Applying for a Bank of America Premium Rewards Elite Credit Card: How to Do It

The Bank of America Premium Rewards Elite card is one of the most coveted options among consumers looking for exclusive benefits and rewards in the banking sector.

Advertisements

This document will present the fundamental characteristics of this card, along with the detailed application process.

Advertisements

By the end, readers will have a clear understanding of the benefits associated with the card and the requirements to obtain it.

How do I apply for a Bank of America Premium Rewards Elite Credit Card?

To apply for the Bank of America Premium Rewards Elite Credit Card, you can follow these steps:

Advertisements

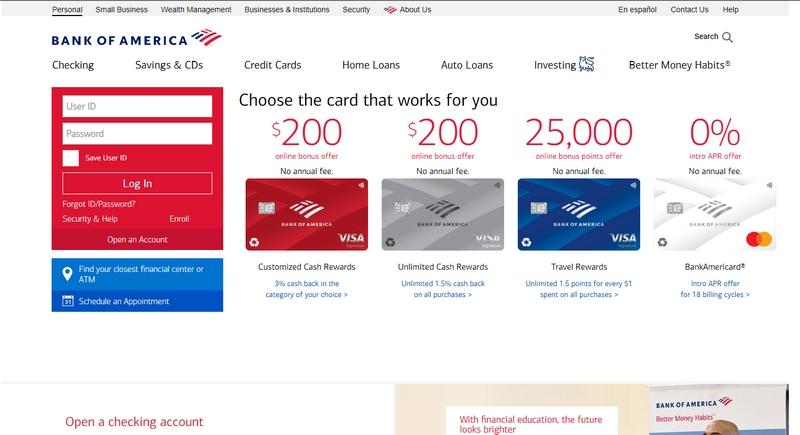

- Go to the Bank of America website and click on “Credit Cards.”

- Click “Request a card”.

- Select the Bank of America Premium Rewards Elite Card.

- Complete the application form with your personal, financial and employment information.

- Provide your bank account information.

- Read and agree to the card’s terms and conditions.

- Click “Submit”.

You can also apply for the card over the phone by calling 1-800-227-3472.

After you submit your application, Bank of America will review your credit and financial history. If you are approved, you will receive your card within 7 to 10 business days.

Waiting time for approval

Bank of America Premium Rewards Elite Card approval time is, on average, 7 to 10 business days. However, this period may vary depending on the applicant’s profile, such as credit history, income and employment.

To increase your chances of approval, it is important to have a good credit history, with bills paid on time. It is also important to have enough monthly income to cover the card’s expenses, which includes the annual fee of US$95.

Here are some tips to increase your chances of approval for the Bank of America Premium Rewards Elite Card:

- Have a good credit history.

- Have a sufficient monthly income to cover card expenses.

- Apply online as the process is faster and more convenient.

- Please provide accurate and complete information in your order.

- Respond quickly to emails and calls from the approval team.

How to unlock the card?

To unlock the Bank of America Premium Rewards Elite Card, you can follow these steps:

- Call the Bank of America Customer Service Center: 1-800-432-4532.

- Provide your card number and expiration date.

- Follow the representative’s instructions to unblock the card.

You can also unblock your card online by going to the Bank of America website and clicking on the “Unblock Card” option.

Here are the steps to unlock the card online:

- Visit the Bank of America website.

- Sign in to your account.

- Click on the “Cards” option.

- Select the card you want to unblock.

- Click on the “Unblock card” option.

After unlocking the card, you can use it for purchases.

Advantages of the Bank of America Premium Rewards Elite Credit Card

The Bank of America Premium Rewards Elite Card offers a number of benefits to its cardholders, including:

- 50,000 point sign-up bonus after spending $3,000 on purchases in the first 90 days.

- 2x bonus points on travel and restaurant purchases.

- 1.5x bonus points on purchases of other items.

- Access to Priority Pass Select, which offers access to airport lounges around the world.

- Travel and luggage insurance.

- Protection against fraudulent purchases.

- Concierge service.

Follow a more detailed description of each advantage:

Sign-up bonus: The Bank of America Premium Rewards Elite Card offers a 50,000-point sign-up bonus after spending $3,000 on purchases in the first 90 days. Points can be redeemed for airline tickets, hotels, merchandise or cash back.

Bonus points: The card also offers 2x bonus points on travel and restaurant purchases. This means you earn 2 points for every dollar spent in these categories. 1.5x bonus points are offered on purchases of other items.

Priority Pass Select Access: Provides access to Priority Pass Select, which provides access to airport lounges around the world. Club lounges offer a variety of amenities such as meals, drinks, Wi-Fi and access to showers.

Travel and baggage insurance: Offers a range of travel insurance, including trip cancellation insurance, flight delay insurance and lost or damaged luggage insurance.

Protection against fraudulent purchases: The Bank de America Premium Rewards Elite Card offers protection against fraudulent purchases. This means you will not be responsible for fraudulent purchases made with your card.

Concierge service: The card offers a concierge service that can help you with a variety of tasks, such as restaurant reservations, purchasing tickets, and travel arrangements.

What are the interest rates on the card?

The Bank of America Premium Rewards Elite card is a premium line that offers a range of benefits, including bonus points, lounge access and travel insurance. However, the card also has high fees and interest, which can be an important factor to consider before applying for it.

- Annual fee: US$550

The annual fee is an annual fee charged by the bank for using the card. The Bank of America Premium Rewards Elite Card has an annual fee of $550. This fee is high, but it is offset by the benefits the card offers.

- Balance transfer fee: 3% of transaction value

The balance transfer fee is a fee charged by your bank when you transfer a balance from another credit card to your Bank of America Premium Rewards Elite Card. The balance transfer fee is 3% of the transaction value. This fee is high, but it’s a common cost for credit cards that offer interest-free balance transfers.

- Standard APR: 20.24% to 27.24%, variable

The standard APR is the interest rate the bank charges if you are late paying your bill. The standard APR for the Bank of America Premium Rewards Elite Card is 20.24% to 27.24%, variable. This fee is high, so it’s important to pay your bill on time to avoid interest.

- Purchase APR: 20.24% to 27.24%, variable

Purchase APR is the interest rate the bank charges if you don’t pay your bill balance in full. The Bank of America Premium Rewards Elite Card purchase APR is 20.24% to 27.24%, variable. This fee is high, so it’s important to pay the bill balance in full to avoid interest.

Do you have a points program?

Yes. The Bank of America Premium Rewards Elite card points program is a good option for those who travel frequently and spend a lot at restaurants. Generous bonus points and flexible rewards make the card a great option for anyone looking to maximize the value of their purchases.

Here are the basic rules of the Bank of America Premium Rewards Elite Card points program:

- Bonus points:

- Travel: 2 points per dollar spent

- Restaurants: 2 points per dollar spent

- Other items: 1.5 points per dollar spent

- Rewards:

- Flight tickets: 1 cent per point

- Hotels: 1 cent per point

- Goods: 1 cent per point

- Cash back: 1 cent per point

- Expiration: Points do not expire.

- Preferred Rewards: Bank of America Preferred Rewards program holders can increase the value of their points by up to 75%.

How to check the card statement?

To check your Bank of America Premium Rewards Elite card statement, you can follow these steps:

Via the Bank of America website

- Visit the Bank of America website.

- Sign in to your account.

- Click on the “Cards” option.

- Select the card you want to view the statement on.

- Click on the “Statement” option.

Through the Bank of America app

- Open the Bank of America app.

- Sign in to your account.

- Select the card you want to view the statement on.

- Tap the “Statement” option.

Through the phone

- Call the Bank of America Customer Service Center: 1-800-432-4532.

- Provide your card number and expiration date.

- Follow the representative’s instructions to consult the statement.

Through the mail

- Request a statement by mail from Bank of America.

- Provide your name, address and card number.

- Send your request to the following address: Bank of America PO Box 660186 Wilmington, DE 19806-0186

Your Bank of America Premium Rewards Elite Card statement includes the following information:

- Transaction date: The date the transaction was carried out.

- Transaction Description: A description of the transaction.

- Transaction Amount: The transaction amount.

- Current Balance: Your current account balance.

- Minimum payment: The minimum payment you must make to keep your account in good standing.

It’s important to check your statement regularly to keep track of your expenses and ensure you’re paying your bill on time.

How to apply for a second copy of the card?

To request a duplicate of the Bank of America Premium Rewards Elite card, simply follow the same steps taught in the previous topic. But the most common way is through the bank’s app.

- Open the Bank of America app.

- Sign in to your account.

- Select the card you want to request a duplicate of.

- Tap the “Request new copy” option.

Bank of America Premium Rewards Elite Phone

Bank of America’s phone number is 1-800-432-4532. This number is toll-free for Bank of America customers in the United States.

Using this number, you can contact the Bank of America Customer Service Center for help with a variety of services, including:

- Account inquiries

- Request for services

- Problem solving

Bank of America Call Center opening hours are Monday to Friday, 7am to 10pm, and Saturdays, 9am to 6pm.