️ Secured Visa®️ benefits without worries.

Rewards Program

The U.S. Bank Cash+®️ Secured Visa®️ offers a flexible and rewarding program, perfect for those looking to maximize the benefits of a secured card. With the ability to earn cashback in categories you choose, it becomes an excellent tool for saving on everyday expenses. Here’s how it works and how to make the most of these rewards:

- Customizable Cashback: Choose two categories to earn 5% cashback, such as dining, groceries, transportation, or streaming services. Additionally, select a third category to earn 2% cashback. The options are updated quarterly, allowing you to adjust your choices based on your needs.

- Cashback on All Purchases: For expenses outside your selected categories, you still earn 1% cashback, ensuring all your purchases are rewarded.

- No Cashback Limit: There’s no cap on the amount of cashback you can earn, meaning the more you use the card, the more you earn.

- Easy Redemption: Cashback can be redeemed as a statement credit, a deposit into your bank account, or as a gift card, offering flexibility to use your rewards however you prefer.

With this rewards program, the U.S. Bank Cash+®️ Secured Visa®️ stands out as a smart choice for those seeking real benefits while building or rebuilding their credit. Make the most of your purchases and turn everyday spending into savings!

How to Increase the Credit Limit

Increasing the credit limit on your U.S. Bank Cash+®️ Secured Visa®️ can be a great way to enhance your financial flexibility and optimize your card usage. However, it’s important to adopt responsible practices to ensure the increase is approved and benefits your financial health. Below, we’ve listed effective strategies to help you achieve a higher limit. Check out the tips and start planning your next move!

Pay Your Bills on Time

Maintaining a history of on-time payments is crucial to demonstrating financial responsibility. U.S. Bank evaluates your payment behavior when considering a credit limit increase, so avoid late payments and always pay the full amount or more than the minimum due.

Use Credit Moderately

Using only a portion of your available limit (ideally less than 30%) shows that you manage credit well. This increases your chances of approval for a higher limit, as the bank sees that you don’t rely excessively on the card.

Contact the Bank

After a few months of responsible use, contact U.S. Bank to request a credit limit increase. Be prepared to justify your request with information about your income and payment history.

Increase Your Income

A boost in income can strengthen your credit limit request. If your financial situation has improved, inform the bank and provide updated documentation, such as pay stubs or tax returns.

How to Use the U.S. Bank Cash+®️ Secured Visa®️ Abroad

The U.S. Bank Cash+®️ Secured Visa®️ is an excellent choice for international travel, thanks to its global acceptance. As a Visa card, it’s recognized at millions of locations worldwide, from restaurants and hotels to shops and tourist attractions. This means you can rely on it for secure and convenient payments during your trips, without needing to carry large amounts of cash.

However, it’s important to be aware of the fees associated with international use. The card applies a 3% currency conversion fee on transactions made in foreign currencies. While this fee is standard for most international cards, it can impact your spending if not planned for. To minimize costs, consider researching local exchange rates and, if possible, opt for payments in U.S. dollars when available.

Additionally, before traveling, don’t forget to notify U.S. Bank of your plans. This prevents international transactions from being flagged for security reasons. With the U.S. Bank Cash+®️ Secured Visa®️, you can explore the world with convenience and security, making the most of your international adventures.

How to Download and Use the App

Managing your finances has never been easier with the U.S. Bank Cash+®️ Secured Visa®️ app. Available for iOS and Android devices, the app offers an intuitive and comprehensive experience to track your spending, pay bills, and monitor your rewards. If you haven’t downloaded the app yet, check out the step-by-step guide below and discover how it can simplify your financial life.

- Download the App: Go to the App Store (for iPhone) or Google Play Store (for Android) and search for “U.S. Bank Mobile App.” Click “Install” and wait for the download to complete.

- Log In or Create an Account: Open the app and enter your U.S. Bank Online Banking credentials. If you don’t have an online account yet, follow the instructions to register using your card number and personal information.

- Access Card Features: Once logged in, you’ll have access to all the details of your U.S. Bank Cash+®️ Secured Visa®️, including your current balance, credit limit, recent transactions, and cashback rewards.

- Manage Your Finances: Use the app to pay bills, set spending alerts, track your rewards, and even lock your card in case of loss or theft. The user-friendly interface and powerful tools make financial management simple and efficient.

Contact

If you need assistance with your U.S. Bank Cash+®️ Secured Visa®️, the institution offers multiple support channels to ensure your questions are resolved quickly and efficiently. With a customer service team known for its quality and availability, you can rely on help whenever you need it, whether for account inquiries, transaction issues, or card benefits.

The main contact options include phone support, available 24/7, where you can speak directly with a representative. Additionally, the online chat on the U.S. Bank website provides a quick way to resolve issues without leaving home. For those who prefer written communication, email and the contact form on the website are also effective alternatives.

For simpler queries, such as checking your balance or locking your card, the U.S. Bank mobile app is a convenient and accessible tool. No matter which channel you choose, the support for the U.S. Bank Cash+®️ Secured Visa®️ is known for its efficiency and professionalism, ensuring you have the best possible experience.