U.S. Bank Visa Platinum: Complete guide for new users

The US Bank Visa Platinum is more than just a credit card; It’s a gateway to a host of exclusive benefits and conveniences. With its competitive interest rates and generous rewards program, this card offers an attractive combination of value and security. Whether it’s for everyday shopping, managing travel expenses or taking advantage of extended protections, it stands out as a smart choice for discerning consumers.

Advertisements

Exploring the features of the US Bank Visa Platinum reveals its multiple facets of supporting the modern lifestyle. From cash back offers to fraud protection, every detail is designed to improve the user’s financial experience. Additionally, cardholders have access to a range of exclusive services, such as travel assistance and complementary insurance, which add invaluable value to their financial journey.

Advertisements

We invite you to dive into the universe of US Bank Visa Platinum and discover how it can enrich your financial life. This introductory guide is just the beginning; There’s a lot more to explore about how to maximize your benefits and use the card effectively. Whether you’re a frequent traveler, an avid shopper, or someone who values security and convenience, there’s something in the US Bank Visa Platinum to meet your needs.

How to apply for the US Bank Visa Platinum card

Below is a step-by-step guide to help you apply for your US Bank Visa Platinum Card efficiently.

Advertisements

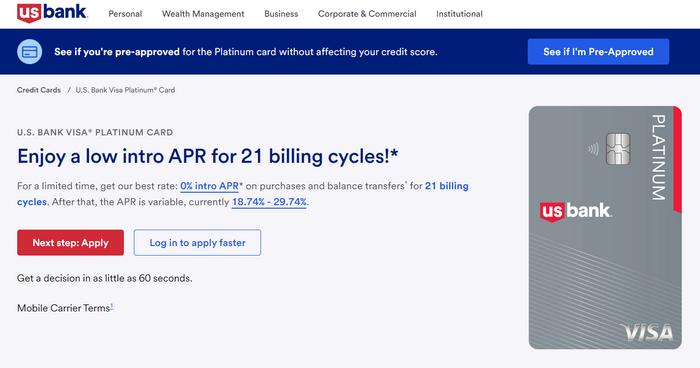

- Visit the US Bank Official Website: Visit the US Bank official website. Navigate to the credit cards section and select the US Bank Visa Platinum Card. You will find detailed information about the card’s benefits and terms.

- Click “Apply Now”: On the US Bank Visa Platinum Card page, click the “Apply Now” button. This will redirect you to the online application form.

- Fill Out the Application Form: Complete the form with your personal information, including your full name, address, date of birth, Social Security number, annual income, and employment details. Make sure to provide accurate information to avoid delays in processing your application.

- Review and Submit Your Application: Review all the information you have provided to ensure it is correct. Once reviewed, submit your application by clicking the appropriate button.

- Wait for Approval: After submitting your application, US Bank will review your information and perform a credit check. The approval process can take a few minutes or a few days, depending on your financial situation and the complexity of the review.

If approved, you will receive your US Bank Visa Platinum Card in the mail at the address provided. Once your card arrives, activate it by following the instructions included in the package.

By following these simple steps, you will be on your way to obtaining the US Bank Visa Platinum Card and starting to enjoy all its benefits.

Who Can Apply for the US Bank Visa Platinum Credit Card

To be eligible for the US Bank Visa Platinum credit card, it is essential to have a solid credit history, demonstrating responsibility and effective financial management. Applicants must have income that supports their expenses and guarantees the ability to meet card obligations. This criterion aims to ensure that holders are able to take advantage of the benefits without compromising their financial health.

US Bank does not specify business or occupation restrictions for the application, but evaluates the applicant’s debt-to-income ratio as part of the approval process. A good to excellent credit history is crucial to increasing your chances of approval, reflecting the importance of an ongoing commitment to responsible financial practices.

By establishing these eligibility requirements, US Bank ensures that the Visa Platinum Card is awarded to individuals with the financial capacity and maturity to manage credit prudently. This selection process contributes to a customer base that can maximize the benefits offered by the card, while maintaining a healthy financial balance.

Discover the US Bank Visa Platinum card

The US Bank Visa Platinum Card is a prominent offering from US Bank, making its presence known with a suite of distinct features. This credit card is valued for its competitive interest rates, offering an initial interest-free period on purchases and balance transfers.

Within the competitive credit card market, the US Bank Visa Platinum stands out for its relevance and adaptability. It can meet a wide range of financial needs, combining flexibility with a series of exclusive advantages. This not only makes it attractive to a variety of consumer profiles, but also reinforces its position as a solid choice for those looking for value and security in a card.

The choice of US Bank Visa Platinum reflects a conscious decision on the part of consumers who are looking for not just a payment method, but a financial partner that offers more. Its customer-centric approach and inclusion of benefits that go beyond the basics demonstrate its value in today’s financial climate.

US Bank Visa Platinum Card Benefits

The US Bank Visa Platinum Card offers a range of benefits designed to provide financial flexibility and peace of mind. Whether you are looking to manage your expenses, protect your purchases, or enjoy some extra security, this card has features that cater to your needs. Here are the key benefits of the US Bank Visa Platinum Card:

- 0% Introductory APR: Enjoy a 0% introductory APR on purchases and balance transfers for the first 20 billing cycles, helping you save on interest.

- No Annual Fee: Save money with no annual fee, allowing you to take full advantage of the card’s features without extra cost.

- Cell Phone Protection: Get coverage for your cell phone against damage or theft when you pay your monthly bill with your US Bank Visa Platinum Card.

- Fraud Protection: Benefit from zero fraud liability, ensuring you are not held responsible for unauthorized charges.

- Online and Mobile Account Management: Easily manage your account, track your spending, and make payments using the US Bank Mobile App or online banking.

- Free Credit Score Access: Monitor your credit score for free, helping you stay informed about your credit health.

- Emergency Assistance: Access emergency cash and card replacement services if your card is lost or stolen.

- Travel and Emergency Assistance Services: Receive support with travel emergencies, including medical and legal referrals.

- Extended Warranty Protection: Extend the manufacturer’s warranty on eligible purchases, giving you added peace of mind.

These benefits make the US Bank Visa Platinum Card a versatile and valuable tool for managing your finances and ensuring your purchases are protected.

Does the US Bank Visa Platinum card have a free annual fee?

The US Bank Visa Platinum card stands out for offering no annual fees, a significant advantage for consumers looking for value and efficiency in financial products. This feature eliminates the worry about additional annual costs, allowing cardholders to fully enjoy the card’s benefits and rewards. The lack of annual fees makes it an attractive option for a wide range of users.

Compared to other cards on the market that charge an annual fee without offering equivalent benefits, the US Bank Visa Platinum stands out as an economical choice. Cardholders benefit from features such as travel insurance and extended warranties on purchases, without the burden of fixed annual fees. This annual fee exemption reinforces the value of the card, making it more accessible and desirable.

Does US Bank Visa Platinum have an app?

Yes, the US Bank Visa Platinum card is supported by the US Bank Mobile App, which allows you to manage your account conveniently from your smartphone. The app offers a variety of features such as viewing your balance, making payments, transferring funds, and accessing customer service.

How to Download the App on the Play Store

- Open the Play Store: On your Android device, open the Google Play Store.

- Search for “US Bank Mobile App”: Use the search bar at the top to type “US Bank Mobile App” and tap the search icon.

- Select the App: Find the app in the search results (look for the official US Bank logo) and tap on it.

- Install the App: Tap the “Install” button to download and install the app on your device.

- Open the App: Once the installation is complete, tap “Open” to launch the US Bank Mobile App.

How to Download the App on the App Store

- Open the App Store: On your iOS device, open the Apple App Store.

- Search for “US Bank Mobile App”: Tap on the search tab at the bottom and type “US Bank Mobile App” in the search bar, then tap the search button.

- Select the App: Find the official US Bank Mobile App from the search results and tap on it.

- Download the App: Tap the “Get” button to download and install the app. You may need to enter your Apple ID password or use Face ID/Touch ID to confirm.Open the App:

With the US Bank Mobile App, you can easily manage your US Bank Visa Platinum card and access all the features and benefits it offers right from your mobile device.

What are the fees and interest for the US Bank Visa Platinum Card?

Understanding the fees and interest rates associated with the US Bank Visa Platinum Card is crucial for making informed financial decisions. This card offers several attractive features, but it’s important to be aware of any potential costs. Here, we detail the main fees and interest rates you can expect with this card.

Annual Fee

One of the most appealing aspects of the US Bank Visa Platinum Card is that it has no annual fee. This allows you to enjoy the card’s benefits without worrying about an additional yearly cost.

APR (Annual Percentage Rate)

The APR for the US Bank Visa Platinum Card varies based on the type of transaction and your creditworthiness:

- Introductory APR: For the first 20 billing cycles, you benefit from a 0% introductory APR on both purchases and balance transfers. This offers significant savings if you plan to make large purchases or transfer balances from higher-interest cards.

- Standard APR: After the introductory period, the APR will revert to a variable rate, typically ranging from 18.99% to 28.99%, depending on your credit score and market conditions.

Balance Transfer Fee

When transferring balances to your US Bank Visa Platinum Card, the fee is either 3% of the amount of each transfer or $5, whichever is greater. This is a common fee among credit cards, but it’s essential to factor it in when considering balance transfers.

Cash Advance Fee

If you use your card for a cash advance, you will incur a fee of 5% of the amount of each cash advance or $10, whichever is greater. Additionally, the APR for cash advances is typically higher, often around 30.99% variable, and interest begins accruing immediately.

Late Payment Fee

The fee for a late payment can be up to $41. It’s crucial to make at least the minimum payment by the due date each month to avoid this fee and any potential negative impact on your credit score.

Returned Payment Fee

If a payment is returned for any reason, a fee of up to $41 may be charged. Ensure that your payment methods are valid and have sufficient funds to avoid this charge.

Foreign Transaction Fee

For those who travel internationally, it’s important to note that the US Bank Visa Platinum Card charges a 3% fee on each transaction made in a foreign currency. This fee can add up if you frequently use your card abroad.

By understanding these fees and interest rates, you can better manage your use of the US Bank Visa Platinum Card and make the most of its benefits while minimizing costs.

How to unlock US Bank Visa Platinum card?

Unlocking your US Bank Visa Platinum card is a simple procedure designed to quickly restore access to your financial functionality. If your card has been blocked for security reasons, such as suspected fraud, or if you blocked it preventively, the first step is to contact US Bank customer service directly.

During contact, be prepared to provide personal information and card details for identity verification. This may include your full name, address, card number (if available), or other requested personal data. The unlocking process is quick, and the attendant will guide you through the necessary steps, ensuring that your card is unlocked safely and that you can resume use immediately.

How do I request a duplicate of the US Bank Visa Platinum card?

To request a duplicate US Bank Visa Platinum card if lost or stolen, cardholders should immediately contact US Bank customer service. The bank will promptly block the card to prevent fraud and begin the process of issuing a new copy.

Cardholders can expect to receive a duplicate in 5 to 10 business days, although express delivery options may be available to speed up this process, potentially at additional cost.

Regarding the costs for issuing a new copy, US Bank may waive the fee in certain situations, such as in cases of theft with the presentation of a police report. However, it is recommended to confirm directly with the bank about any applicable fees.

How do I contact you about the US Bank Visa Platinum card?

The most direct method is by phone, with dedicated customer service lines operating 24/7, allowing immediate access to assistance in any situation, email for detailed queries, or online chat for quick assistance. These channels offer flexibility to resolve queries or problems conveniently.

Online chat and email services may have specific hours, while phone support is always available. It’s important to check the US Bank website for updated hours and choose the contact method that best suits your needs.

For efficient support, please have relevant card and account information on hand. This facilitates communication and allows customer support to offer faster and more accurate solutions to any questions or problems faced.