Applying for a Bank of America Custom Cash Rewards Credit Card: How to Do It

The Bank of America Customized Cash Rewards Credit card is an attractive proposition for anyone looking for flexibility and personalized rewards in their everyday expenses.

Advertisements

Offered by one of the largest banks in the United States, this card combines targeted benefits with the reliability of a renowned institution. In this guide, we will detail the application process for this card and the main points to consider before starting your application.

Advertisements

How do I apply for a Bank of America Customized Cash Rewards Credit Card?

To apply for a Bank of America Cash Rewards Card (or any other Bank of America Card), follow the steps below:

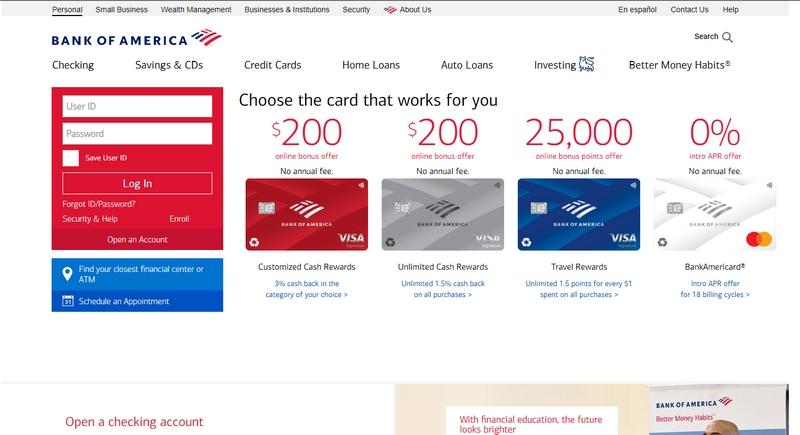

- Visit the Official Website : Go to the official Bank of America website and navigate to the credit cards section.

- Choose Card : Look for the Cash Rewards card or any other card you prefer.

- Click “Order Now” : Once you’ve found the card you want, click the button, usually labeled “Order Now” or something similar.

- Complete the Application : You will be redirected to a page where you will need to provide personal and financial information, such as your name, address, annual income, among others.

- Read the Terms and Conditions : Before finalizing the application, it is crucial to read the card’s terms and conditions to fully understand the fees, interest and other important details.

- Submit Application : After filling in all the required information, submit your application. You will usually get an instant response, but in some cases it may take a few days to get a decision.

- Wait for Approval : If approved, you will receive the card in the mail along with information on how to activate it and the associated terms.

Waiting time for approval

Bank of America Cash Rewards card approval times can vary depending on several factors, such as your credit score, income, and the amount of information the bank needs to verify.

Advertisements

In so many cases:

Immediate Response : If you meet all the criteria and there is no ambiguity in the information provided, it is possible to receive an immediate or same-day response after submitting your online application.

Additional Review Required : If the bank needs more time to review your request, it can usually take anywhere from a few days to two weeks to receive a response. During this time, your request may be “pending review”.

Request for Additional Information : In some cases, the bank may contact you requesting additional documents or information to process your request. This can extend the approval time.

Once approved, the physical card is usually mailed and can take between 7-10 business days to arrive depending on your location.

How to unlock the card?

If you need to unblock your Bank of America Customized Cash Rewards card, follow the steps below:

Online

- Log in to your account on the official Bank of America website.

- Go to the card management section.

- Select the option to unlock your card.

Mobile Application

- Open the Bank of America app on your cell phone.

- Access the card management area.

- Look for the option to unlock and follow the instructions.

Telephone

- Call the customer service number on the back of your card.

- Follow the automated instructions or speak directly to a representative and let them know that you want to unlock your card.

visit an agency

- If you prefer, you can visit a Bank of America branch in person and ask a representative to unlock your card.

Text Messaging (if available)

- Some financial institutions offer the option to send a text message to a specific number to perform certain actions, such as unlocking a card. Check if Bank of America offers this service and follow the instructions.

Advantages of the Bank of America Customized Cash Rewards Credit Card

The Bank of America Customized Cash Rewards card is known to offer a number of perks, making it an attractive option for many consumers. Exact perks may vary over time and depending on promotional offers,

What are the interest rates on the card?

Interest rates, also known as the Annual Percentage Rate (APR), for the Bank of America Customized Cash Rewards card can vary based on a number of factors, including bank policy, your credit score , and market conditions.

- APR for Purchases : A variable interest rate applied to the balance of purchases if you do not pay the balance in full by the due date.

- APR for Balance Transfers : An interest rate applied to the balance transferred from another credit card.

- Promotional APR : In some promotions, the card could offer a reduced or 0% APR rate for purchases or balance transfers for a limited period after account opening.

- APR for Cash Advances : The interest rate applied when you use the card to get a cash advance.

- Penalty APR : A higher interest rate that may apply if you make a late payment or have another type of default on your account.

It is important to note that these rates are indicative only and may vary.

Do you have a points program?

The Bank of America Customized Cash Rewards card does not traditionally operate with a “points program”, but rather with a cash rewards, or cashback, system. This system allows cardholders to earn a percentage back on their purchases in certain categories.

Here are the key features of this card’s rewards program, as currently available through 2021:

Custom Cashback

- Cardholders have the opportunity to choose a category (eg, gas, online shopping, dining, travel, drugstores, or home improvement/furniture stores) in which they earn a higher percentage of cashback.

Other Categories

- In addition to the chosen category, cardholders also earn cashback on other standard categories such as supermarkets and other purchases.

Bonuses for Bank of America Customers

- Cardholders who hold certain accounts with Bank of America or Merrill may qualify for a cashback bonus, which can increase the reward percentage they receive.

Rescue

- Accumulated cashback can be redeemed in a variety of ways, including account credit, deposit into a Bank of America or Merrill account, or even as credits in certain loyalty programs.

Unlimited Rewards

- An attractive feature of this card is that there is generally no cap on the amount of cashback that cardholders can earn.

How to check the card statement?

To view your Bank of America Customized Cash Rewards card statement, you have several options. Here are the most common methods:

Online

- Go to the official website of Bank of America.

- Sign in to your account. If you don’t already have an online account, you may need to register and create one.

- Once logged in, navigate to the credit cards section and select your Customized Cash Rewards card.

- There you should see a link or option to view your current invoice and past histories.

Mobile Application

- If you have the Bank of America mobile app installed on your smartphone or tablet, you can log into it.

- Once logged in, go to the credit cards section and select your Customized Cash Rewards card to access your statement.

By phone

- You can call the customer service number on the back of your Customized Cash Rewards card.

- Follow the automated instructions or speak directly with a representative to request information about your invoice.

- If you have opted for paper invoices, Bank of America will send your monthly invoice to your registered address. However, the electronic option is worth considering as it is more environmentally friendly and offers faster access to invoice information.

Visit an Agency :

- If you prefer, you can visit a physical Bank of America branch and request a copy of your invoice or get assistance in viewing it online.

I recommend that you always check your invoice regularly to stay informed about your expenses, applicable fees, due date and other relevant information.

How to apply for a second copy of the card?

As with the invoice consultation, the request for the duplicate of the Bank of America Customized Cash Rewards Credit card can be carried out through the application or other ways mentioned in the topic above.

To refresh your memory, do the following:

Online

- Go to the official website of Bank of America.

- Sign in to your account.

- Go to the credit card management section.

- Choose the option to request a duplicate or report a lost/stolen card.

Mobile Application

- Open the Bank of America app on your smartphone or tablet.

- Log in and navigate to the credit cards section.

- Select the option to request a duplicate or report a lost/stolen card.

Telefone Bank of America Customized Cash Rewards Credit

Bank of America service channels can be accessed through the following numbers:

- 800,432,1000 .

- 800.688.60863 .