Amex Blue Cash Preferred® Card: Complete Application and Usage Guide

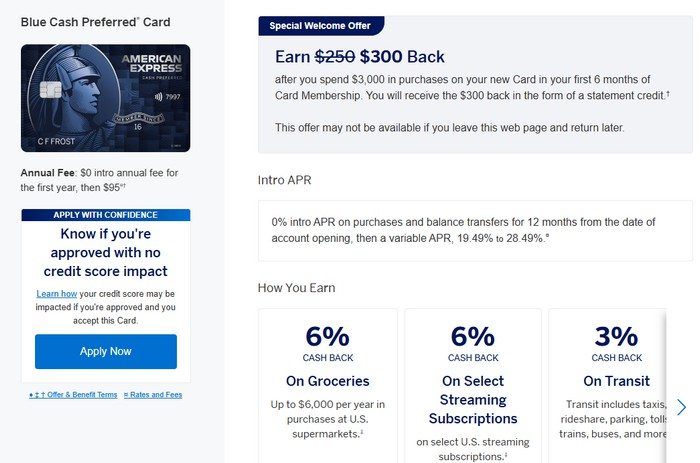

The Amex Blue Cash Preferred® Card is one of the most popular cash back credit cards in the United States, designed for consumers who want to earn high rewards on everyday spending—especially groceries, streaming services, and transit. Issued by American Express, a globally recognized financial institution, this card is best suited for individuals with good to excellent credit who want to maximize cash back without managing complex reward systems.

Advertisements

Unlike secured or credit-builder cards, the Blue Cash Preferred® is an unsecured credit card, meaning no security deposit is required. Approval is based on creditworthiness, income, and overall financial profile. With strong cash back categories and premium Amex benefits, it is widely used by families and professionals seeking real value from recurring expenses.

Advertisements

With millions of U.S. households spending heavily on groceries, gas, and subscriptions, the Amex Blue Cash Preferred® stands out as a practical card that transforms daily purchases into consistent cash back savings.

Step-by-Step Guide to Apply for the Amex Blue Cash Preferred® Card

The application process for the Amex Blue Cash Preferred® Card is straightforward and can be completed entirely online. Unlike secured cards, this product does require a credit evaluation, though American Express is known for a relatively smooth and transparent approval process.

Advertisements

- Check eligibility requirements: You must be at least 18 years old, be a legal U.S. resident, have a valid Social Security Number (SSN), and maintain good to excellent credit (typically FICO 690+ recommended).

- Access the American Express website: Visit www.americanexpress.com and navigate to the credit cards section. Locate the Blue Cash Preferred® Card.

- Click “Apply Now”: This will redirect you to a secure application form.

- Provide personal information: Enter your full legal name, SSN, date of birth, residential address, phone number, and email address.

- Enter financial details: Report your total annual gross income, employment status, and housing costs.

- Review card terms and benefits: Carefully review the annual fee, APR ranges, rewards structure, and cardmember agreement.

- Submit the application: After accepting the terms, submit your application for review.

- Receive a decision: Many applicants receive instant approval. In some cases, Amex may request additional verification.

- Receive your card: Approved cards are typically delivered within 7–10 business days, with expedited shipping often available.

- Activate your card: Activate online, via the Amex mobile app, or by phone once received.

What Network Does the Amex Blue Cash Preferred® Use?

The Amex Blue Cash Preferred® operates on the American Express payment network, which functions as both issuer and processor. This integrated model allows American Express to offer enhanced customer service, advanced fraud protection, and exclusive cardmember benefits.

While American Express acceptance is slightly lower than Visa or Mastercard, it is widely accepted across the U.S. and internationally, particularly at major retailers, grocery stores, and service providers. Key network benefits include:

- Real-time fraud monitoring

- Purchase protection and extended warranty

- Amex Offers with statement credits

- Global Assist® Hotline for travel emergencies

Amex Blue Cash Preferred® Card Fees

Understanding the fee structure is essential before applying.

- Annual fee: $95 (often waived for the first year)

- Purchase APR: Variable, typically 19.24%–29.99% based on creditworthiness

- Cash advance APR: Higher than purchase APR

- Foreign transaction fee: None

- Late payment fee: Up to $40

- Returned payment fee: Up to $40

There is no security deposit, no setup fee, and no application fee.

Understanding the Amex Blue Cash Preferred® Card

The American Express Blue Cash Preferred® Card was designed with a different objective than secured or credit-builder products: to maximize cash back on everyday spending for consumers with established credit. As an unsecured credit card, it does not require any security deposit and approval is based on creditworthiness, income, and overall financial profile. This makes it ideal for individuals who already have good to excellent credit and want to extract tangible value from recurring household expenses.

The real strength of the Blue Cash Preferred® lies in its generous cash back structure, especially on categories that represent a significant portion of monthly budgets. By offering elevated rewards on U.S. supermarket purchases, streaming services, gas, and transit, the card turns routine expenses into consistent statement credits. All account activity is reported to the three major U.S. credit bureaus—Equifax, Experian, and TransUnion—helping cardmembers maintain and strengthen their credit profile through responsible use.

Over time, consistent on-time payments and low credit utilization with the Amex Blue Cash Preferred® can contribute to a stronger credit score, increased credit limits, and access to even more premium American Express products. While this card is not designed to build credit from scratch, it plays an important role in maintaining excellent credit health while delivering meaningful financial rewards on everyday spending.

What are the Main Benefits of the Amex Blue Cash Preferred® Card

The American Express Blue Cash Preferred® Card offers a set of benefits focused on maximizing cash back on everyday spending while providing the reliability, security, and service quality associated with American Express. Unlike secured or credit-builder cards, its value proposition is centered on reward optimization, premium protections, and long-term financial efficiency for consumers with good to excellent credit.

- High cash back at U.S. supermarkets: Earn 6% cash back on purchases at U.S. supermarkets (up to $6,000 per year, then 1%), making it one of the strongest grocery reward cards available.

- Cash back on streaming services: Receive 6% cash back on select U.S. streaming subscriptions, ideal for households with multiple digital services.

- Everyday transportation rewards: Earn 3% cash back at U.S. gas stations and on transit, including rideshares, parking, tolls, trains, and buses.

- Unlimited 1% cash back on other purchases: All remaining eligible purchases earn consistent rewards with no spending cap.

- No foreign transaction fees: Use the card internationally without paying additional fees on purchases made abroad.

- Strong American Express security protections: Includes real-time fraud monitoring, purchase protection, extended warranty, and dispute resolution support.

- Amex Offers and statement credits: Access targeted promotions that provide additional savings through statement credits or bonus rewards.

- Credit bureau reporting: Account activity is reported to Equifax, Experian, and TransUnion, helping maintain and strengthen an established credit profile.

- User-friendly mobile app: Manage spending, payments, rewards, alerts, and offers through the American Express app.

- Premium customer service: American Express is widely recognized for fast, efficient, and high-quality customer support.

- Introductory offers: Many applicants qualify for welcome bonuses and introductory APR periods on purchases or balance transfers (subject to current promotions).

- Flexible redemption: Cash back is earned as Reward Dollars and can be redeemed easily as statement credits with no complicated reward system.

This combination of high everyday rewards, premium protections, and ease of use makes the Amex Blue Cash Preferred® Card an excellent choice for families and individuals seeking consistent cash back without complexity.

How to Download the Amex Blue Cash Preferred® Card App

The American Express mobile app is the primary tool for managing your Amex Blue Cash Preferred® Card, tracking cash back rewards, monitoring spending, activating Amex Offers, and making payments securely. The app is designed to provide full control over your account in real time, making day-to-day financial management simple and efficient.

For Android devices:

- Open the Google Play Store on your Android smartphone or tablet.

- Tap the search icon (magnifying glass) at the top of the screen.

- Type “American Express” in the search bar.

- Locate the official app developed by American Express. Always confirm the developer name to ensure authenticity and avoid fraudulent applications.

- Tap the app to open its details page, where you can review features, screenshots, and user ratings.

- Tap the “Install” button and wait for the app to download and install automatically.

- Once installation is complete, tap “Open” or locate the American Express app icon on your home screen.

- Sign in using your existing American Express credentials or create an account if this is your first Amex product.

For iOS devices (iPhone and iPad):

- Open the App Store on your iPhone or iPad.

- Tap the search icon (magnifying glass) in the bottom navigation bar.

- Enter “American Express” in the search field.

- Identify the official app published by American Express, confirming the developer name for security.

- Tap the app to access the full information page.

- Tap “Get” and authenticate using Face ID, Touch ID, or your Apple ID password.

- Wait for the app to download and install, which typically takes only a few seconds with a stable internet connection.

- Tap “Open” or find the American Express app on your device’s home screen and log in.

Once configured, the American Express app allows you to monitor cash back earnings, pay your statement, set alerts, review transactions, and manage all card features associated with the Amex Blue Cash Preferred® Card in one place.

How to Request a Replacement Amex Blue Cash Preferred® Card

Situations that require a replacement card are relatively common and may include loss, theft, physical damage (such as a broken chip or worn magnetic stripe), suspected fraud, or expiration of the card. American Express offers a streamlined and efficient replacement process to ensure continued access to your account with minimal disruption.

The fastest and most convenient way to request a replacement is through the American Express mobile app. After logging in, navigate to your Blue Cash Preferred® Card account and select options such as “Account Services,” “Replace a Card,” or “Report Lost or Stolen Card.” If the card is reported as lost or stolen, American Express will immediately block the card to prevent unauthorized transactions and issue a replacement with a new card number.

You may also request a replacement through the American Express website. Log in at www.americanexpress.com, access your credit card account, and follow the instructions under card management to request a new card. This option is especially convenient for users who prefer managing their accounts via desktop.

In the event of theft, it is recommended to report the incident promptly and review recent transactions for any unauthorized charges. American Express has a strong fraud protection policy and typically does not charge replacement fees, whether the card was lost, stolen, damaged, or expired, reinforcing its reputation for premium customer service.

Amex Blue Cash Preferred® Card Contacts

American Express offers multiple customer support channels to ensure cardmembers receive fast, reliable, and efficient assistance for any issue related to the Amex Blue Cash Preferred® Card. Below are the official contact methods, organized for clarity and ease of access:

- Customer Service Phone Support: Call 1-800-528-4800 to speak directly with an American Express representative. Support is available 24/7 for a wide range of needs, including account questions, balance and payment inquiries, reporting a lost or stolen card, disputing transactions, requesting card replacements, understanding fees, and general account assistance.

- American Express Mobile App: The Amex app provides secure in-app messaging and account management. Cardmembers can chat with support, review transactions, make payments, lock or replace cards, and manage account settings without calling. This option is ideal for both urgent and non-urgent requests.

- Official Website: Visit www.americanexpress.com and log in to your account to access the Help Center, FAQs, step-by-step guides, and self-service tools. The website allows full account management and support access from a desktop or mobile browser.

- Global Assist® Hotline (Travel Support): Available to cardmembers while traveling, offering emergency assistance such as card replacement coordination, medical or legal referrals, and travel-related support.

- Social Media Channels: American Express maintains verified profiles on platforms such as Twitter (X), Facebook, Instagram, and LinkedIn. These channels are useful for general inquiries and service updates, but sensitive account information should never be shared publicly.

- Mailing Address (Formal Correspondence):

American Express

P.O. Box 981535

El Paso, TX 79998

This address is appropriate for official documents, written disputes, or formal communications.

- Consumer Financial Protection Bureau (CFPB): If an issue cannot be resolved through American Express support channels, consumers may file a complaint with the Consumer Financial Protection Bureau via www.consumerfinance.gov, the U.S. federal agency responsible for overseeing consumer financial products and dispute resolution.

These support options reflect American Express’s reputation for premium customer service and rapid issue resolution.