Bank of America Custom Cash Rewards Credit Card: Know the benefits and advantages

The Bank of America Custom Cash Rewards Credit Card is not just another credit card on the market. This financial product stands out for offering a wide range of benefits to its holders, from personalized rewards to exclusive advantages.

Advertisements

Throughout this article, we will explore in detail the characteristics that make this card a valuable option for different consumer profiles. Check out!

Advertisements

Bank of America Customized Cash Rewards Credit Card Benefits and Perks

The Bank of America Customized Cash Rewards credit card offers cardholders several benefits. Here are some of the typical benefits associated with the card:

- Cashback Category Choice Option : Cardholders can choose a category (eg Gasoline, Online Shopping, Dining, Travel, Pharmacy or Home/Furniture Improvements) to earn 3% cashback.

- Cashback on Other Categories : 2% cashback on groceries and wholesalers. 1% cashback on all other purchases.

- Sign-up Bonus : Occasionally, the bank offers a sign-up bonus to new holders who spend a certain amount on purchases in the first few months after opening the account.

- No Annual Fee : There is no annual fee associated with this card.

- Flexibility : The 3% cashback category can be changed once a month.

- Bonuses for Preferred Rewards Customers : If you are a member of Bank of America’s Preferred Rewards program, you can receive a 25% to 75% bonus on the rewards you earn, depending on your level in the program.

- Fraud Protection : Offers zero liability guarantee for fraudulent transactions.

- Access to FICO Score : Cardholders can access their FICO Score for free.

Minimum income

Bank of America does not require a specific minimum income to qualify for the Customized Cash Rewards card. However, it’s important to understand that income is just one of the factors considered when you apply for a credit card.

Advertisements

The bank will also evaluate other aspects such as your credit history, credit score, other debts and financial commitments, among others.

Annuity

No, the Bank of America Customized Cash Rewards card has no annual fee. This is one of the attractive features of this card for many consumers.

Roof

International.

Flag

Visa.

IOF

The Bank of America Customized Cash Rewards card is tax free. However, they may have associated fees and charges, depending on your use of the card. For example, there may be late payment fees, overseas transactions, cash withdrawals (cash advances) and other specific situations.

However, there may still be interest or interest rate, which is the fee charged by the bank when you keep a debit balance on the card from month to month. If you pay your credit card balance in full each month by the due date, you usually won’t pay interest.

Rewards such as cashback, points or miles are also non-taxable in most cases. However, in some situations, such as when a sign-up bonus is too large, there may be tax implications. In such cases

Application

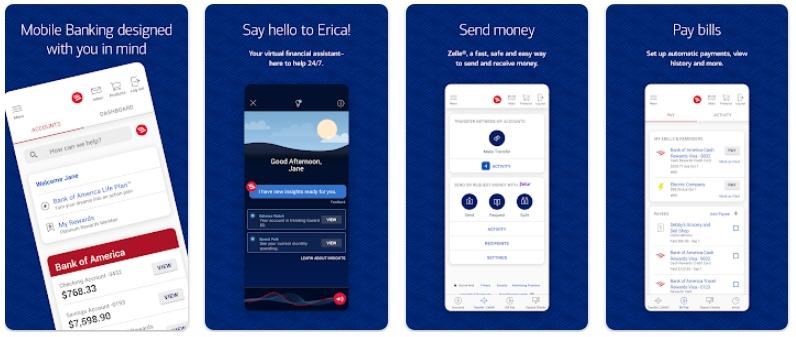

Bank of America has a mobile app that allows customers to manage their accounts, including the Customized Cash Rewards card, directly from their devices. Among the advantages that the app brings, we can mention:

- Balance and Activity View : You can check your card balance, view recent transactions, and review your payment history.

- Payments : Facility to pay your credit card bill directly through the application.

- Alerts : Set up and receive custom alerts, such as purchase notifications, payment reminders, and security alerts.

- Rewards Management : If you have the Customized Cash Rewards card, you can manage and redeem your rewards through the app.

- Card Blocking and Unblocking : If you lose your card or suspect fraudulent activity, you can temporarily block your card through the app.

- Personal Information Updates : Possibility to update your address, phone number and other personal information.

- Free FICO Score : Some cards offer access to your FICO Score directly through the app.

- Customer Support : Quick access to customer support for any queries or issues.

- Security : The app has several layers of security, including biometric authentication (fingerprint or facial recognition) for some devices.

To download the app, go to:

Telephone

The main Bank of America service channels can be accessed through the following numbers:

- 800,432,1000 .

- 800.688.60863 .

Support is available Monday through Friday from 8:00 AM to 11:00 PM Eastern Time and Saturday and Sunday from 8:00 AM to 8:00 PM Eastern Time.