Bank of America Premium Rewards Elite Credit Card: Know the benefits

If you are looking for a credit card that combines exclusivity, convenience, and high-level benefits, the Bank of America Premium Rewards Elite Credit Card is the perfect choice for those who want to elevate their financial experience. With a robust rewards program and premium services, this card is designed to meet the needs of discerning clients, offering a journey filled with advantages both in everyday life and during international travel.

Advertisements

Among its key benefits are reward points earned on every purchase, which can be redeemed flexibly for flights, hotel stays, or statement credits. Additionally, the card offers advanced protections, such as travel insurance, access to exclusive airport lounges, and concierge services that assist with everything from restaurant reservations to personalized experiences. All of this comes with a superior customer service structure focused on excellence.

Advertisements

In this article, you will discover the main reasons why the Bank of America Premium Rewards Elite Credit Card has become a symbol of sophistication and financial security. We will explore its benefits, fees, and everything you need to know to make the most of this premium card’s rewards, ensuring that your purchases and travels become even more rewarding and convenient.

Bank of America Premium Rewards Elite Credit Card Benefits and Perks

The Bank of America Premium Rewards Elite Card offers a host of benefits and perks, including:

Advertisements

Rewards

- 60,000 bonus points after you spend at least $4,000 on eligible purchases in the first 90 days of your account;

- 2 points per dollar spent on travel and restaurants;

- 1.5 points per dollar spent on all other purchases;

- Points do not expire.

Additionally, it also offers:

- Access to airport lounges around the world with Priority Pass;

- Benefits at luxury hotels with the Visa Signature Luxury Hotel Collection;

- Visa Signature concierge service;

- Zero liability protection;

- Baggage delay insurance;

- Trip cancellation insurance.

Minimum income

The Bank of America Premium Rewards Elite Credit Card does not have a publicly disclosed minimum income requirement. However, it is targeted at individuals with a strong financial profile and an excellent credit score. According to Bank of America, a credit score of at least 750 is generally required for approval, indicating that this card is designed for applicants with a history of responsible credit usage.

While income verification may not be explicitly stated, it can vary based on factors such as credit history, outstanding debts, and the total available credit across your accounts. Applicants with higher annual incomes are generally more likely to be approved for a card in this tier, as they demonstrate the ability to manage the associated expenses, such as the $595 annual fee and potential high credit limits.

Additionally, your debt-to-income (DTI) ratio plays a crucial role in the approval process. This metric evaluates how much of your income is allocated to monthly debt payments. A low DTI ratio can significantly increase your chances of approval, even if your total income is moderate. If you are unsure about your eligibility, it is recommended to contact Bank of America directly or consult their prequalification tool, which provides a soft credit check without affecting your score.

For example, individuals with a combined annual income from multiple sources, such as employment, investments, or rental properties, may improve their profile during the review process. This card is typically best suited for high-income earners who seek exclusive benefits and can maintain financial stability while enjoying luxury travel and premium services.

Annuity

The Bank of America Premium Rewards Elite Credit Card has an annual fee of $595, reflecting its premium status and the extensive benefits provided. Although the fee may seem high compared to standard credit cards, it offers valuable perks that can offset this cost, especially for frequent travelers and those who prefer luxury experiences.

One notable feature that helps justify the fee is the $300 annual travel credit, which can be used for airfare, hotels, and other eligible travel expenses. Additionally, cardholders gain access to airport lounges via a Priority Pass membership, providing comfort and convenience during travel layovers. The concierge service also adds value, assisting with restaurant reservations, event planning, and special requests.

If used strategically, these perks can easily surpass the annual fee. For example, frequent flyers who regularly utilize the travel credit and airport lounges can save hundreds of dollars annually. Moreover, the reward points earned on purchases can be redeemed for travel, gift cards, or statement credits, further enhancing the card’s overall value. Understanding how to align your spending habits with the card’s benefits is key to maximizing your investment.

Roof

International.

Flag

Visa.

Rates

The Bank of America Premium Rewards Elite Card has the following fees:

- Annual fee: US$595.

- Balance transfer fee: 3% of the amount transferred.

- Late payment fee: 30% of the amount of the outstanding installment.

- Late payment fee: $35.

The card also has a 0% introductory APR on purchases and balance transfers for 12 months. After the initial period, the standard APR is 20.24% to 27.24%, varying depending on your credit score.

Application

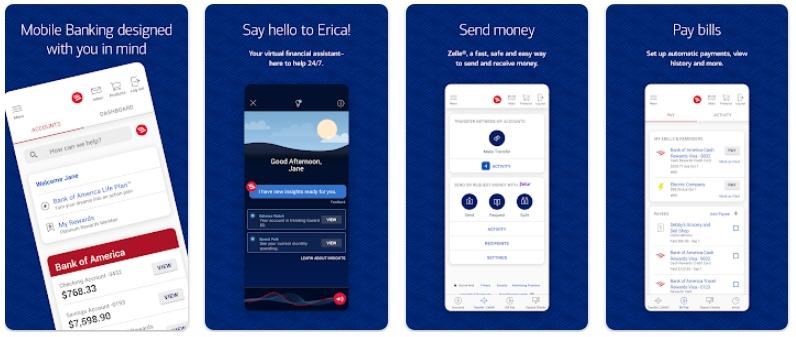

The Bank of America app allows customers to access their bank accounts, credit cards and other bank services. The app is available for iOS and Android devices.

In other words, it offers a variety of features, including:

- View balances and transactions: Customers can view their current balances and recent transactions across all their accounts.

- Bill Payment: Customers can pay utility bills, loans and other bills directly from the app.

- Money transfers: Customers can transfer money between accounts or to other people.

- Credit Card Payment: Customers can use the app to pay with their credit cards.

- Budget Management: Customers can use the app to create and track budgets.

- Investment Information: Customers with Bank of America investment accounts can access information about their accounts directly from the app.

Telephone

For any questions or assistance regarding your Bank of America Premium Rewards Elite Credit Card, the dedicated customer service team is available to support you 24/7. You can contact them by calling the toll-free number 1-800-642-4720. This service provides quick access to information about your account, helps resolve issues related to transactions or benefits, and offers guidance for travel-related inquiries, such as lost cards or international support. With round-the-clock availability, Bank of America ensures that you receive premium assistance whenever you need it, whether you’re at home or abroad.