Applying for a Wells Fargo Active Cash Credit Card: How to Do It

The Wells Fargo Active Cash Card is a popular option among consumers looking for cash back rewards on their transactions. With attractive perks and the bank’s reputation behind it, many consider this card to be a worthy addition to their financial portfolio.

Advertisements

In this context, understanding the application process and associated requirements is essential for potential stakeholders. Here, we will discuss how to apply for the Wells Fargo Active Cash Card and the benefits it offers.

Advertisements

How do I apply for a Wells Fargo Active Cash Card?

To apply for the Wells Fargo Active Cash Card, follow the steps below. Please note that the process may vary depending on bank updates or current regulations. Let’s go:

- Visit the Official Website : Go to the official Wells Fargo website .

- Navigate to Credit Cards : From the main menu, look for the credit cards section and select Wells Fargo Active Cash or any other card you prefer.

- Click “Order Now” : Typically, there will be a button or link to start the order process.

- Complete the Application Form : You will be asked to provide personal, financial and employment information. Some of the information that may be requested includes: full name, address, Social Security number (or equivalent depending on the country), annual income, among others.

- Review and Accept the Terms : Before finalizing the application, carefully read the terms and conditions associated with the card. This includes fees, APRs, benefits, and other details.

- Submit Your Request : After filling in all the information and reviewing the terms, click the button to submit your request.

- Wait for Decision : Wells Fargo will review your request, which can take a few minutes or even days, depending on several factors. You may receive a response immediately or be notified by email or post.

Waiting time for approval

The wait time for approval of a Wells Fargo credit card can vary depending on several factors, including the complexity of the applicant’s profile, the need for additional documentation, and the volume of applications the bank is currently processing.

Advertisements

So always be aware of the bank’s service channels, especially its application.

How to unlock the card?

If you need to unlock your Wells Fargo card, please follow the guidelines below. Keep in mind that procedures may vary slightly depending on updates made by the bank or policies currently in effect:

Mobile Application

- Access the Wells Fargo mobile app on your smartphone or tablet.

- Log in using your username and password.

- Go to the card management section or a similar menu.

- Select the option to unlock your card and follow the instructions provided.

Online Banking

- Go to the official Wells Fargo website and log in to your account.

- Navigate to the card management section or a related menu.

- Locate the option to unblock your card and follow the steps indicated.

Telephone

- You can call the Wells Fargo Customer Service Center. The phone number is usually printed on the back of your card.

- Follow the automated system instructions or speak directly with a representative to request the unlock.

In person

In some cases, it may be possible to visit a physical Wells Fargo branch to request a card unlock. Take an identity document to facilitate the process.

Advantages of the Wells Fargo Active Cash Card

The Wells Fargo Active Cash Card has several benefits. Objectively, here are the main ones:

Cash Rewards : Earn a fixed percentage cash back on all purchases, with no rotating categories.

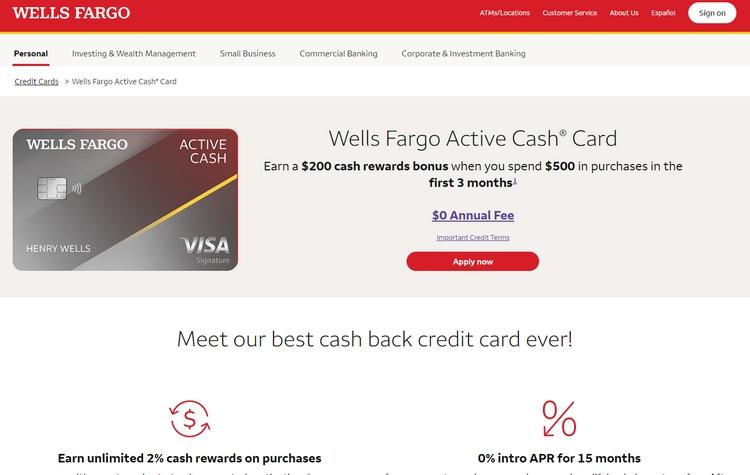

Welcome Bonus : Cash bonus offer for new cardholders who meet a minimum spending requirement in the first few months.

No Annual Fee : The card does not charge an annual fee.

Protection : Offers protections like security alerts, fraud protection, and EMV chip technology.

Access to Wells Fargo Online : Possibility to manage your account, pay invoices and verify rewards through the Wells Fargo online platform or mobile application.

Special Offers : Promotions and discounts from selected partners may be available.

0% Introductory APR : Offers a 0% introductory rate on purchases and balance transfers for a certain period after account opening.

Remember to always check the current terms and conditions and specific card details on the official Wells Fargo website or in promotional materials, as features and benefits may change over time.

What are the interest rates on the card?

The Wells Fargo Active Cash Card has various fees and interest rates associated with it. Briefly, here are some of the main points:

- Annuity Fee : No annual fee.

- Introductory APR : Offers an introductory annual percentage rate (APR) of 0% for purchases and balance transfers for a specified period after account opening.

- Standard APR : After the introductory period, the standard APR applies and may vary based on the cardholder’s credit rating and market interest rates.

- Balance Transfer Fees : There is usually a percentage fee for balance transfers, with an established minimum and maximum amount.

- Cash Withdrawal Fees : Withdrawing cash using the card at ATMs or banks may incur a percentage fee, with an associated minimum amount.

- Late Payment Fees : If payment of the invoice is not made by the due date, there may be an associated flat fee.

- Fees for International Transactions : Transactions made outside the United States may incur a percentage fee on the transaction amount.

These are the general fees and interest associated with the Wells Fargo Active Cash Card. However, it is important to review your card agreement or the official Wells Fargo website for up-to-date and specific details, as fees and terms may change over time.

Do you have a points program?

Yes. The Wells Fargo Active Cash Card is primarily focused on cash rewards rather than a traditional points program. Here is a summary of the card’s rewards features:

Cash Back Rewards : The card offers a fixed percentage cash back on all purchases, no need to worry about rotating categories or sign-ups. It’s a simple way to accumulate rewards.

Redemption : Accrued cash back can be redeemed in a variety of ways, including account credit, deposit into Wells Fargo accounts, gift cards, and more.

No Limit to Earn : There is no maximum limit to the cash back cardholders can earn, and rewards generally do not expire as long as the account is open and in good standing.

Welcome Bonus : Wells Fargo Active Cash often offers a welcome bonus to new holders who spend a certain amount within the first few weeks or months after opening an account.

How to check the card statement?

To view your Wells Fargo Active Cash card statement, you have several options:

Online Banking

- Visit the official Wells Fargo website.

- Log in to your account using your username and password.

- Go to the “Accounts” or “Card Management” section (exact section names may vary).

- Select the Wells Fargo Active Cash card and view transactions and invoices.

Mobile Application

- Open the Wells Fargo mobile app on your smartphone or tablet.

- Sign in to your account.

- Go to the section related to credit cards.

- Select the Wells Fargo Active Cash card and view invoice and transaction details.

via phone

- Call the customer service number on the back of your Wells Fargo Active Cash card.

- Follow the automated system instructions or speak with a representative to inquire about your invoice.

If you have chosen to receive paper invoices, they will be sent to your registered address on a monthly basis. However, it is worth remembering that the digital option is faster and more ecological.

Personally

- You can also visit a Wells Fargo branch to inquire about your bill or get help viewing your bill.

How to apply for a second copy of the card?

As with the invoice, you can request a duplicate of your Wells Fargo card through the methods taught in the topic above, simply selecting the “Replica” option. It is most recommended that this request be made via the official application or website, due to practicality.

Wells Fargo Phone

Contact Wells Fargo Bank at the following numbers:

- Account Management: 1-800-642-4720

- International Collect Calls: 1-925-825-7600

Opening hours are 24 hours a day, 7 days a week.