Wells Fargo Active Cash Credit Card: Know the benefits and advantages

The Wells Fargo Active Cash Card has become an attractive option in the credit card market, standing out for its cash rewards and associated benefits.

Advertisements

In this article, we’ll explore the key perks and benefits of this card, providing a clear picture of its value to consumers and helping those interested make an informed decision about joining.

Advertisements

Benefits and Perks of the Wells Fargo Card

The Wells Fargo Active Cash Card is known for its simple and straightforward rewards structure. It has a number of advantages for its customers. They are:

- Cashback Reward : Offers a fixed percentage of cashback on all purchases, with no rotating categories or caps.

- Welcome Bonus : There may be a bonus offer for new cardholders who spend a certain amount within the first few weeks or months after opening the account.

- Promotional APR : Offers a promotional 0% Annual Percentage Rate (APR) for purchases and balance transfers during an introductory period.

- No Annual Fee : The Wells Fargo Active Cash Card does not charge an annual fee.

- Cell Phone Protection : When you pay your monthly cell phone bill with the Wells Fargo Active Cash card, you may qualify for covered damage or theft protection for your phone.

- Fraud Protection : Wells Fargo provides continuous monitoring of suspicious activity and protection against liability for unauthorized transactions.

- Access to Wells Fargo Online : Cardholders have access to Wells Fargo’s online platform to manage their accounts, check balances, make payments, and more.

- 24/7 Customer Service : Customer support is available at any time of the day.

- Account Alerts : You can set up and receive alerts to monitor your account and card activities.

- Contactless Technology : The card may come equipped with contactless payment technology for fast and convenient transactions.

- Travel Accident Insurance : Depending on current offerings, the card may provide coverage for unexpected accidents while traveling when tickets are purchased with the card.

Keep in mind that terms and benefits may change over time, and there may be specific requirements to qualify for certain benefits.

Advertisements

minimum income

Wells Fargo does not require a minimum income to qualify for the Active Cash card. However, several factors, including income, credit history, existing debt and other financial commitments, are taken into account when the bank assesses an applicant’s eligibility and credit limit.

Annuity

It has no annuity.

Roof

International.

Flag

Visa.

IOF

Here are some of the fees associated with the Wells Fargo Card:

- Annual Fee : $0 (no annual fee).

- APR for Purchases and Balance Transfers : Varies, depending on creditworthiness. There is often a 0% promotional rate for an introductory period.

- Cash Advance APR : Generally higher than the shopping APR.

- Overseas Transaction Fee : A certain percentage of the value of each transaction in US Dollars.

- Cash Advance Fee : A percentage of the advance amount or a fixed amount, whichever is greater.

- Balance Transfer Fee : A percentage of the transfer amount or a fixed amount, whichever is greater.

- Late Payment Fee : A flat fee charged if the minimum payment is not made by the due date.

Keep in mind that exact fees and APRs may vary from card to card.

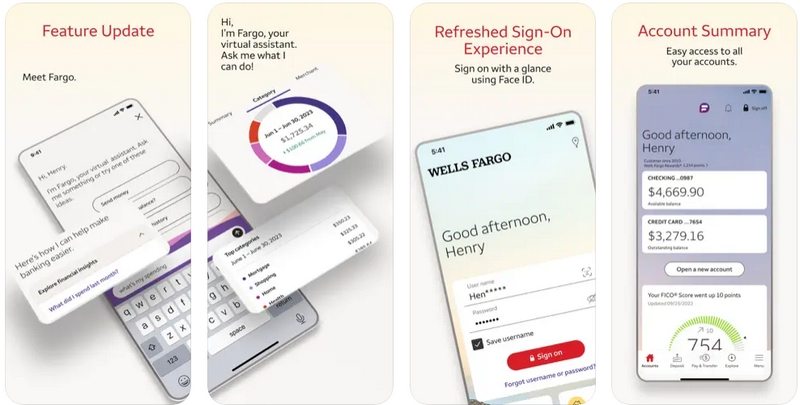

Application

Wells Fargo has a mobile app that allows cardholders to manage their accounts, including those associated with the Wells Fargo Active Cash Card. Simply put, on the Wells Fargo mobile app, you can:

- View Balances and Activity : Access your account details and monitor recent transactions.

- Pay Invoices : Make payments from your credit card directly through the app.

- Transfer Funds : Move money between your Wells Fargo accounts or to external accounts.

- Mobile Deposit : Deposit checks using your device’s camera.

- Locate ATMs and Branches : Find nearby Wells Fargo ATMs and branches.

- Manage Alerts : Set up and receive alerts about your account activity.

Telephone

To resolve any issue related to your Wells Fargo Active Cash credit card, please contact the following service channels:

- Account Management: 1-800-642-4720

- International Collect Calls: 1-925-825-7600

Opening hours are 24 hours a day, 7 days a week.