Amex Platinum Credit Card: Know the benefits and advantages

The Amex Platinum credit card, issued by the renowned institution American Express, is positioned as one of the most coveted premium cards in the international financial market.

Advertisements

It goes beyond simply allowing financial transactions, offering its holders a wide range of exclusive benefits and advantages. From access to VIP lounges at airports around the world, to credits for specific expenses, to a highly competitive rewards program.

Advertisements

Amex Platinum is the ideal choice for those seeking luxury, convenience and unparalleled customer service. Therefore, find out more about this card with the content below.

Benefits and Perks of the Citi American Airlines Card

The Amex Platinum card, from American Express, is recognized not only for its prestige, but especially for the benefits and advantages it offers to its cardholders. Let’s explore some of the most notable ones:

Advertisements

- Lounge Access: Amex Platinum holders have access to more than 1,200 airport lounges in more than 130 countries, including the coveted Centurion Lounge, providing a comfortable environment to relax and work before flights.

- Rewards Program: The card allows you to accumulate points on each purchase, which can be exchanged for travel, accommodation, upgrades and other exclusive prizes within the Membership Rewards program.

- Travel Credits: Each year, holders receive credits to be used toward travel expenses, ranging from baggage fees to airport meal credits.

- Personalized Service: 24/7 concierge service is available to help with restaurant reservations, event tickets or any other needs, ensuring a premium experience.

- Accommodation Upgrades: When booking hotels and resorts through the Fine Hotels & Resorts program, holders are entitled to benefits such as free breakfast, room upgrades, late check-out, among others.

- Exemption from International Fees: When using the card abroad, there are no international transaction fees, making it ideal for travel.

- Travel Insurance: The card offers a range of insurance, covering everything from trip cancellation to lost luggage, ensuring greater peace of mind when traveling.

- Exclusive Experiences: Through the “By Invitation Only” program, cardholders have access to exclusive events and experiences, from fashion shows to private dinners with renowned chefs.

Amex Platinum, therefore, goes far beyond a simple payment method. It represents a lifestyle, offering convenience, luxury and memorable experiences, reaffirming its status as one of the most desired credit cards in the world.

Minimum income

American Express did not officially disclose a specific minimum income for approval of the Amex Platinum card. However, it’s important to note that this is a premium credit card, and the company considers a combination of factors when evaluating applicants, including credit history, spending, payments and, of course, income.

Approval may vary based on analysis of all of these elements. While a higher income can increase the chances of being approved for premium cards, there is no publicly disclosed minimum limit.

Annuity

The annual fee for the Amex Platinum card in the United States was $695. However, it is essential to highlight that the rates and benefits associated with credit cards may change over time.

Roof

International.

Flag

Visa Platinum

Rates

Rates and interest on the Amex Platinum card may vary depending on the country and even changes made by American Express itself over time. However, regarding Amex in the United States, know that it has:

- Annual fee: The annual fee for the Amex Platinum was $695. This fee may seem high, but the card offers a series of benefits that, for many users, can offset this annual fee.

- Foreign Transaction Fee: Amex Platinum does not charge foreign transaction fees, making it a good choice for international travel.

- Purchase Interest (APR): The Amex Platinum is a charge card, which means the full balance must be paid at the end of each month. If the cardholder does not pay the balance in full by the due date, late payment interest may be charged.

- Cash Advance Fee: There is a fee associated with the cash advance, usually a percentage of the amount withdrawn.

- Late and Return Fee: If a payment is late or returned, a fee may apply.

It’s crucial to note that the rates, interest, and benefits associated with credit cards can change over time. Additionally, there are other factors to consider, such as possible specific transaction fees or benefits that may offset certain fees.

Application

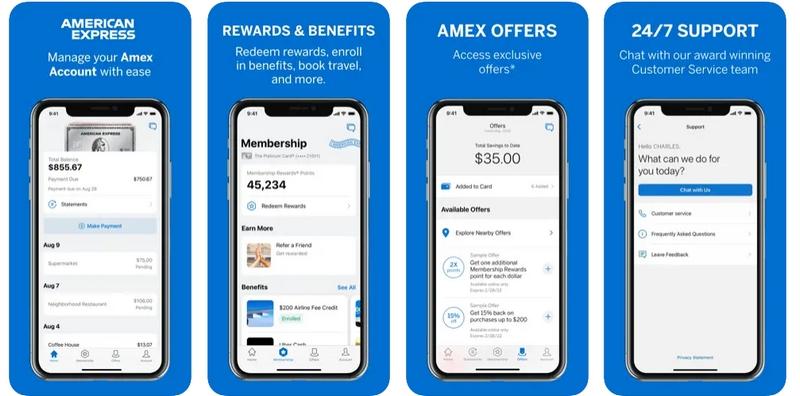

The American Express (Amex) Platinum card application is a digital tool that allows cardholders to manage their accounts, view statements, pay invoices, check benefits, among other functions.

It is intended to provide a more convenient experience for American Express customers.

Main features of the application:

- Balance and Statement View: Cardholders can check their current balance, view recent transactions and view payment history.

- Invoice Payment: Users can pay their invoices directly through the app.

- Notifications: The app can send notifications about transactions, invoice due dates and other relevant alerts.

- Offers and Benefits: Depending on the region, the app may show special offers or benefits available to Platinum cardholders.

- Rewards Management: Holders can check their accumulated reward points and, in some cases, redeem them or use them for bookings and purchases.

- Travel Services: Some versions of the app may offer travel-related information and benefits, such as airport lounge access, upgrades and special offers.

How to download the app:

Android

- Go to the Google Play Store .

- In the search bar, type “American Express” or “Amex.”

- Search for the official American Express app and tap “Install.”

iOS

- Go to the App Store .

- In the search bar, type “American Express” or “Amex.”

- Search for the official American Express app and tap “Get” or “Install.”

- Once installed, you can open the app and log in with your American Express account details.

Telephone

To contact Amex Platinum and resolve any issue related to your card, simply contact the following numbers:

- 1-800-801-6564

- 1-954-503-8868