Find out all about applying for the Destiny Mastercard credit card

The Destiny Mastercard credit card is an option for those who are looking for rebuilding or improving their credit history in the United States. It is issued by First Electronic Bank, a digital bank based in Utah, and has the Mastercard brand, which is accepted in millions of places in the country and around the world. In this text, you will learn about the main features, advantages, disadvantages, requirements, and ways to apply for this card.

Advertisements

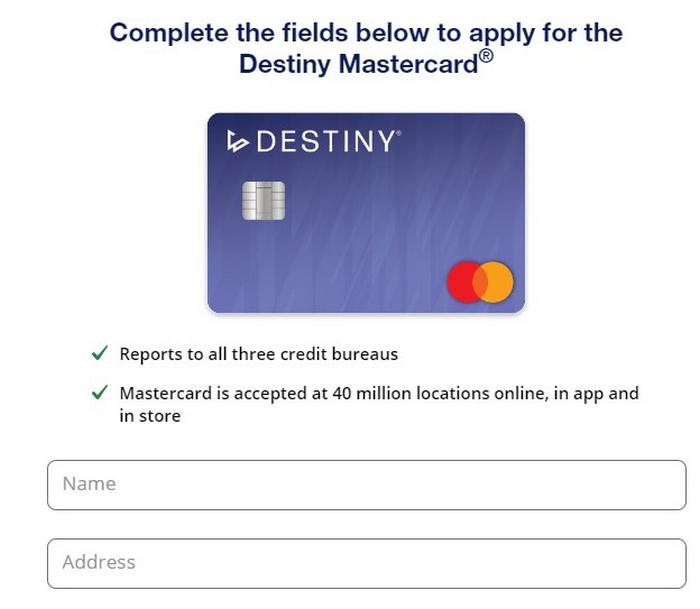

How to apply for the Destiny Mastercard credit card

Applying for the Destiny Mastercard is a straightforward process that can help you build or rebuild your credit. Follow these simple steps to get started:

Advertisements

- Visit the Official Website: Go to the Destiny Mastercard official website.

- Check Pre-Qualification: Use the pre-qualification tool to see if you are eligible without affecting your credit score.

- Complete the Application Form: Fill out the online application form with your personal and financial information.

- Submit the Application: Review your information for accuracy and submit the application.

- Wait for Approval: You will receive a decision on your application, typically within minutes. If approved, your card will be mailed to you.

What are the requirements to apply for the Destiny Mastercard credit card

To apply for the Destiny Mastercard credit card, you need to be at least 18 years old, be a legal resident of the US, and have a valid physical address in the country. You also need to have a monthly income enough to pay your expenses and your card, and have a credit history that fits the criteria of the issuer.

You do not need to have a high score or a security deposit to get the card, but that may influence your credit limit and the fees that you will pay. The issuer will analyze your credit profile based on the information that you provide on the application form and on the reports from the credit bureaus.

Advertisements

Advantages that the Destiny Mastercard credit card offers

The main benefit of the Destiny Mastercard credit card is the possibility of getting credit even without having a good score or a security deposit. It is intended for people who have a limited or damaged credit history, and who want to increase their chances of approval in future loans, financing, or cards. Besides, the card offers other advantages, such as:

- Monthly report to the three major credit bureaus in the US (Equifax, Experian, and TransUnion), which can help you improve your score over time, if you pay your bills on time and keep a low balance;

- Use in the US and abroad, anywhere that accepts Mastercard, whether in physical stores, online, or in apps;

- Protection against fraud, loss, or theft of the card, with the chip technology and the possibility of locking and unlocking the card by the app;

- Access to exclusive benefits from Mastercard, such as travel assistance, accident insurance, discounts on purchases and services, among others.

Annual fee

The annual fee for the Destiny Mastercard varies between $59 and $99, depending on your credit analysis. This affordable amount allows you to enjoy the card’s benefits without compromising your budget.

Interest rates and fees of the card

The Destiny Mastercard credit card has an annual interest rate (APR) of 24.9%, which is applied to the balance that you do not pay in full by the due date of the bill.

This rate is relatively high, compared to other credit cards available in the market, so it is advisable that you always pay the full amount of your bill, to avoid the accumulation of interest.

In addition, the card charges a series of fees, which may vary depending on your credit profile and your limit. Some of the main fees are:

- Annual fee: a fixed charge that you pay every year to have the card. It can be $59, $75, or $99, depending on your credit limit;

- Program processing fee: a one-time charge that you pay when your card is approved and issued. It can be $25, $49, or $95, depending on your credit limit;

- Foreign transaction fee: a charge of 1% on the value of each purchase that you make outside the US, in foreign currency;

- ATM withdrawal fee: a charge of $5 or 5% of the value of each withdrawal that you make with the card, whichever is greater;

- Late fee: a charge of up to $40 if you do not pay the minimum amount of your bill by the due date;

- Returned payment fee: a charge of up to $40 if your payment is rejected for lack of funds or another reason.

Coverage

Destiny Mastercard offers both national and international coverage, allowing you to use your card in millions of establishments around the world, guaranteeing convenience and security in all your transactions.

Flag

Destiny Mastercard carries the Mastercard brand, recognized and accepted globally, offering you wide acceptance and exclusive benefits on purchases and services.

How to access the bill of the Destiny Mastercard credit card

The bill of the Destiny Mastercard credit card is the document that shows the summary of your purchases, payments, interest, fees, and other information about your card. It is generated monthly, and has a due date, which is the deadline for you to pay the total or minimum amount of your bill.

You can access your bill in two ways: by mail or by the app. If you choose mail, you will receive your printed bill at your address, a few days before the due date. If you choose the app, you will receive your digital bill on your phone, and you will be able to view it at any time.

To choose how you want to receive your bill, you need to access the app of the card, go to “Settings”, and select the option “Paperless Statements”. You can change your preference at any time, without any additional cost.

How to Unlock your Destiny Card

To unlock your Destiny Mastercard, simply call the customer service number provided with the card and follow the instructions. You can also unlock via the CFC Mobile Access app, available for download from the App Store and Google Play.

How to download the card app

The Destiny Mastercard credit card app is a tool that allows you to manage your card in a practical and secure way by your phone. With the app, you can:

- See your balance, your available limit, and your transaction history;

- Pay your bill online, with your debit card or your bank account;

- Lock and unlock your card in case of loss, theft, or suspicion of fraud;

- Receive alerts and notifications about your card, such as payment reminders, purchase confirmations, and security warnings;

- Access the benefits and offers from Mastercard;

- Contact the customer service.

To download the app, you need to have a smartphone with Android or iOS operating system. You can download the app for free on the Google Play Store or on the App Store, depending on your device. After installing the app, you need to register with your card number, your name, your date of birth, and your zip code. Then, you can create a username and a password, and access the app whenever you want.

How to get a second copy of the Destiny Mastercard credit card

If your Destiny Mastercard credit card is lost, stolen, damaged, or expired, you can request a second copy by the app or by phone. You will not be charged for the replacement of the card, unless you request an expedited delivery. The new card will have the same number, expiration date, and security code as the old one.

How do I contact my card provider?

The contact details for the Destiny Mastercard in the United States are as follows:

- Official website: www.destinycard.com;

- Customer service phone number: 1-844-222-5695;

- Customer service e-mail: [email protected];

- Mailing address: First Electronic Bank, P.O. Box 5019, Sandy, UT 84091-5019.

In conclusion, the Destiny Mastercard Credit Card stands out as a solid option for consumers in the United States, offering attractive benefits and an efficient management platform. By understanding its advantages, fees and procedures, users can make the most of this versatile financial tool.