Discover the Benefits and Fees of The Platinum Card from American Express

The Platinum Card from American Express is widely recognized as one of the most exclusive and advantageous credit cards on the market. It offers a range of benefits that attract high-net-worth consumers, such as access to airport lounges, generous rewards, and personalized services. This card is not just a payment method, but also a key to unique and convenient experiences.

Advertisements

With a powerful rewards structure and a variety of exclusive benefits, The Platinum Card from American Express is ideal for those looking to maximize their financial experience. Read on to discover how this card can transform the way you spend and live, and whether it’s truly worth it for your lifestyle.

Advertisements

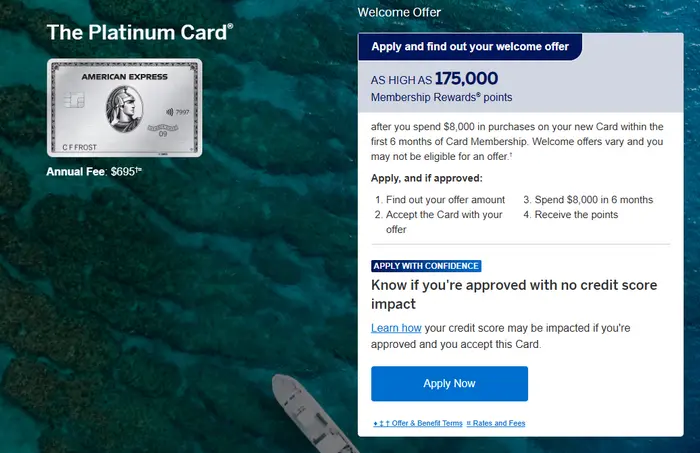

How to Apply for The Platinum Card from American Express

If the benefits and fees of The Platinum Card from American Express have piqued your interest, the next step is to understand how to apply for this exclusive card. The application process is simple, but there are some requirements you need to meet.

- Visit the official American Express website.

- Click on the “Apply Now” button to start the application process.

- Fill in your personal information, such as your name, address, and phone number.

- Provide details about your annual income and financial situation.

- Review all the information and submit your application.

- Wait for approval, which can be responded to in minutes or a few business days.

Requirements:

Advertisements

- Minimum age: 18 years old.

- Minimum income: An income level sufficient to cover the annual fee and your spending.

- Credit history: Good to excellent (at least a 700 credit score).

- Financial information: Social Security Number (SSN) or ITIN.

- Residency: Must reside in the United States.

By following these steps and meeting the listed requirements, you’ll be ready to apply for your The Platinum Card from American Express and begin enjoying all its exclusive benefits.

Benefits of The Platinum Card from American Express

The Platinum Card from American Express offers benefits that go beyond traditional cards, making it a highly desired option for individuals who value comfort and exclusivity. Let’s explore the main benefits that make this card a premium choice:

- Access to VIP Lounges in Airports: Enjoy access to over 1,200 airport lounges worldwide through Centurion Lounges and Priority Pass, making your travel more comfortable and stress-free.

- Generous Membership Rewards Points: Earn 5 points per dollar on flights booked directly with airlines or through Amex Travel and 1 point per dollar on other purchases. Redeem these points for travel, luxury experiences, and more.

- Exclusive Travel Benefits: The card provides comprehensive travel insurance, including trip cancellation coverage, lost luggage protection, and medical assistance while traveling abroad, making it ideal for frequent travelers.

- Travel and Shopping Credits: Receive an annual credit for eligible travel purchases, such as flights, hotels, or car rentals, helping you offset travel expenses.

These benefits make The Platinum Card from American Express an excellent choice for those looking for premium perks and rewards.

Fees and Charges of The Platinum Card from American Express

The Platinum Card from American Express offers exclusive benefits, but it’s important to be aware of the associated fees. Here are the main charges:

- Annual Fee: The annual fee for The Platinum Card from American Express is $695.

- Foreign Transaction Fee: There is no foreign transaction fee, making it ideal for frequent travelers.

- ATM Withdrawal Fee: The fee for ATM withdrawals is $5 or 3% of the withdrawal amount, whichever is greater.

While the fees may be high, the benefits provided can make the costs worthwhile for those who take full advantage of the card.

Rewards Program

The Platinum Card from American Express offers a robust rewards program, perfect for those looking to maximize their purchases and enjoy exclusive benefits. Every purchase you make earns points that can be redeemed for travel, unique experiences, and other perks. Below, we highlight how the rewards program works and how you can take full advantage of it.

- Earning Points: You earn 5 points per dollar spent on airfare purchased directly from airlines or through Amex Travel, and 1 point per dollar on all other purchases. This allows you to quickly accumulate points, especially on travel-related expenses.

- Double Value for Travel: When you use your points to book travel through Amex Travel, your points are worth 1.5x more, allowing you to get more value out of your rewards.

- Welcome Bonus: Upon meeting a minimum spend within the first three months, you receive a generous points bonus, which can be used immediately to redeem products and travel.

- Exclusive Promotions and Offers: The Platinum Card from American Express provides access to special promotions and extra points with select partners, allowing you to accelerate your points accumulation.

How to Increase the Credit Limit of The Platinum Card from American Express

If you’re looking to increase your credit limit on The Platinum Card from American Express, there are several effective strategies that can help. A higher credit limit provides more flexibility for making purchases and can also improve your credit score if used responsibly. Below, we highlight some tips that can assist you in this process.

Use the Card Responsibly

The most effective way to increase your credit limit is by using the The Platinum Card from American Express responsibly. Paying your bills on time, keeping your balance low, and avoiding maxing out your credit are crucial. With a good payment history and a balanced use of your credit, the bank is more likely to feel comfortable increasing your limit because they see you as capable of managing credit effectively.

Additionally, make sure to use the card regularly, as frequency of use can be an important factor in the decision to increase your limit. Remember that keeping your balance below 30% of your available credit demonstrates that you can manage your spending in a controlled manner.

Request an Increase After 6 Months of Use

A common strategy is to request a credit limit increase after at least six months of consistent use of your The Platinum Card from American Express. This period allows the bank to assess your financial behavior, such as bill payments, card usage frequency, and credit history. Waiting this time shows that you have a good control of the card and that your financial profile is stable.

Furthermore, a six-month period allows you to build more credit points, which can be favorable when requesting a limit increase. The bank will be able to see that you have a consistent track record and that your payment behavior is reliable, which will increase your chances of approval.

Report Income Increase

If your income has increased since you first applied for The Platinum Card from American Express, it’s important to notify the bank about this change. A higher income can justify a higher credit limit, as it shows that you have more financial capacity to handle a larger limit. This update can be easily done through customer service or via the card management area.

With higher income, you can justify a higher credit limit because it demonstrates that your finances are more robust and you have greater ability to pay off your bills. The bank will consider this factor as a guarantee that you can manage a higher credit limit without compromising your financial health.

Avoid Requesting Multiple Credits at the Same Time

Avoiding requesting multiple credit limit increases or new credit cards simultaneously can improve your chances of getting the desired limit increase. When you apply for multiple credit increases or open new cards, the bank may see this as an attempt to access excess credit, which could negatively affect your request. Instead, make the limit increase request in isolation, based on a solid history of payments and responsible card use.

This approach shows that you are focused on your credit and are seeking an increase based on your continuous and responsible use of The Platinum Card from American Express. The bank will view this more favorably and be more inclined to approve the increase.

How to Use The Platinum Card from American Express Abroad

The The Platinum Card from American Express offers great benefits for travelers, such as no foreign transaction fees and access to VIP airport lounges. Here are some tips for using your card abroad:

- No Foreign Transaction Fees: Make purchases abroad without additional fees, taking advantage of the competitive exchange rate.

- Access to VIP Lounges: Access over 1,200 airport lounges worldwide with Priority Pass.

- Notify the Bank About Your Travels: Inform the bank about your international trips to avoid card blocks and protect your account.

How to Download the App

Downloading the The Platinum Card from American Express app is simple and provides the convenience of managing your finances directly from your phone. With the app, you can track spending, pay bills, redeem points, and much more. Here’s how to download:

- Go to the Google Play Store (for Android) or the App Store (for iOS).

- Search for “American Express” in the search bar.

- Click on “Install” and wait for the download to complete.

- Open the app and log in with your credentials to access all features.

Now, with the app, you can manage your The Platinum Card from American Express quickly and efficiently, wherever you are.

Contact

The The Platinum Card from American Express offers several communication channels to quickly resolve any questions or issues. Whether you need information about the card, have questions about benefits, or need assistance with billing, American Express provides specialized support through various means.

- Phone Support: Call 1-800-528-4800 for U.S. customers or use the international number when abroad.

- Online Chat: Access the official website or app to chat with a representative through live chat.

- Social Media: American Express is active on Twitter and Facebook, providing support and answering frequently asked questions.

- Email Support: Send an email directly through the American Express website for more detailed inquiries.

These contact methods make it easy and quick to resolve any issues you may have.