Capital One Venture Rewards Credit Card: Know the benefits and advantages

Anúncios

In recent years, the world of credit cards has witnessed exponential growth in terms of offers and benefits for users. Among the various options available on the market, the Capital One Venture Rewards card stands out for a series of benefits and advantages that can be extremely attractive for travelers and those looking to maximize their returns on everyday expenses.

This article aims to elucidate some of the key features of this card and demonstrate why it has been a preferred choice for many consumers.

Anúncios

Benefits and Perks of the Capital One Venture Rewards Card

The Capital One Venture Rewards Card, like many premium cards on the market, is designed to offer a variety of benefits and perks to its cardholders. If you’re considering adding this card to your wallet or simply want to understand its value, here are some of the highlights:

- Miles for every dollar spent : One of the most attractive features of Capital One Venture Rewards is the ability to earn miles for every dollar spent, regardless of the expense category. This flexibility ensures cardholders receive ongoing value regardless of where they choose to spend.

- Sign-up bonus : New cardholders often have the opportunity to earn substantial bonus miles after reaching a certain spending limit in the first few months of card ownership.

- Competitive exchange rates : When traveling abroad, holders of this card can benefit from favorable exchange rates, which can result in significant savings on international travel.

- No foreign transaction fees : This is an essential benefit for frequent travelers. When making purchases abroad, Capital One Venture Rewards holders are not subject to additional fees related to foreign transactions.

- Flexible Rewards Program : Earned miles can be redeemed in a variety of ways, including travel, merchandise, car rentals and more. The program’s flexibility allows users to tailor their rewards to their individual needs.

- Travel insurance and protections : The card also offers a variety of travel insurance and protections, including travel accident insurance, car rental insurance, and protection against trip delays or cancellations.

- Access to exclusive experiences : Many premium cards, including Capital One Venture Rewards, offer access to exclusive events and experiences, from concerts to dining experiences, that are not available to the general public.

When considering all of this, it’s clear that the Capital One Venture Rewards card was designed with the traveler in mind, but also offers a range of benefits that are attractive to a wide range of users. If you value flexibility, generous rewards and travel benefits, this card could be the ideal choice for you.

Anúncios

Annuity

The minimum income requirement for the Capital One Venture Rewards Card is $75,000 annually for individual account holders and $150,000 annually for joint account holders. The card also requires applicants to have a good or excellent credit history.

It’s a no-annual-fee credit card that offers a return rate of 2 points per dollar spent on purchases anywhere. Points can be redeemed for airline tickets, hotels, car rentals and other prizes.

Roof

International.

Flag

Visa.

Rates

Capital One Venture Rewards Card fees are as follows:

- Annual fee: US$95;

- Purchase interest rate: 20.99% to 28.99% (variable);

- Interest rate on cash withdrawals: 3% (minimum US$3);

- Balance Transfer Interest Rate: 3% for first 15 monthly payments, $0 for balances transferred at Balance Transfer Interest Rate;

- Late Interest Fee: $40.

The Capital One Venture Rewards Card does not charge foreign transaction fees. But if you have any questions, it is best to contact the bank.

Application

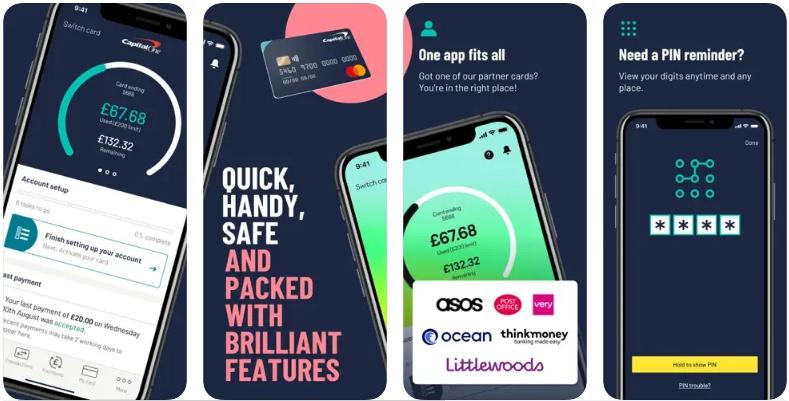

The Capital One app is a digital tool that allows Capital One bank account holders to manage their finances directly from their mobile devices. It was designed to offer an optimized user experience and has several features to make financial management simpler and more intuitive. Here are some of the app’s features and advantages:

- Account Overview : The app gives you a clear and concise view of your accounts, including balances, recent transactions and account details.

- Payments and Transfers : You can make invoice payments, transfer money between Capital One accounts, and even send or receive funds to accounts at other banks.

- Credit Card Management : For Capital One credit card holders, the app offers the ability to view balance, check transactions, make payments, and even lock or unlock the card.

- Alerts and Notifications : Users can configure and customize notifications to be informed about specific activities on their accounts, such as suspicious transactions or payment reminders.

- Security : The app utilizes multiple layers of security to ensure users’ information and funds are protected. This includes biometric authentication (fingerprint or facial recognition, depending on the device) and data encryption.

- Customer Service : For questions or issues, users can easily contact the Capital One support team directly through the app.

- Additional Features : Depending on region or app updates, Capital One may offer additional features such as budgeting tools, spending insights, exclusive offers, and more.

In short, the Capital One app is a comprehensive solution for customers who want complete control over their finances in the palm of their hand. With its user-friendly interface and wide range of features, it stands out as an essential tool for modern financial management.

Telephone

You can contact Capital One bank to resolve any situation Capital One Venture Rewards bank contact numbers:

- Customer Service: 1-877-383-4802

- Scam: 1-800-427-9428

- Lost or stolen card: 1-800-528-2273

- Account-Related Incidents: 1-800-528-2273

Customer service is available 24/7. The fraud phone number is available 24/7.