Citi American Airlines Credit Card: Know the benefits and advantages

The Citi American Airlines Card has become a popular financial tool among travelers and benefit-conscious consumers. Offering a combination of travel rewards and exclusive benefits, this card provides cardholders with an enriching experience both on the ground and in the air.

Advertisements

In this article, we will explore in detail the benefits and advantages that make the Citi American Airlines card a standout option in the credit card market.

Advertisements

Benefits and Perks of the Citi American Airlines Card

The Citi American Airlines card is more than just a payment method. It stands out for offering a series of benefits and advantages, especially for those who frequently fly American Airlines or who want to maximize their travel rewards. Let’s detail the main benefits and advantages associated with this card:

Bonus Miles at Opening : Often, by signing up and meeting initial spending requirements, cardholders can earn a generous amount of bonus miles, which can be used to redeem flights on American Airlines.

Advertisements

Miles Accumulation : For every dollar spent on eligible purchases with American Airlines, cardholders earn multiple miles. Additionally, everyday purchases, such as supermarkets and gas stations, also accumulate miles, although at a lower rate.

Lounge Access : Depending on the card version, cardholders may have free or discounted access to American Airlines lounges, such as the Admirals Club, providing a comfortable place to relax before their flight.

Preferential Rate : At many airports, Citi American Airlines cardholders have the benefit of a preferential boarding line. This means less time in line and faster access to the plane.

Free Baggage Check : A valuable perk for many travelers is the ability to check the first bag for free on domestic flights operated by American Airlines, resulting in significant cost savings for frequent travelers.

In-Flight Purchase Discounts : In some cases, cardholders can benefit from in-flight purchase discounts on American Airlines flights, making snacks and drinks more affordable.

Extended Expiration of Miles : Unlike some loyalty programs, miles earned with the Citi American Airlines Card do not expire as long as the card account is active and in good standing.

Exemption from Foreign Transaction Fees : For international travelers, the absence of foreign transaction fees is a significant advantage, allowing you to make purchases in other countries without additional fee concerns.

Travel Protection and Insurance : Depending on the card variant, there may be additional coverages such as travel accident insurance, trip delay protection, and even car rental insurance.

24/7 Customer Service : For questions or issues, cardholders have access to customer service available 24/7.

In summary, the Citi American Airlines card is a robust choice for those looking to maximize travel-related benefits.

Minimum income

Citibank considers a few factors when evaluating your card application, such as your credit history and spending profile. If you don’t meet the minimum income requirement, you may still be approved for the card if you have a good credit history and spend a significant amount of money on travel.

Annuity

The annual fee for the Citi American Airlines Platinum Select World Elite Mastercard costs US$95, while the annual fee for the Citi American Airlines Executive World Elite Mastercard is US$450.

However, Citibank waives the annual fee in the first year for these two card options. After this period, there is the possibility of obtaining an exemption from the annual fee if there is a considerable expense with the card.

Roof

International.

Flag

Mastercard.

Rates

In addition to the annual fee, the Citi American Airlines card also includes other fees, such as:

- Revolving Interest : Revolving interest is applied when the invoice is not paid in full on the due date. For the Citi American Airlines Platinum Select World Elite Mastercard, the revolving interest rate is 24.99% per year, while for the Citi American Airlines Executive World Elite Mastercard, the rate is 23.24% per year.

- Withdrawal Fee : There is a $29.99 fee for ATM withdrawals with the Citi American Airlines Card.

- Late Fee : The Citi American Airlines Card charges a $35 fee if you are late in paying your bill.

- Late Interest Rate : If payment is late, a late payment interest rate of 1% per month will be applied to the outstanding balance.

It is extremely important to be aware of these fees before applying for a Citi American Airlines card. If you are unfamiliar with these fees, it is advisable to seek guidance from a financial advisor for additional information.

Application

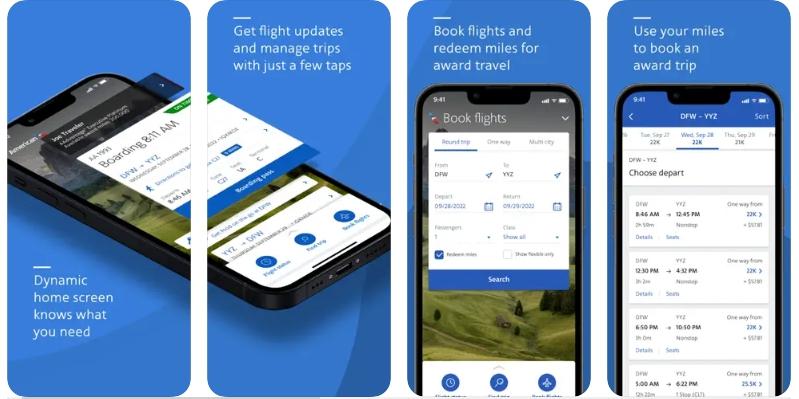

The Citi American Airlines app is an essential tool for American Airlines cardholders. The app offers a variety of features that allow users to manage their card, plan their trips and make the most of the card’s benefits.

Advantages of the Citi American Airlines app

- Card Management: Allows users to view their balance, statements, invoices and purchase history. Users can also pay their bills, change their credit limits and apply for new cards.

- Travel Planning: Offers a flight search feature that allows users to compare American Airlines and partner flight prices and times. Users can also book flights, hotels and car rentals.

- Card Benefits: Provides information about card benefits such as bonus points, lounge access and travel insurance.

How to Download the Citi American Airlines App

The Citi American Airlines app is available for download on the App Store and Google Play Store. To download the app, follow these steps:

- Open the App Store or Google Play Store .

- Search for “Citi American Airlines.”

- Tap the app icon to open the app information page.

- Tap the “Get” or “Install” button to download the app.

Once downloaded, open the app and follow the on-screen instructions to create an account.

Access the Citi American Airlines app

To access the Citi American Airlines app, open the app and enter your username and password. If you don’t already have an account, you can create an account from the login screen.

After logging in, you will be able to view all the app’s features.

Telephone

The Citi American Airlines telephone number for US customers is 1-800-882-8880. This number is toll-free and available 24 hours a day, 7 days a week.

If you are outside the US, you can call the Citi American Airlines international customer service number:

- Canada: 1-800-882-8880

- United Kingdom: 0800-745-4433

- Australia: 1-300-355-873

- India: 1-800-228-9744

You can also contact Citi American Airlines via live chat or email. To access live chat, visit the Citi American Airlines website and click the “Live Chat” link in the bottom right corner of the screen. To send an email, visit the Citi American Airlines website and click the “Contact” link in the top menu.