Citi Diamond Preferred Credit Card: Know the benefits and advantages

The Citi Diamond Preferred card is another credit option offered by Citibank, standing out for a series of exclusive advantages and benefits. From attractive rates to reward programs, this card seeks to meet the needs of consumers looking for more than just a payment tool.

Advertisements

In this article, we’ll explore the key features that make the Citi Diamond Preferred a worthy choice in the world of credit cards.

Advertisements

Benefits and Perks of the Citi American Airlines Card

The Citi Diamond Preferred card offers a series of benefits and advantages to its cardholders. While some of these benefits may vary depending on the current offer and terms and conditions, the main ones include:

- Rewards Program: Accumulate points for every dollar spent, which can be redeemed for rewards such as airline tickets, hotel stays, car rentals and other prizes.

- Promotional Interest Rate: In many cases, the card offers a promotional interest rate for a set period of time for balance transfers and/or purchases.

- Fraud Protection: Provides 24/7 monitoring and protection against suspicious activities, ensuring transaction security.

- Travel Assistance: Access to services such as travel accident insurance, emergency assistance and other facilities to make your trips safer and more comfortable.

- Purchase Protection: Protection for items purchased with the card that are damaged or stolen within a specific period of time after purchase.

- Extended Warranty: Extension of the manufacturer’s warranty for products purchased with the card.

- Access to Special Events: Exclusive opportunities to purchase tickets to cultural, musical and sporting events.

- 24/7 Customer Service: Support available at any time of the day to answer questions and assist with card-related needs.

- Payment Flexibility: Flexible payment options, allowing cardholders to choose to pay the full balance, the minimum or any amount in between.

- No APR Penalty Fee: Some versions of the card do not charge an APR Penalty fee, which is a higher fee applied for late payments.

These are just some of the benefits associated with the Citi Diamond Preferred card.

Advertisements

Minimum income

The suggested minimum income to apply for the Citi Diamond Preferred Card is $50,000. However, Citibank may adjust this amount based on your credit history and other criteria. Some of the factors evaluated by Citibank include:

- Credit History: A positive record can favor your approval.

- Income: The value of your income influences the decision.

- Credit Score: A high score can increase your chances of approval.

Annuity

The Citi Diamond Preferred card has an annual fee of $95. However, by spending $3,000 on purchases in the first 3 months after account opening, cardholders can receive a bonus of 60,000 points.

In addition to the advantageous points program, the card offers benefits such as travel insurance and access to VIP lounges. It is ideal for American Airlines regulars, but it is essential to consider the annual fee when thinking about purchasing it.

Roof

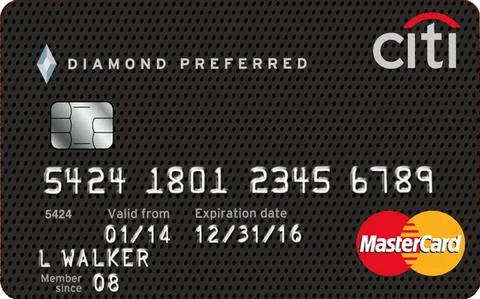

International.

Flag

Mastercard.

Rates

The Citi Diamond Preferred card has the following fees:

- Annual fee : US$95, with the possibility of earning a bonus of 60,000 points when you spend US$3,000 in the first 3 months of account opening.

- Revolving interest : 24.99% per year, applied if the total balance of the invoice is not paid by the due date.

- Withdrawal fee : US$29.99 for ATM withdrawals.

- Late fee : US$35 if the invoice is delayed.

- Late payment interest rate : 1% per month on the amount due.

Before applying for the card, it is vital to be informed about these fees. If you have any doubts, it is recommended that you consult a financial advisor.

Application

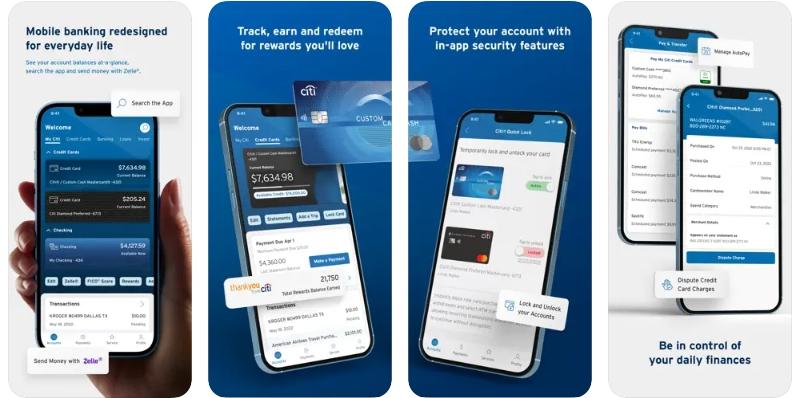

The Citi Diamond Preferred app is designed to provide cardholders with a more convenient and streamlined banking experience. With the growing demand for digital solutions in the financial sector, having a robust and easy-to-use app is essential for modern users.

Main Features

- Balance and Statement Check: Users can check their card’s current balance and view recent transactions, providing more detailed financial control.

- Bill Payment: The application allows quick and secure payment of your card bill, avoiding delays and inconveniences.

- Rewards Management: Track and redeem your AAdvantage® points directly through the app, choosing from several reward options.

- Real-Time Notifications: Receive purchase alerts, information about invoice due dates and other important notifications.

- Blocking and Unblocking: In case of loss or theft, it is possible to block the card immediately through the application. Likewise, unlocking can also be carried out with ease.

- Customer Service: The application has a section dedicated to customer service, where users can clarify doubts, request services and report problems.

How to download

Identify your Platform

Make sure you know whether your smartphone is Android or iOS as this will determine which app store you should download Citi Diamond Preferred from.

Access the App Store

- For Android: Open the Google Play Store .

- For iOS: Open the App Store .

Use the Search Function

In the app store search field, type “Citi Diamond Preferred” and press “Search” or the magnifying glass icon.

Select the Correct Application

Among the search results, find the official Citi Diamond Preferred app. Be careful to avoid fake or unofficial apps.

Download and Install

Click “Install” (for Android) or “Get” (for iOS). The app will start downloading and then automatically install on your device.

Open the Application

After installation, you can open the app directly from the app store or find the icon on your smartphone’s home screen.

Telephone

It is very important that, whenever you have any questions or need to resolve a problem related to your Citi Diamond Preferred card, you contact the institution. Next we will leave the bank number:

- 1 888 248 4226

The Citi Diamond Preferred card stands out in the credit card market not only for its elegance, but, above all, for the countless benefits and advantages it provides to its cardholders.

Its combination of attractive rewards, competitive rates and exclusive services makes it a valuable option for those looking to maximize their daily spending, guaranteeing unparalleled convenience and advantages in the financial world.