How to Download Bank of America Custom Cash Rewards Credit App for Android/IOS

In today’s digital world, quick and easy access to our finances is essential. The Bank of America app offers just that, allowing your customers to manage their accounts, make transfers, pay bills and more, all with just a few taps.

Advertisements

In this guide, we’ll cover the simple steps to download and install the Bank of America app on your device.

Advertisements

Bank of America Active Cash Card App

Bank of America does not offer a specific application just for the “Customized Cash Rewards” card. Instead, cardholders typically utilize the main Bank of America application to manage their accounts, including their activities and rewards related to the Customized Cash Rewards card.

Download Bank of America Active Cash App

Downloading the Bank of America app is a simple process. Here are the basic steps to download and install the app on iOS (iPhone/iPad) and Android devices:

Advertisements

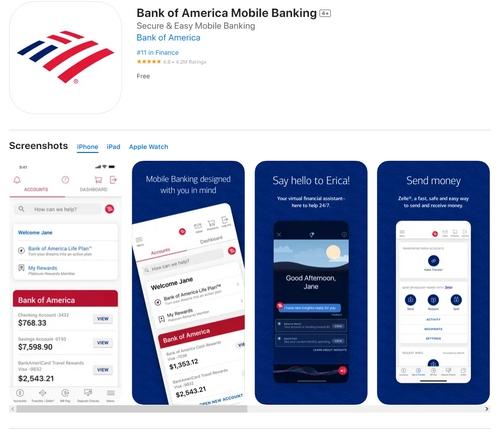

For iOS devices (iPhone/iPad)

- Open the App Store on your device.

- Tap the magnifying glass (search) icon at the bottom of the screen.

- Type ” Bank of America ” in the search bar.

- Look for the official Bank of America app in the list of results and tap it.

- Tap the “Get” button or cloud icon (if you have previously downloaded the app).

- If prompted, authenticate the installation using Face ID, Touch ID, or your Apple ID password.

- After downloading and installing, you will find the app icon on your device’s home screen. Open the app and follow the instructions to set up or access your account.

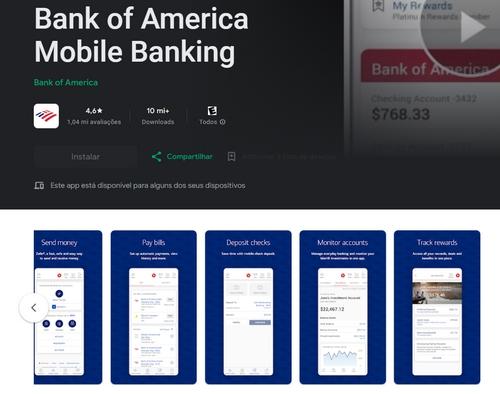

For android devices

- Open the Google Play Store on your device.

- Tap the search bar at the top of the screen.

- Type ” Bank of America ” and press “Search” or the magnifying glass icon.

- Look for the official Bank of America app in the list of results and tap it.

- Tap the “Install” button.

- After downloading and installing, you will find the app icon on your device. Open the app and follow the instructions to set up or access your account.

Always make sure to download and install apps only from official sources (App Store for iOS and Google Play Store for Android) to ensure app security and authenticity. Avoid downloading apps from third party sources or untrustworthy links.

Application Services

If you have Customized Cash Rewards card, you can manage your account and enjoy various features through this app. Here are some of the potential benefits of the Bank of America mobile app for Customized Cash Rewards cardholders:

- Balance and Activity View : Users can quickly check their balances, view recent transactions, and review payment history.

- Mobile Payments : The app allows users to pay their credit card bills easily, and also allows setting up recurring payments.

- Rewards Management : Customized Cash Rewards holders can see how much they’ve earned in rewards, choose their cashback categories (if applicable), and redeem their rewards directly from the app.

- Custom Alerts : Users can set up and receive alerts for various activities, such as when a purchase is made, when a payment is due, or when they are approaching their credit limit.

- Enhanced Security : Users can set up biometric authentication (fingerprint or facial recognition) to access their accounts. In addition, there are functionalities to block or unblock the card instantly in case of loss or theft.

- Customer Support : Through the app, users have easy access to customer support for any queries or issues they may have.

- Access to FICO Score : Some Bank of America cards, possibly including Customized Cash Rewards, offer free access to your FICO Score, allowing you to monitor your credit health.

- Additional Banking Functions : In addition to credit card management, the app also allows users to perform a variety of banking functions such as transferring funds, depositing checks using the phone’s camera, and more.

Card Contacts

To contact Bank of America, you have several options. However, the most specific or most effective way of contacting you may depend on why you want to communicate with the bank. Here are some general ways to contact Bank of America:

Telephone

Typically, the Bank of America customer service number is printed on the back of credit or debit cards. If you have a Bank of America card, you can start there. Also, the official Bank of America website usually lists different phone numbers for different services and inquiries.

Website

The official Bank of America website has a “Contact” or “Customer Service” section where you can find specific contact information, including phone numbers, email addresses and more.

Physical Branches

If you prefer face-to-face contact, you can visit one of the Bank of America physical branches. The bank’s website usually has a branch locator that can help you find the branch closest to you.

Mobile Application

If you have the Bank of America mobile app installed on your smartphone, there are usually options for contacting customer support directly through the app.

For questions that do not require an immediate response, you may choose to send a letter to the bank’s corporate address or to the address listed on your statement, if you have one.

Social media

Some questions or inquiries may be handled through Bank of America’s official social media pages, such as Twitter and Facebook. However, never share personal or confidential information on public platforms.