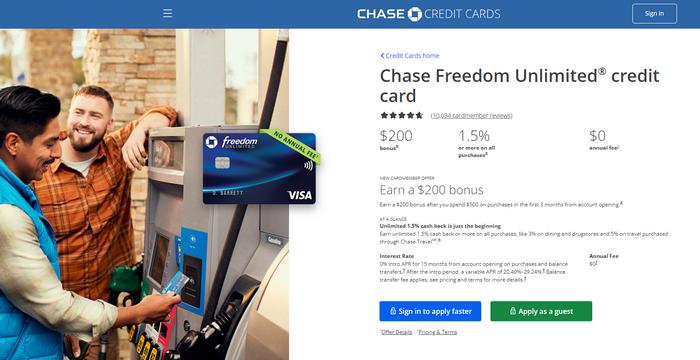

How to Apply Chase Freedom Unlimited Visa Credit Card

The Chase Freedom Unlimited Visa credit card is an option for those who want to earn cash back on all purchases, without worrying about revolving categories or reward limits. It is issued by Chase Bank, one of the largest banks in the United States, and carries the Visa flag, which is accepted at millions of establishments in the country and around the world. In this article, you’ll learn about the main features, advantages, disadvantages, requirements and ways to apply for this card.

Advertisements

How to apply for the Chase Freedom Unlimited Visa credit card

Applying for the Chase Freedom credit card is a straightforward process that can be completed in just a few steps. Whether you’re looking to take advantage of its cashback rewards or its flexible payment options, here’s how you can apply:

Advertisements

- Check Your Credit Score: Ensure you have a good to excellent credit score (680-850) to increase your chances of approval.

- Visit the Chase Website: Go to the official Chase website and navigate to the Chase Freedom credit card page.

- Review Card Details: Read through the card benefits, terms, and conditions to ensure it meets your needs.

- Click on “Apply Now”: Locate the “Apply Now” button on the Chase Freedom credit card page and click it to start your application.

- Fill Out the Application Form: Provide your personal information, including your name, address, Social Security number, income, and employment details.

- Submit the Application: Double-check your information for accuracy and submit your application.

- Wait for Approval: Chase will review your application and typically respond within a few minutes. If additional information is needed, they will contact you.

- Receive Your Card: If approved, your new Chase Freedom credit card will arrive in the mail within 7-10 business days.

By following these steps, you can quickly and easily apply for the Chase Freedom credit card and start enjoying its numerous benefits.

Who can apply for the Chase Freedom Unlimited Visa card?

To apply for the Chase Freedom Unlimited Visa card, you need to be at least 18 years old, a legal resident of the United States and have a valid physical address in the country. You also need to have a monthly income sufficient to pay your expenses and your card, and have a credit history that fits the issuer’s criteria.

Advertisements

You need to have a good or excellent credit score to get the card, as it is aimed at people who have a solid and responsible credit history. The issuer will analyze your credit profile based on the information you provide on the application form and on credit bureau reports.

Advantages of the Chase Freedom Unlimited Visa card

The main benefit of the Chase Freedom Unlimited Visa card is the possibility of earning cash back on all purchases, without restrictions or complications. It offers a flat rate of 1.5% cash back on all purchases, plus higher rates in some specific categories, such as 5% on travel, 3% at restaurants and pharmacies, and a $200 bonus if you spend $500 in the first three months. In addition, the card offers other advantages, such as:

- Flexible redemption: you can redeem your money back at any time, with no minimum amount, and without it expiring while your account is open. You can choose to receive the money in your bank account, on your debit card, as a credit on your bill, or as points in the Chase Ultimate Rewards program, which can be redeemed for travel, purchases, gift cards and more.

- Points transfer: you can transfer your Chase Freedom Unlimited Visa points to other Chase cards that participate in the Chase Ultimate Rewards program, such as the Chase Sapphire Preferred or Chase Sapphire Reserve. This way, you can take advantage of the exclusive benefits of these cards, such as a 25% or 50% bonus on the value of your points when redeeming them for travel, or the possibility of transferring your points to partner airline and hotel loyalty programs.

- Purchase protection: you can rest easy when shopping with your Chase Freedom Unlimited Visa card, as it offers protections such as theft or damage insurance of up to $500 per item and $50,000 per account, extended warranty of up to one year on eligible items, and trip cancellation or interruption insurance of up to $1,500 per person and $6,000 per trip.

- Security and convenience: you can use your Chase Freedom Unlimited Visa card safely and conveniently, as it features chip and proximity payment technology, 24-hour fraud monitoring, card locking and unlocking via the app, and access to Visa benefits and offers, such as emergency assistance, discounts on purchases and services, among others.

Annual fee

The Chase Freedom card has no annual fee, allowing you to enjoy all its benefits and rewards at no additional cost.

Interest rates and card fees

The Chase Freedom Unlimited Visa card has a variable APR of 14.99% to 23.74%, which is applied to the balance you don’t pay in full by the due date. This rate can vary according to your credit profile and market conditions. That’s why it’s recommended that you always pay your bill in full, to avoid accruing interest.

Coverage

The Chase Freedom card offers both domestic and international coverage, allowing you to make purchases and enjoy benefits anywhere in the world.

Flag

The Chase Freedom card is issued under the Visa flag, providing global acceptance and access to a wide range of exclusive benefits offered by the Visa network.

How to access your Chase Freedom Unlimited Visa card bill

The Chase Freedom Unlimited Visa card bill is the document that shows a summary of your purchases, payments, interest, fees and other information about your card. It is generated monthly and has a due date, which is the deadline for you to pay the full or minimum amount of your bill.

You can access your bill in two ways: by post or via the app. If you choose mail, you will receive your printed invoice at your address a few days before the due date. If you choose the app, you’ll receive your digital bill on your cell phone, and you can view it at any time.

To choose how you want to receive your bill, you need to access the card app, go to “Settings”, and select the “Paperless Statements” option. You can change your preference at any time, free of charge.

How to unlock your card

To unlock your Chase Freedom card, simply call the customer service number on the back of the card or log in to your online account on the Chase website or app and follow the instructions for activation.

How to download the card application

The Chase Freedom Unlimited Visa card app is a tool that allows you to manage your card conveniently and securely from your cell phone. With the app, you can:

- View your balance, your available limit and your transaction history;

- Pay your bill online, with your debit card or your bank account;

- Block and unblock your card in the event of loss, theft or suspected fraud;

- Receive alerts and notifications about your card, such as payment reminders, purchase confirmations and security warnings;

- Access Visa and Chase Ultimate Rewards benefits and offers;

- Contact customer service.

To download the app, you need to have a smartphone with an Android or iOS operating system. You can download the app for free from the Google Play Store or the App Store, depending on your device. After installing the app, you need to register with your card number, your name, your date of birth and your zip code. You can then create a username and password and access the application whenever you want.

How to get a duplicate Chase Freedom Unlimited Visa card

If your Chase Freedom Unlimited Visa card is lost, stolen, damaged or expired, you can request a duplicate via the app or over the phone. You won’t be charged for replacing the card, unless you request expedited delivery. The new card will have the same number, expiry date and security code as the old one.

To request a duplicate via the app, you need to access the card app, go to “Account Services”, and select the “Replace a Lost or Damaged Card” option. You will need to confirm your address and choose the type of delivery you prefer. You will receive your new card at your address within 10 working days.

To request a duplicate over the phone, you need to call 1-800-432-3117 and follow the instructions on the recording or speak to an agent. You will need to enter your card number, your name, your date of birth and your postal code. You will receive your new card at your address within 10 working days.

Chase Freedom Unlimited Visa card contacts in the United States

The Chase Freedom Unlimited Visa card contacts in the United States are as follows:

- Official website: www.chase.com/freedom

- Customer service phone number: 1-800-432-3117

- Customer service e-mail: Not available

- Mailing address: Card Services, P.O. Box 15298, Wilmington, DE 19850