Applying for a Citi American Airlines Credit Card: How to Do It

Applying for the Citi American Airlines card is a financial decision that can offer the cardholder a series of travel-related benefits and advantages. This choice, however, requires a clear understanding of how the card works, what requirements are necessary for approval and the potential advantages it can bring to the cardholder’s daily life.

Advertisements

Throughout this text, we will cover in detail the application process, inherent benefits, and essential considerations to determine whether this card is the right choice for your financial and travel needs.

Advertisements

How do I apply for a Citi American Airlines Credit Card?

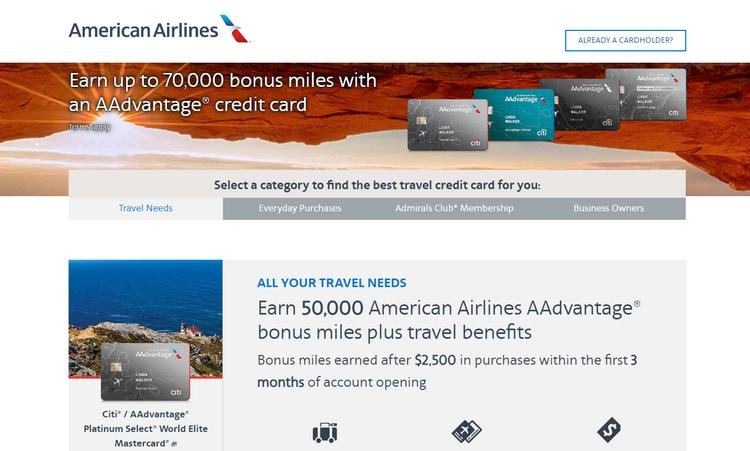

The Citi American Airlines Card is a travel credit card that offers bonus points on purchases made with American Airlines and select partners. Bonus points can be redeemed for airline tickets, cabin upgrades, hotels, car rentals and other rewards. Here are the detailed steps for each request stage:

1. Visit the Citibank website or open the Citibank app.

Advertisements

You can apply for the Citi American Airlines card online on the website , through the Citibank app or over the phone.

2. Click the “Request Card” button.

When you click the “Request Card” button, you will be directed to a page where you can select the Citi American Airlines card you wish to apply for.

3. Provide your personal and credit information.

You will need to provide your basic personal information such as name, address, phone number and date of birth. You will also need to provide your credit information, such as your credit history and income.

4. Read and accept the card’s terms and conditions.

Before applying for the card, you will need to read and accept the card’s terms and conditions. The terms and conditions include information about the annual fee, fees and charges associated with the card, and the card’s benefits.

5. Click the “Request” button.

After providing your personal and credit information and reading and accepting the card’s terms and conditions, you can click the “Request” button to submit your request.

Waiting time for approval

After applying for the Citi American Airlines card, you will receive a response within 10 business days. If your request is approved, you will receive your card within 7 business days.

How to unlock the card?

Unlocking the Citi American Airlines card is a process that aims to ensure the cardholder’s security. If you received a new card or blocked yours for any reason and need to unblock it, follow the steps below:

Via Telephone

Most of the time, when you receive a new Citi American Airlines card in the mail, it will come with a sticker attached that provides a specific phone number for activation and unlocking.

Call that number and follow the instructions provided. You will usually be asked to confirm some personal details to verify your identity.

Online

- Visit the official Citibank website.

- Log in to your account using your username and password.

- Go to the card management section and look for the option to unlock or activate a card.

- Follow the on-screen instructions to complete the process.

Mobile Application

- Open the Citibank mobile app on your smartphone.

- Log in with your credentials.

- In the cards section, look for the unlock or activation option and follow the steps indicated.

Customer service

If you have problems or prefer to carry out the process with assistance, you can call Citibank customer service directly. Have your card ready and be prepared to answer security questions.

At an Agency

In some cases, you can unblock your card by visiting a Citibank branch in person. Take with you an identification document and the card you want to unlock.

Advantages of the Citi American Airlines Card

The Citi American Airlines card, like any co-branded airline card, offers a number of perks and benefits to its cardholders, especially those who frequently fly with American Airlines.

Specific benefits may vary based on the exact type of card and current bank and airline policies. However, here are some of the most common perks associated with this type of card:

- Miles Accumulation : One of the main advantages is the ability to accumulate airline miles for every dollar spent, which can be redeemed for flights, seat upgrades and other American Airlines services.

- Sign-up Bonus : New cardholders often have the opportunity to earn bonus miles after reaching a certain spending threshold in the first few months.

- Priority Boarding : Cardholders often enjoy priority boarding, allowing them to board the plane before other passengers.

- Waived Checked Baggage Fees : Some cards offer the first checked bag for free, which can result in significant savings for frequent travelers.

- Onboard Discounts : Discounts on inflight purchases, such as dining and entertainment, may be offered to cardholders.

- Lounge Access : Depending on card level, cardholders may have access to American Airlines lounges at airports, offering a quiet space to relax before your flight.

- First-Year Annual Fee Waiver : Some Citi American Airlines cards may offer an annual fee waiver for the first year of card ownership.

- Partnerships and Promotions : Opportunities to earn additional miles through partnerships with hotels, car rental companies and other travel-related services.

- Travel Insurance : Many cards include travel insurance, such as cancellation insurance, trip interruption insurance, and lost luggage insurance.

- Purchase Protection : Some card versions may offer additional purchase protections, such as extended warranties and protection against damage or theft.

These are just some of the benefits associated with the Citi American Airlines card. It is essential to check the current terms and conditions and benefits offered by the specific card you are interested in to gain a full understanding of its advantages.

What are the interest rates on the card?

The Citi American Airlines Platinum Select World Elite Mastercard has an annual fee of $95. On the other hand, the Citi American Airlines Executive World Elite Mastercard has an annual fee of $450.

In addition to these annual fees, the Citi American Airlines card has other associated charges:

- Revolving Interest Rate: If you do not pay the full amount of your invoice by the due date, revolving interest will be applied. In the case of the Platinum Select World Elite Mastercard, the rate is 24.99% annually, while for the Executive World Elite Mastercard, it is 23.24% annually.

- Withdrawal Fee: The card has a charge of US$29.99 for ATM withdrawals.

- Late Fee: If there is a delay in paying your invoice, a $35 fee will apply.

- Late Payment Interest: There is a monthly late payment interest charge of 1% on the outstanding amount.

Do you have a points program?

The Citi American Airlines card’s points program is called AAdvantage. They can be used to redeem airline tickets, cabin upgrades, hotels, car rentals and other rewards.

How to redeem points

AAdvantage points can be redeemed for airline tickets, cabin upgrades, hotels, car rentals and other rewards.

Airline Tickets: Can be used to book American Airlines and select partner airline tickets. You can book airline tickets using the American Airlines website or by phone.

Cabin Upgrades: Can be used to purchase cabin upgrades for American Airlines flights. You can purchase cabin upgrades using the American Airlines website or over the phone.

Hotels: Can be used to book hotels around the world. You can book hotels using the American Airlines website or over the phone.

Car rental: Can be used to rent cars around the world. You can book car rentals using the American Airlines website or by phone.

Other Rewards: Can also be used to redeem other Rewards such as merchandise, experiences and services.

How to check the card statement?

To view their Citi American Airlines card statement, cardholders have several options available, allowing them to conveniently access their spending and transaction information. Here are the most common steps to do this:

Online via Website

- Visit the official Citibank website.

- Log in to your account using your username and password.

- Once logged in, navigate to the credit cards section.

- Select the Citi American Airlines card and you will be able to view the most recent statement as well as past history.

Mobile Application

- Download and install the official Citibank app, available for Android and iOS.

- Log in with your credentials.

- Go to the credit cards section and select the Citi American Airlines card. Here, you can view your statement and recent activity.

Customer service

- If you prefer, you can call Citibank customer service. The contact number is usually available on the back of your card.

- After passing the security check, you can request information about your statement or even ask them to send you a copy by email or post.

Automated Teller Machines (ATMs)

At some Citibank ATMs, you can enter your card and password to access your account details, including your Citi American Airlines card statement.

By mail

Typically, banks send monthly statements to cardholders. If you have chosen to receive paper communications, you should receive your statement in the mail each month.

How to apply for a second copy of the card?

Requesting a duplicate Citi American Airlines card can be done in the same way as described in the topic above. However, the most common is via the bank’s application.

Via Mobile App

- Open the Citibank app on your smartphone.

- After logging in, navigate to the credit cards section.

- Look for the option to request a duplicate or report a card as lost or stolen.

Citi American Airlines Phone

US customers can contact Citi American Airlines at 800-882-8880. The call is free and the service operates 24 hours a day, every day of the week.

For those located outside the US, there are international support numbers:

- Canada : 1-800-882-8880 ;

- United Kingdom : 0800-745-4433;

- Australia : 1-300-355-873;

- India : 1-800-228-9744.