Learn how to apply for the Wells Fargo Reflect Visa card and its benefits

In today’s financial world, where efficient credit management becomes increasingly crucial, the Wells Fargo Reflect Visa card emerges as an attractive option for those looking for flexibility and benefits.

Advertisements

This article is dedicated to guiding step by step those interested in acquiring the Wells Fargo Reflect Visa card, highlighting its main characteristics, the requirements necessary for the application, and the procedures to follow.

Advertisements

Let’s explore how it can be a valuable tool for your financial planning and what unique advantages set it apart in the competitive credit card market.

How to apply for the Wells Fargo Reflect Visa credit card

Applying for the Wells Fargo Reflect Visa Credit Card is straightforward. Follow these simple steps to complete your application.

Advertisements

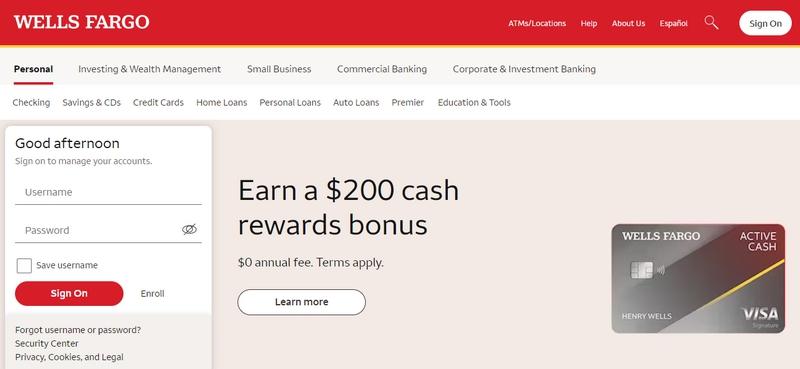

- Visit the Wells Fargo Website: Open your web browser and go to the official Wells Fargo website.

- Navigate to the Credit Card Section: On the homepage, find the ‘Credit Cards’ menu and select the Wells Fargo Reflect Visa Credit Card.

- Click ‘Apply Now’: Once on the card’s page, locate the ‘Apply Now’ button and click it to start your application.

- Fill in Personal Information: Enter your full name, date of birth, address, and Social Security number in the respective fields.

- Provide Employment and Income Details: Fill out your employment status, annual income, and other financial details as requested.

- Review Terms and Conditions: Carefully read the terms and conditions. Ensure you understand the interest rates, fees, and benefits of the card.

- Submit Your Application: Double-check all the information you’ve entered for accuracy. Click the ‘Submit’ button to complete your application.

Wells Fargo will review your application. You may receive an immediate decision or be notified via email within a few days.

By following these steps, you can easily apply for the Wells Fargo Reflect Visa Credit Card and take advantage of its benefits.

What are the requirements to apply for the Wells Fargo Reflect Visa credit card

To apply for the Wells Fargo Reflect Visa credit card, you must meet certain requirements:

- Minimum age: It is essential to be 18 years or older.

- Residence: You must be a permanent resident of the United States.

- Credit Condition: Having a positive credit history is essential.

- Financial Income: Annual income must be sufficient to meet standards set by Wells Fargo.

- Additional Requirements: Have a valid Social Security number. Maintain an active bank account in the United States.

To improve the likelihood of your application being approved, consider:

- Ensure that all information provided in the application is complete and correct.

- Maintain a robust credit history, with payments made on time.

- Have a stable and verifiable source of income.

You can apply for the Wells Fargo Reflect Visa credit card online or in person at a Wells Fargo branch.

Advantages that the Wells Fargo Reflect Visa credit card offers

The Wells Fargo Reflect Visa Card offers a number of benefits that make it an attractive choice for consumers looking for flexibility and efficiency in their credit solutions. Below are listed some of the main benefits of this card:

Low Interest Introductory Period: The card offers an extensive introductory period with a reduced interest rate, which is ideal for those planning to make large purchases or transfer balances from other cards.

Rewards Program: Users have access to a competitive rewards program, allowing them to accumulate points for every dollar spent, which can be exchanged for various prizes and benefits.

No Annual Fee: A big advantage of the Wells Fargo Reflect Visa is the annual fee waiver, reducing the costs of maintaining the card.

Fraud Protection: The card comes with robust fraud protection, ensuring transaction security and peace of mind for the user.

Travel Benefits: Includes travel insurance and assistance, such as rental car insurance, emergency travel assistance, among others, making it an excellent option for travelers.

Access to Exclusive Services: Cardholders have access to exclusive Visa services, including personal travel and shopping assistance.

Payment Flexibility: Offers flexibility in payment options, allowing users to choose the best way to manage their expenses and finances.

Online Card Management: Through the Wells Fargo app or website, users can easily manage their accounts, check balances, and make payments conveniently.

These benefits make the Wells Fargo Reflect Visa card a solid and advantageous option for a wide range of consumers, from those looking to better manage their finances to those looking to accumulate rewards and enjoy travel benefits.

Annuity

No, the Wells Fargo Reflect card has no annual fee. You can use it for free, even if you don’t go through the zero APR period.

Interest rates and fees of the card

The fees and interest associated with the Wells Fargo Reflect Visa card are flexible and vary depending on the user’s credit profile and the type of transaction carried out. Below, we present a summary of the most relevant rates and interests:

Introductory APR (Annual Percentage Rate):

0% for the first 21 months after account opening for eligible purchases and balance transfers.

Variable APR After Introductory Period:

It varies between 18.24%, 24.74% or 29.99%, depending on the user’s credit rating.

Other taxes:

- Balance Transfer: 3% of the amount transferred, with a minimum of US$5.

- Cash Advance: 5% of the advance amount, minimum $10.

- Late Payment: $38.

- Excess Balance: Up to US$39.

- Additional Card Issuance: US$0.

Roof

Internacional.

Flag

Visa.

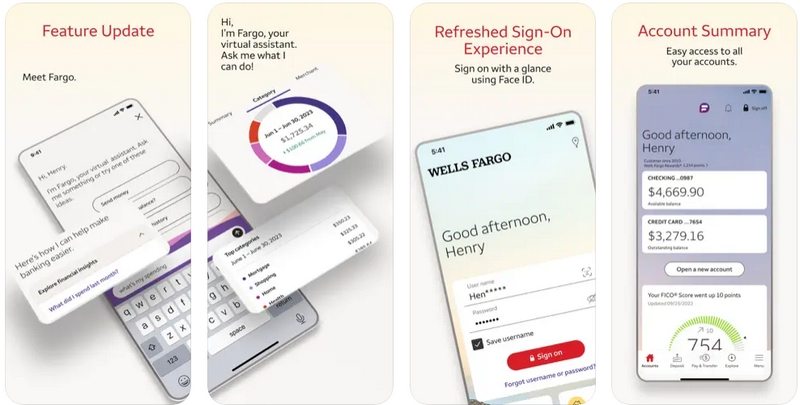

How to download the card app

There are several ways to download the Wells Fargo app, depending on your device and preferences:

For iPhone

App Store: Open the App Store on your iPhone and search for “Wells Fargo Mobile.” Tap the app and then tap “Get” to download and install it.

Text Message: Text “IPH” to 93557. You will receive a text message with a link to download the app. Tap the link and follow the instructions to install it.

For Android

Google Play Store: Open the Google Play Store on your Android device and search for “Wells Fargo Mobile.” Tap the app and then tap “Install” to download and install it.

Text Message: Text “AND” to 93557. You will receive a text message with a link to download the app. Tap the link and follow the instructions to install it.

General Tips

- Be sure to download the official Wells Fargo app from the App Store or Google Play Store. Do not download apps from unknown sources.

- Before downloading, check the app size and data usage requirements to ensure you have enough space on your device.

- You may need to create a Wells Fargo online banking account before using the app.

How to access the bill of the Wells Fargo Reflect Visa credit card

There are several options for checking your Wells Fargo Reflect Visa card statement:

Online Access

- To sign in to Wells Fargo Internet Banking: Go to the Wells Fargo website and log in to your internet banking account.

- Navigate to “Credit Cards”: From the main menu, select the “Credit Cards” option.

- Choose the Wells Fargo Reflect Visa Card: From the cards listed, choose your Wells Fargo Reflect Visa card.

- “View Invoice” option: On the card details page, select “View Invoice”.

- View and Download Invoice: View an invoice online and, if necessary, download it in PDF format.

Through the Wells Fargo Mobile App

- Open the Wells Fargo Mobile App: On your smartphone or tablet, open the Wells Fargo Mobile app.

- Select “Credit Cards”: On the home screen, tap “Credit Cards.”

- Choose the Wells Fargo Reflect Visa Card: From the list of cards, select your Wells Fargo Reflect Visa card.

- Access “Invoice”: On the card’s detailed page, tap “Invoice”.

- View and Download the Invoice: View the invoice directly in the application and, if desired, download it in PDF format.

By Mail

Receive the Invoice at Home: The invoice can be sent monthly to your address. If you do not receive it, contact Wells Fargo at 1-800-869-3557.

By phone

Contacting Customer Service: Call Wells Fargo customer service at 1-800-869-3557 to request a copy of your bill.

Additional Observations:

- Invoices for the last 18 months are available online or through the Wells Fargo Mobile app.

- By choosing to subscribe to the electronic invoice service, you will be notified by email when your invoice is ready for online consultation.

How to unlock the card?

The Wells Fargo Reflect Card is a credit card that offers an initial 0% interest rate on purchases and balance transfers for up to 21 months.

However, if the card is blocked, you will not be able to use it to make purchases or balance transfers. There are two ways to unlock the Wells Fargo Reflect card:

Through the Wells Fargo app

- Open the Wells Fargo app.

- Tap the “Cards” tab.

- Tap the card you want to unblock.

- Tap “Unblock Card”.

- Follow the instructions on the screen.

Via the Wells Fargo website

- Visit the Wells Fargo website.

- Sign in to your account.

- Click on “Cards”.

- Click on the card you want to unlock.

- Click “Unblock card”.

- Follow the instructions on the screen.

To unlock your card through the Wells Fargo app or website, you will need to provide the following information:

- Your card number;

- The expiration date of your card;

- Your card’s security code.

If you don’t have access to the Wells Fargo app or website, you can unlock your card over the phone.

- Call Wells Fargo at 1-800-453-9703.

- Provide your personal information, including your name, address and telephone number.

- Provide your card information, including your card number, expiration date, and security code.

The Wells Fargo representative will unlock your card for you.

How to get a second copy of the credit card

If you have lost or had your Wells Fargo Reflect card stolen, you can request a replacement card in several ways:

Online

- Access Wells Fargo Online Banking: Go to the Wells Fargo website and log into your online banking account.

- Click on “Credit Cards”: From the main menu, click on “Credit Cards”.

- Select your Wells Fargo Reflect Visa card: From the list of credit cards, select the Wells Fargo Reflect Visa card.

- Click “Request a duplicate card”: On the card details page, click “Request a duplicate card”.

- Follow the instructions: Follow the instructions on the screen to request a duplicate of your card.

Phone

- Call Wells Fargo Customer Service: Call Wells Fargo customer service at 1-800-869-3557 and request a duplicate of your card.

Bank branch

Visit a Wells Fargo branch: You can go to any Wells Fargo branch and request a duplicate of your card.

Comments

- Issuing a second copy of the card may incur a cost.

- The new card may take up to 10 business days to arrive.

- You can activate your new card online or over the phone.

How do I contact my card provider?

Wells Fargo bank offers several means of contact for its customers and interested parties. Here are the main ways to contact Wells Fargo:

Telephone

For customer service, including general inquiries and assistance with bills and services, Wells Fargo provides different telephone numbers, which may vary depending on the specific service. One of the general numbers is 1-800-869-3557.

Online service

Wells Fargo offers support through its official website, where customers can log in to online banking to access services, carry out transactions or obtain information.

Mobile App

The Wells Fargo Mobile app allows customers to manage their accounts, perform transactions and access customer support directly from their mobile devices.

Online Chat

Some services may offer an online chat option through the Wells Fargo website, providing a quick and convenient way to get assistance.

Social media

Wells Fargo maintains a presence on several social media platforms where customers can obtain information and, in some cases, contact us for support.

Physical Agencies:

Customers can visit physical Wells Fargo branches for in-person assistance. Branch locations can be found on the Wells Fargo website.

For formal correspondence, customers can send letters to the Wells Fargo postal address available on the official website.

Assistance Service for the Hearing Impaired

Wells Fargo offers specific services for hearing-impaired customers, which can be accessed through dedicated phone numbers.

It is always advisable to check the official Wells Fargo website for the most up-to-date phone numbers and information on available contact methods, especially if you need assistance specific to a product or service.