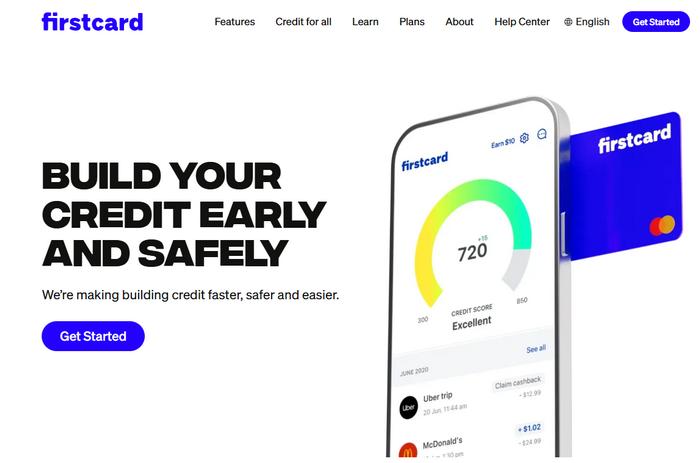

Firstcard®️ Secured Credit Builder: Build Your Credit with Ease and Exclusive Benefits

Anúncios

In the world of personal finance, having a good credit history is essential to achieving goals such as buying a car, financing a home or even getting better terms on loans. However, for many people, building or rebuilding this score can be a challenge. That’s where Firstcard®️ Secured Credit Builder comes in, an innovative solution designed to help you establish or improve your credit in a simple and efficient way.

With Firstcard®️, you don’t have to worry about complicated approvals or hidden fees. The card is secure, which means you set your own credit limit based on the amount you deposit, ensuring total control over your spending. In addition, each payment is reported to the main credit agencies, helping to strengthen your score over time. Whether you are a young adult starting your financial journey or someone looking to regain your credit health, Firstcard®️ is the ally you need to turn your dreams into reality.

Anúncios

Ready to take the first step towards a more stable financial future? Discover how Firstcard®️ Secured Credit Builder can be the key to opening doors that previously seemed inaccessible. Keep reading and see how this tool can make a difference in your life!

Advantages of the Firstcard®️ Secured Credit Builder

The Firstcard®️ Secured Credit Builder was designed to offer benefits that simplify users’ financial lives, whether in daily routines or during travels. With features tailored for those looking to build or rebuild their credit, this card goes beyond the basics, providing security, control, and unique opportunities. Below, discover how it can transform your relationship with money and open doors to new experiences.

Anúncios

- Efficient Credit Building: Every payment is reported to major credit bureaus, helping to increase your credit score consistently and securely.

- Full Control Over Your Limit: You set your own credit limit based on your deposit, ensuring greater control over your spending.

- No Credit Check: Perfect for those starting or rebuilding their credit history, with no worries about complicated approvals.

- Security and Protection: The card is secured, reducing the risk of fraud and offering peace of mind for online purchases or while traveling.

- Global Acceptance: Use the Firstcard®️ at establishments worldwide, ideal for those who enjoy hassle-free travel.

- No Hidden Fees: Complete transparency, with no unexpected charges that could impact your budget.

- Easy Management: Track your spending and payments in real-time through an intuitive and user-friendly app.

These benefits make the Firstcard®️ Secured Credit Builder an essential tool for anyone looking to improve their financial health and enjoy greater freedom in daily life and while traveling!

How to Apply for the Firstcard®️ Secured Credit Builder

Applying for the Firstcard®️ Secured Credit Builder is a simple and quick process, designed to provide convenience for those looking to build or rebuild their credit. With clear steps and no unnecessary bureaucracy, you can take the first step toward a more stable financial life in just a few minutes. Below, we detail the complete step-by-step process, from registration to approval, so you can start enjoying the benefits of this card as soon as possible.

- Visit the Official Website: Go to the Firstcard®️ website and click on the “Apply for Card” option or equivalent.

- Fill Out the Form: Enter your personal details, such as full name, ID number, address, and contact information.

- Set the Deposit Amount: Choose the amount you wish to deposit to define your card’s limit. This amount will be blocked as collateral.

- Submit Required Documentation: Attach copies of the requested documents, such as ID, CPF, and proof of address.

- Wait for Analysis: The Firstcard®️ team will quickly review the provided data. Since there’s no credit check, the process is fast.

- Approval and Activation: Once approved, you’ll receive instructions to activate your card and start using it right away.

With this step-by-step guide, applying for the Firstcard®️ Secured Credit Builder becomes an easy and accessible task, perfect for those seeking convenience and effective results in building their credit.

Fees and Charges of the Firstcard®️ Secured Credit Builder

Understanding the fees and charges associated with the Firstcard®️ Secured Credit Builder is essential to make the most of the card’s benefits without unpleasant surprises. With transparency and clarity, Firstcard®️ offers a simple and affordable cost structure, designed for those looking to build credit without complications.

Below, we list the main fees and explain how each one works, so you can manage your finances with confidence.

- Annual Fee: The Firstcard®️ Secured Credit Builder charges no annual fee, allowing you to save while building your credit.

- ATM Withdrawal Fee: Withdrawals at ATMs may incur a small fee, depending on the network used. We recommend checking the terms before proceeding.

- Currency Conversion Fee: For international purchases, a currency conversion fee is applied, typically between 2% to 3% of the transaction amount. This fee is common for international cards.

- Card Replacement Fee: In case of loss or theft, there may be a fee for issuing a new card. The amount varies according to current policy.

- Late Payment Fee: To avoid interest and penalties, it’s essential to pay your bill on time. In case of delay, a late fee may be applied, along with interest on the outstanding balance.

Rewards Program

The Firstcard®️ Secured Credit Builder not only helps you build your credit but also rewards every purchase with an exclusive benefits program. With options like cashback or accumulable points, the card offers advantages that turn your everyday purchases into opportunities to save or earn rewards. Learn how the program works and how you can maximize your earnings while taking care of your financial health.

- Cashback on Purchases: For every purchase made with the Firstcard®, you receive a percentage of the amount back as cashback. This amount can be used to reduce your bill or saved for future redemption.

- Accumulable Points: In addition to cashback, the card offers a points system that can be exchanged for discounts, products, or even travel, depending on the partnership program.

- Welcome Bonus: New users can earn an extra bonus by reaching a minimum spending amount in the first few months of use.

- Exclusive Promotions: Firstcard® offers seasonal promotions and partnerships with establishments, where you can earn double cashback or points.

- Easy Redemption: Cashback or points can be redeemed directly through the Firstcard® app, quickly and intuitively.

How to Increase the Credit Limit

Increasing the credit limit on your Firstcard®️ Secured Credit Builder is a great way to expand your financial possibilities, whether for making larger purchases or improving your credit score. However, it’s important to adopt responsible practices to ensure this increase is granted safely and sustainably.

Pay Your Bills on Time

Maintaining a flawless payment history is key to gaining the bank’s trust. Paying your bills on time and in full demonstrates financial responsibility, increasing your chances of getting a higher limit.

Use Credit Moderately

Avoid using your entire available credit limit. Keeping your usage below 30% of the limit shows that you can manage credit well, which is viewed favorably by financial institutions.

Contact the Bank

If you already have a good history with Firstcard®, contact support to request a credit limit increase. Sometimes, a simple request is enough to get approval.

Increase Your Income

An increase in your income can be a deciding factor in getting a higher limit. Update your financial information with the bank so they can reassess your profile and offer a higher limit.

How to Use the Firstcard®️ Secured Credit Builder Abroad

The Firstcard®️ Secured Credit Builder is more than just a tool for building credit; it’s also the perfect ally for those who love to travel or need to make international purchases. With global acceptance at millions of establishments worldwide, the card offers convenience and security for your transactions abroad.

- Global Acceptance: The card is accepted at establishments in over 200 countries, from restaurants and hotels to stores and gas stations.

- Competitive Conversion Fees: For purchases in foreign currency, Firstcard® applies a fair conversion fee, typically between 2% to 3%, with no hidden additional charges.

- Transaction Security: With chip and PIN technology, plus real-time notifications, you can use the card with peace of mind, even in unfamiliar destinations.

- No International Usage Fees: Unlike many cards, Firstcard® does not charge extra fees for transactions made outside your home country.

- Easy Management: Through the app, you can track your spending in real-time, receive transaction alerts, and block the card in case of loss or theft.

How to Download App

The Firstcard®️ Secured Credit Builder app is the perfect tool to manage your finances conveniently and efficiently. With it, you can track your spending, pay bills, receive real-time notifications, and even block your card in case of loss or theft. Downloading and using the app is simple and fast, and we’ll guide you step by step so you can start enjoying all the benefits it offers.

- Access the App Store: On your smartphone, open the App Store (iOS) or Google Play Store (Android).

- Search for the App: Type “Firstcard®️ Secured Credit Builder” in the search bar and select the official app.

- Download the App: Click “Install” or “Download” and wait for the process to complete.

- Open the App and Log In: After installation, open the app and enter your credentials (email and password) to access your account.

- Explore the Features:

- Track Spending: View all your transactions in real-time.

- Pay Bills: Make payments directly through the app.

- Receive Notifications: Stay updated on all your card activities.

- Block Your Card: In case of loss or theft, block your card with a single tap.

- Set Up Custom Alerts: Configure alerts for spending limits, bill due dates, and more.

Contact

Below, we list all the ways to get in touch and ensure your experience with Firstcard®️ is always positive.

- Phone Support: Call the 24/7 support number and get assistance from a specialist.

- Online Chat: Visit the official Firstcard®️ website and use the online chat to resolve your queries in real-time.

- Email: Send an email to the support team and receive a detailed response within 24 business hours.

- App: Through the Firstcard® app, you can open support tickets, block your card, or check FAQs.

- Social Media: Follow Firstcard® on social media and send a direct message for quick and easy communication.