Exploring the Trading Platforms of Interactive Brokers Brokerage

If you’re considering investing with a global broker that offers access to diverse markets, Interactive Brokers (IBKR) might be an excellent choice.

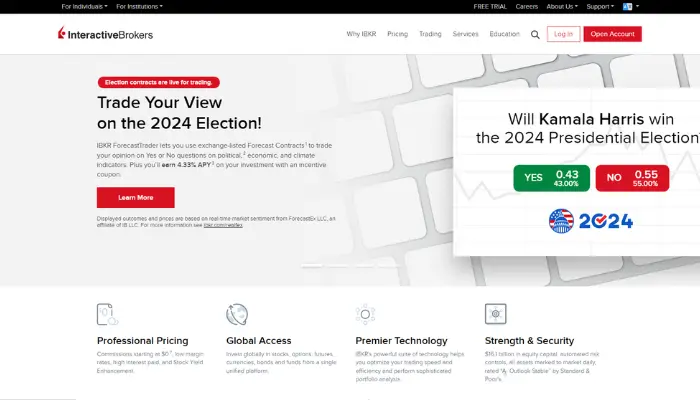

Advertisements

Known for its competitive cost structure and a wide range of financial products, Interactive Brokers is one of the top brokers for investors looking to diversify their portfolio and explore new markets.

Advertisements

In this article, we’ll cover how to open an account, understand fees, explore its trading platforms, and much more.

Opening an Account

Opening an account with Interactive Brokers is the first step toward accessing a vast array of global investment opportunities.

Advertisements

While the process may initially seem complex due to the thorough requirements, it’s designed to comply with high regulatory standards, ensuring a secure and well-protected investment environment for clients.

Interactive Brokers prioritizes security and transparency, which means that each step is structured to verify your information and meet global compliance standards.

Following these steps carefully will allow you to start trading on one of the world’s most comprehensive trading platforms.

Step-by-Step Guide to Opening an Account with Interactive Brokers:

- Access the Official Website: Visit the Interactive Brokers website and select the option to open a new account. Use a secure device and have all necessary documents ready.

- Select the Account Type: There are various account options, including individual, joint, corporate, and retirement accounts. Choose the one that best meets your financial goals.

- Fill in Personal Information: Provide basic details, such as full name, date of birth, nationality, and address. IBKR requires detailed information to comply with international financial regulations.

- Provide Financial Information: To assess investor suitability, you’ll need to provide information about employment, annual income, net worth, and investment experience.

- Submit Identification Documents: IBKR requires an official photo ID (passport or ID card) and proof of residence. This is part of the verification process to ensure your account’s security.

- Complete Verification: After submitting documents, you’ll undergo a verification process that can take a few days. Once approved, you’ll be able to access your account and make deposits.

Opening an account with Interactive Brokers is simple, and most steps can be managed online.

Fees and Commissions

One standout aspect of Interactive Brokers is its transparent, competitive fee and commission structure. Known for some of the lowest fees in the market, Interactive Brokers is especially popular among high-volume traders who value the cost efficiency that IBKR provides.

By keeping trading costs minimal, investors can maximize returns without being significantly impacted by fees, which can be a deciding factor when choosing a broker for frequent trades.

IBKR’s pricing model is particularly appealing because it tailors fees based on the trading volume, type of account, and the asset classes traded, allowing investors to benefit from economies of scale.

Let’s explore some of the key fees and how they impact your trading experience with Interactive Brokers.

- Commissions: Commissions vary depending on the asset traded and the market. For example, US stock trades generally have a low and competitive commission structure, typically around $0.005 per share.

- Margin Rates: Interactive Brokers also offers attractive margin rates, allowing investors greater leverage in their trades. IBKR’s margin interest rate is tiered, meaning the higher the margin balance, the lower the rate applied.

- Inactivity Fee: Interactive Brokers charges an inactivity fee if the account balance falls below a specific amount and the investor doesn’t meet a minimum trade volume. This fee can be avoided by meeting the activity requirements or maintaining a higher balance.

- Withdrawal Fees: The first withdrawal each month is free; additional withdrawals may incur fees depending on the chosen method.

Trading Platforms

Interactive Brokers provides some of the most advanced and versatile trading platforms in the market, tailored to meet the needs of both novice and experienced investors.

Whether you’re a high-frequency trader, a long-term investor, or someone interested in exploring algorithmic trading, Interactive Brokers has a platform to suit your style.

With powerful tools, real-time market data, and a range of customization options, these platforms allow investors to make well-informed decisions and execute trades efficiently. Here’s an overview of the primary platforms available:

- Trader Workstation (TWS): TWS is a robust and widely used platform for advanced trading. It provides access to technical analysis tools, detailed charts, and a variety of order types.

- IBKR Mobile: For those who prefer trading via smartphone, IBKR Mobile is an excellent option, offering nearly all the functionality of the desktop version. Available for both iOS and Android, this platform allows you to monitor the market and execute trades from anywhere.

- Client Portal: This online portal offers a simplified interface for investors who prefer a more straightforward trading experience. It’s ideal for checking balance, transaction history, and performing quick trades.

- API and Automation Tools: For experienced investors interested in creating automated trading strategies, IBKR provides a flexible API that allows integration with third-party software or building custom solutions.

Customer Support

Reliable customer support is crucial for investors navigating international markets, where timely assistance can make a significant difference.

Interactive Brokers understands this need and provides a variety of support channels to ensure clients receive help when they need it most.

With multilingual support available, though somewhat limited for Portuguese speakers, IBKR strives to address the diverse needs of its global clientele efficiently and effectively.

- Support Channels: IBKR offers support via phone, email, and online chat. Chat is typically the fastest channel for resolving simple queries, while phone support can be helpful for more complex issues.

- Availability: Interactive Brokers provides 24-hour customer support during trading days. It’s always wise to check the support hours for your specific language if you need specialized assistance.

- Knowledge Base: Interactive Brokers has an online knowledge base with answers to common questions. Many investors find solutions through this library, which covers topics like account opening, deposits, withdrawals, and more.

Security and Regulation

Security is one of Interactive Brokers’ core pillars, with the broker fully committed to implementing the highest standards of protection for its clients’ assets and data.

In a global market, where financial security and regulatory compliance are paramount, Interactive Brokers has established a reputation for robust safeguards and comprehensive risk management practices.

The broker operates under strict regulatory oversight and offers additional measures like insurance coverage and advanced account security features, ensuring clients can invest with peace of mind.

- Global Regulation: IBKR is regulated by renowned financial authorities, including the SEC (Securities and Exchange Commission) in the US and the FCA (Financial Conduct Authority) in the UK. These regulations ensure that the broker operates according to international investor protection standards.

- Account Insurance: Interactive Brokers provides additional protection through the US SIPC (Securities Investor Protection Corporation) insurance, which offers coverage against losses in case of broker insolvency.

- Two-Factor Authentication: IBKR implements two-factor authentication (2FA) to provide an extra layer of security when accessing your account. It’s recommended that all users enable this feature.

Available Products and Markets

Interactive Brokers is known for its diverse range of financial products, allowing investors a wide variety of options.

List of Products Offered by Interactive Brokers:

- Stocks: IBKR allows stock trading in several global markets, including the US, Europe, Asia, and more.

- ETFs: Exchange Traded Funds (ETFs) are popular for diversification, and IBKR offers access to a vast range of ETFs.

- Options and Futures: The broker is also one of the best options for trading options and futures, allowing you to explore advanced investment strategies.

- Forex: For investors interested in the foreign exchange market, IBKR offers access to currency pairs with competitive spreads.

- Fixed Income Securities: Interactive Brokers also offers a selection of fixed-income securities, such as bonds and other investment funds.

Educational Tools

Interactive Brokers is committed to empowering its clients with a comprehensive suite of educational tools designed to help investors of all levels enhance their knowledge and trading skills.

Whether you’re new to the world of investing or a seasoned trader looking to refine strategies, IBKR provides resources that cater to your learning needs.

These tools cover a wide range of topics, from foundational investment principles to advanced trading techniques, ensuring that every client can access the information necessary to make informed and confident decisions.

Educational Resources Available:

- IBKR Campus: This is a learning platform with courses and tutorials on topics like stock trading, risk management, and using IBKR’s platforms.

- Webinars: Interactive Brokers hosts free webinars with market experts, covering everything from investment strategies to using trading tools.

- Demo Account Simulator: For new investors, IBKR offers a demo account that lets you practice investment strategies without risking real capital.

- Calculators and Research Tools: The broker offers tools that help simulate the impact of fees, calculate margin requirements, and provide insights for investment decisions.

Interactive Brokers is a solid and robust broker, full of tools and resources that make it a favorite among investors. From opening an account to using its advanced platforms and educational options, it offers everything you need to invest confidently in a global market.