All About the Citi Strata Elite: How to maximize benefits and rewards

The Citi Strata Elite is one of the most sought-after credit cards for those looking for exclusive benefits and personalized service. With a range of advantages that cater to various customer profiles, it offers everything from access to rewards programs to special conditions on purchases and services.

Advertisements

In this article, we will explore all the details of the Citi Strata Elite, including its main benefits, how to apply for the card, associated fees, and tips to make the most of what it has to offer. Keep reading to find out why this card might be the perfect choice for your financial needs.

Advertisements

How to Apply for the Citi Strata Elite

The application process for the Citi Strata Elite is simple and straightforward, allowing you to enjoy all the exclusive benefits of the card with ease. To apply, just follow a few quick online steps and make sure you meet the necessary requirements. Below, we explain how to apply for the Citi Strata Elite in an easy and efficient way.

- Visit the official Citi Strata Elite website.

- Click on the “Apply Now” button to begin the application process.

- Fill in the form with your personal information, such as your name, address, and contact details.

- Provide your financial information, including your annual income and other relevant details.

- Review the information entered and submit your application.

- Wait for your application to be processed and receive a response within a few business days.

Requirements:

Advertisements

- Minimum age of 18 years.

- Specific minimum annual income (typically, Citi requires an amount above $30,000).

- Good to excellent credit history (usually above 700 points).

- Identification document (such as ID or Social Security number).

- Must be a resident of the country where the card is issued.

By following these steps and meeting the requirements, you’ll be ready to apply for the Citi Strata Elite and enjoy all of its exclusive benefits.

Advantages of the Citi Strata Elite

The Citi Strata Elite is one of the most comprehensive credit cards on the market, designed to offer exclusive advantages to its users. Perfect for those looking to maximize rewards and access a range of benefits that make everyday life easier, this card goes beyond the usual credit card functions. Below, we’ll explore the key benefits that make the Citi Strata Elite such an attractive option.

- Exclusive Rewards Program: Earn points for every dollar spent and redeem them for travel, products, or statement credits.

- Access to VIP Lounges: Enjoy access to airport VIP lounges around the world, enhancing your travel experience.

- Comprehensive Travel Insurance: The card provides coverage for medical emergencies, trip cancellations, and lost luggage, giving you peace of mind during your travels.

- Exclusive Discounts and Offers: Access special promotions and discounts at various partner merchants, such as hotels, restaurants, and car rental services.

- Concierge Services: Personalized concierge service to assist with reservations, special events, and other tailored services.

These benefits make the Citi Strata Elite the perfect card for those seeking flexibility, financial perks, and exclusivity.

Fees and Charges of the Citi Strata Elite

While the Citi Strata Elite offers a range of exclusive benefits, it’s essential to understand the associated fees. Although some fees may be high, the benefits provided by the card often justify the costs. Below, we highlight the main fees and charges related to this premium card.

- Annual Fee: The annual fee for the Citi Strata Elite is $500, which grants access to all of the card’s exclusive benefits.

- Foreign Transaction Fee: There are no additional fees for purchases made abroad, making international shopping easier.

- ATM Withdrawal Fee: If you need to withdraw cash, the fee will be $15 or 6% of the withdrawal amount, whichever is greater.

- Late Payment Charges: The late payment fee can reach up to $40.

These fees are relatively common for premium cards, but as mentioned, the benefits provided by the Citi Strata Elite can make these costs worthwhile for frequent users.

Rewards Program

The Citi Strata Elite offers a strong and attractive rewards program, ideal for those looking to maximize the benefits of every purchase. By using the card, you accumulate points that can be redeemed for a variety of options, from travel to exclusive products. Below, we highlight how the rewards program works and how you can make the most of it.

- Earn points: You earn 2 points per dollar spent in selected categories such as travel and dining, and 1 point per dollar on other purchases.

- Redeem points: The accumulated points can be redeemed for travel, products, experiences, and statement credits. The program’s flexibility allows you to choose how to use your points based on your needs.

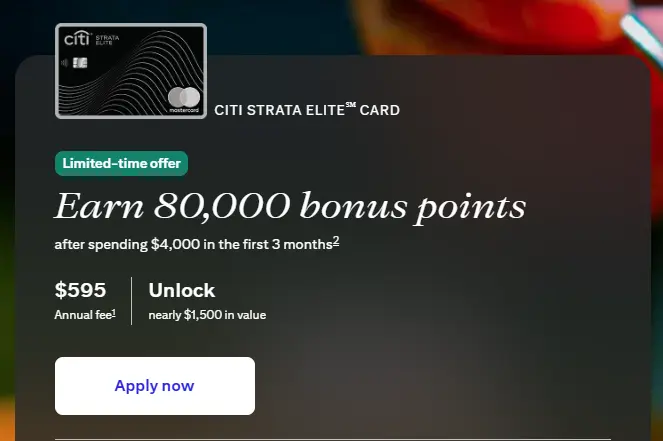

- Welcome bonus: After meeting the minimum spend within the first three months, you receive a substantial points bonus, giving you a head start on earning rewards.

- Exclusive promotions: The Citi Strata Elite offers access to special promotions with partners, allowing you to earn extra points on selected purchases.

With this rewards program, the Citi Strata Elite provides a practical and valuable way to enjoy your everyday purchases and get more value from your transactions.

How to Increase the Credit Limit

If you’re looking to increase your Citi Strata Elite credit limit, there are several effective strategies that can help you secure an approval. By using your card responsibly and demonstrating good financial behavior, you can improve your chances of getting a higher credit limit. Below, we explore some valuable tips to effectively increase your credit limit.

Maintain a Good Payment History

A solid payment history is key to increasing your credit limit. When reviewing your request for an increase, American Express will look at your financial behavior, especially how punctual you are with paying your bills. Staying on time with payments and avoiding late fees will reflect positively, showing the bank that you are a reliable customer.

In addition, keeping your balance below 30% of your available limit demonstrates that you can manage your spending. This practice also directly impacts your credit score, making you more likely to be approved for a higher limit.

Request an Increase After Six Months of Use

After using your Citi Strata Elite for at least six months, you will have a usage history that can justify requesting a higher limit. During this time, the bank can evaluate how you’ve used the card and whether the current limit is suitable for your needs. This period is important because it shows the bank that you have a stable financial behavior.

Requesting an increase after this time frame also allows you to demonstrate consistent payment history, which increases your chances of approval. During this period, it is crucial to use the card responsibly and always pay your bill on time.

Report income increase

If your income has increased since your initial Citi Strata Elite application, inform the bank of this change. An increase in your repayment capacity justifies an increase in your credit limit, as the bank will see that you have more financial resources to handle a higher limit. This update can be easily made through customer service.

With your higher income, the bank may consider you more capable of handling a higher credit limit, which increases your chances of success when requesting an increase. Furthermore, this update helps reflect your true repayment capacity.

Avoid requesting multiple limit increases

Requesting multiple limit increases at the same time can hurt your chances of getting a Citi Strata Elite increase. The bank may interpret this as an attempt to access more credit than you can handle, which can decrease the likelihood of success. It’s recommended to request an increase individually, based on your financial behavior and the need for the increase.

Furthermore, if you’ve already requested an increase on other credit cards, this may affect the bank’s review. American Express generally views excessive requests as a risk, so only request an increase when truly necessary and with a good history of card use.

How to Use the Citi Strata Elite Abroad

The Citi Strata Elite offers practical benefits for travelers, including no foreign transaction fees and exclusive perks. Here are a few tips for making the most of your card abroad:

- Take Advantage of No Foreign Transaction Fees: Make purchases abroad without extra fees, benefiting from a competitive exchange rate.

- Access Exclusive Travel Benefits: Enjoy comprehensive travel insurance and access to VIP airport lounges worldwide.

- Notify the Bank About Your Travel: Inform the bank about your travel to avoid card blocks and ensure smooth transactions.

- Use the Rewards Program for Travel: Earn points on your international purchases and redeem them for travel, products, and exclusive benefits.

How to Download the App

Downloading the Citi Strata Elite app is simple and allows you to manage your finances conveniently and efficiently. With the app, you can track spending, pay bills, redeem rewards, and much more, all from your phone. Here’s how to download it:

- Go to the Google Play Store (for Android) or the App Store (for iOS).

- Search for “Citi Mobile” in the search bar.

- Click “Install” and wait for the download to complete.

- Open the app and log in with your credentials to start using all the features.

Now, with the app, you can manage your Citi Strata Elite quickly and easily, wherever you are.

Contact

The Citi Strata Elite offers multiple communication channels to ensure you receive support whenever needed. Whether you have questions about your card, want to learn more about the benefits, or need to resolve specific issues, American Express provides different ways to get in touch. Here are the main contact options:

- Phone Support: Call 1-800-950-5114 for assistance.

- Online Chat: Visit the Citi website or app to chat with a representative quickly and directly.

- Social Media: American Express is active on Facebook, Twitter, and Instagram, where you can find information and ask questions.

- Email Support: You can send emails through the official website for more detailed inquiries, and a support representative will respond.

These channels ensure that you receive fast and efficient assistance for any questions related to your Citi Strata Elite.