U.S. Bank Secured Visa: Complete Guide to Build or Rebuild Credit

The U.S. Bank Secured Visa® Card is more than just a starting point in the world of credit—it is a strategic tool for building or rebuilding a solid financial foundation. Designed for individuals who want to establish credit responsibly, this card combines simplicity, security, and the credibility of one of the largest banks in the United States. With a refundable security deposit and straightforward terms, it offers a practical path to improving your credit profile.

Advertisements

Exploring the features of the U.S. Bank Secured Visa reveals how it supports a modern and disciplined financial lifestyle. Cardholders benefit from fraud protection, zero liability for unauthorized transactions, and access to powerful digital tools that help track spending and manage payments efficiently. Most importantly, responsible use of the card is reported to major credit bureaus, helping users strengthen their credit history over time.

Advertisements

We invite you to explore how the U.S. Bank Secured Visa can play a key role in your financial journey. This guide is just the beginning. Whether you are starting your credit journey, recovering from past financial challenges, or seeking a safer way to manage everyday expenses, the U.S. Bank Secured Visa offers a reliable and accessible solution tailored to your needs.

How to apply for the US Bank Secured

Below is a step-by-step guide to help you apply for the U.S. Bank Secured Visa Card in a simple and efficient way.

Advertisements

U.S. Bank Secured Visa® Card

- Visit the U.S. Bank Official Website: Access the official U.S. Bank website and navigate to the credit cards section. Look for the U.S. Bank Secured Visa Card, where you will find detailed information about how the card works, including security deposit requirements, fees, and credit-building benefits.

- Click “Apply Now”: On the U.S. Bank Secured Visa Card page, click the “Apply Now” button to begin the online application process.

- Complete the Application Form: Fill out the application with your personal details, such as full name, address, date of birth, Social Security number, employment information, and annual income. You will also be asked to choose the amount of your refundable security deposit, which will typically determine your credit limit.

- Submit Your Security Deposit: After completing the application, you must fund your security deposit. This deposit acts as collateral and is fully refundable as long as your account remains in good standing.

- Review and Submit Your Application: Carefully review all the information provided. Once confirmed, submit your application for review.

- Wait for Approval: U.S. Bank will evaluate your application. Approval decisions may be made quickly or take a few business days, depending on verification requirements.

If approved, your U.S. Bank Secured Visa Card will be mailed to the address provided. Once it arrives, activate the card following the instructions included, and you can begin using it to build or rebuild your credit responsibly.

Who Can Apply for the US Bank Secured Credit Card

The U.S. Bank Secured Visa Credit Card is designed for individuals who want to build or rebuild their credit, making its eligibility requirements more accessible than traditional unsecured cards. Applicants do not need an established credit history, which makes this card an ideal option for those with limited credit, past financial difficulties, or those starting their credit journey.

To apply, you must have a verifiable source of income to demonstrate your ability to manage monthly payments, as well as the funds required to make a refundable security deposit. The deposit amount typically determines your credit limit and serves as collateral, reducing risk for the issuer while offering applicants greater approval chances.

U.S. Bank also evaluates basic financial information, such as identity verification and compliance with banking requirements, but does not require good or excellent credit for approval. By setting these criteria, the U.S. Bank Secured Visa Card provides a responsible and structured pathway for individuals seeking to establish stronger credit habits while maintaining financial control and stability.

Discover the U.S. Bank Secured Visa Card

The U.S. Bank Secured Visa Card is a reliable financial solution designed to help individuals build or rebuild their credit with confidence. Backed by U.S. Bank, this secured credit card offers a straightforward structure that emphasizes security, control, and responsible credit use. By requiring a refundable security deposit, it provides access to credit while minimizing risk for both the bank and the cardholder.

In a market filled with traditional and unsecured credit cards, the U.S. Bank Secured Visa stands out for its accessibility and purpose-driven design. It is well suited for those with limited or challenged credit histories, offering essential protections such as fraud monitoring, zero liability for unauthorized transactions, and tools that support better financial habits.

Choosing the U.S. Bank Secured Visa Card represents a practical step toward long-term financial stability. Rather than focusing on rewards or promotional rates, it prioritizes credit-building, transparency, and trust—making it a strong option for consumers who want a dependable financial partner while working toward a healthier credit profile.

U.S. Bank Secured Visa Card Benefits

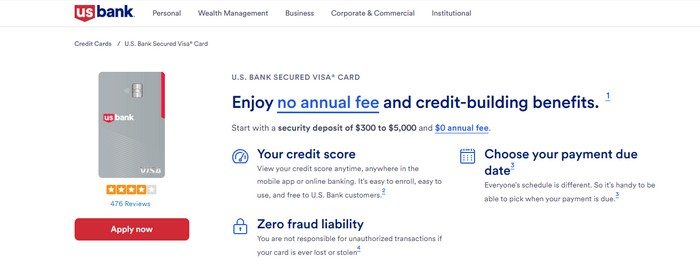

The U.S. Bank Secured Visa Card offers essential benefits focused on security, control, and credit-building rather than promotional rewards. Designed for individuals who want to establish or rebuild their credit, this card provides practical tools and protections that support responsible financial management. Below are the key benefits of the U.S. Bank Secured Visa Card:

- Credit Building Opportunity: Responsible use is reported to major credit bureaus, helping cardholders build or improve their credit history over time.

- Refundable Security Deposit: Your deposit determines your credit limit and is fully refundable when the account is closed in good standing.

- No Rewards Pressure: A simple structure that encourages disciplined spending without the complexity of rotating categories or reward tracking.

- Fraud Protection: Zero liability for unauthorized transactions, providing peace of mind in case of fraud or card misuse.

- Online and Mobile Account Management: Easily track spending, make payments, and manage your account through the U.S. Bank mobile app and online banking.

- Free Credit Score Access: Monitor your credit score and track progress as you build stronger credit habits.

- Emergency Card Replacement: Access assistance for card replacement if your card is lost or stolen.

- Visa Acceptance Worldwide: Use your card anywhere Visa is accepted, both domestically and internationally.

- Purchase Security: Eligible purchases may be protected against damage or theft for a limited period after purchase.

These benefits make the U.S. Bank Secured Visa Card a reliable and responsible choice for anyone seeking financial stability and a structured path toward stronger credit, without unnecessary fees or complicated features.

Does the U.S. Bank Secured Visa Card Have an Annual Fee?

The U.S. Bank Secured Visa Card does not charge an annual fee, making it an accessible option for individuals who want to build or rebuild their credit without unnecessary ongoing costs. By eliminating an annual fee, the card allows users to focus on responsible credit use rather than worrying about recurring charges that can hinder financial progress.

While the U.S. Bank Secured Visa requires a refundable security deposit, this amount is not a fee and can be recovered when the account is closed in good standing. Compared to many secured cards that combine deposits with annual fees, this card stands out as a cost-effective and transparent solution.

This no-annual-fee structure reinforces the card’s purpose as a practical financial tool rather than a premium product. It makes the U.S. Bank Secured Visa Card particularly appealing for consumers seeking a straightforward, low-risk way to establish healthier credit habits.

Does the U.S. Bank Secured Visa Card Have an App?

APR (Annual Percentage Rate)

The APR for the U.S. Bank Secured Visa Card applies to carried balances and varies based on market conditions and the cardholder’s credit profile. As a secured card focused on credit building, it does not offer an introductory 0% APR period.

- Standard Purchase APR: A variable APR applies to purchases if the statement balance is not paid in full by the due date.

- Interest Accrual: Interest begins accruing after the grace period if you carry a balance from month to month.

To avoid interest charges, it is recommended to pay the full statement balance each billing cycle.

Balance Transfer Fee

The U.S. Bank Secured Visa Card generally does not emphasize balance transfers as a primary feature. If balance transfers are available, standard fees may apply, typically calculated as a percentage of the transferred amount, with a minimum fee.

Because terms may vary, it is important to review the card’s current disclosure or confirm directly with U.S. Bank before initiating a balance transfer.

Cash Advance Fee

If you use your U.S. Bank Secured Visa Card for a cash advance, a fee will apply. This is usually calculated as a percentage of the cash advance amount, with a minimum dollar charge.

- Cash Advance APR: Typically higher than the purchase APR.

- Interest Timing: Interest begins accruing immediately, with no grace period.

Cash advances are generally not recommended when the goal is responsible credit building.

Late Payment Fee

If a payment is made after the due date, a late payment fee may be charged, up to the maximum allowed under the card’s terms. Late payments can also negatively impact your credit score, which is especially important to avoid when using a secured card to build or rebuild credit. Setting up automatic payments is a practical way to prevent this.

Returned Payment Fee

If a payment is returned due to insufficient funds or invalid payment details, a returned payment fee may be applied. To avoid this fee, ensure your payment method is valid and has sufficient funds before submitting a payment.

Foreign Transaction Fee

The U.S. Bank Secured Visa Card typically charges a foreign transaction fee on purchases made outside the United States or in foreign currencies. This fee is usually calculated as a percentage of the transaction amount. For frequent international use, it’s important to factor in this cost when planning expenses.

How to Unlock the U.S. Bank Secured Visa Card

If your U.S. Bank Secured Visa Card is blocked due to security concerns or a preventive action, unlocking it is a straightforward process. The first step is to contact U.S. Bank customer service directly.

You will need to verify your identity by providing personal and account-related information. Once verification is complete, the representative will guide you through the unlocking process. In most cases, access to your card is restored quickly.

How Do I Request a Replacement for the U.S. Bank Secured Visa Card?

If your U.S. Bank Secured Visa Card is lost or stolen, contact U.S. Bank customer service immediately. The bank will block the card to prevent unauthorized transactions and initiate the issuance of a replacement card.

Replacement cards are typically delivered within 5 to 10 business days, though expedited delivery may be available. Fees for replacement may apply, but in certain cases—such as theft with proper documentation—fees may be waived.

How Can I Contact U.S. Bank About the U.S. Bank Secured Visa Card?

You can contact U.S. Bank through several official channels:

- Phone Support: Available 24/7 for immediate assistance.

- Online Chat: Accessible through the U.S. Bank website or mobile app for quick questions.

- Email or Secure Messaging: Ideal for detailed inquiries that do not require urgent resolution.

For faster service, keep your card and account information available when contacting customer support. Always consult the official U.S. Bank website for the most up-to-date contact options and hours of operation.