Wells Fargo Attune Card Benefits: Cashback and Exclusive Perks

The Wells Fargo Attune credit card is an excellent option for those seeking exclusive benefits, flexibility and control over their finances. This card is ideal for both individual consumers and companies that want practicality and convenience in their day-to-day spending.

Advertisements

You can count on an attractive rewards program, offering cashback in several categories, in addition to advantages such as personalized offers and high-quality customer service. Its flexibility of use and additional advantages, such as transaction security and easy online management, make this card a great choice for those who want to maximize their financial experience.

Advertisements

If you are looking for a smart alternative to manage your expenses and gain exclusive benefits, the Wells Fargo Attune is the perfect choice. Keep reading and find out how it can transform the way you pay and save. Don’t miss the chance to explore all the advantages this card offers and how it can fit into your lifestyle.

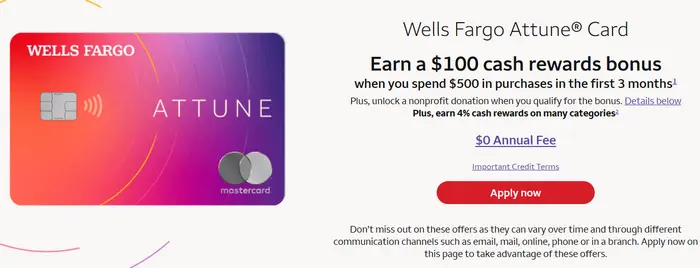

Wells Fargo Attune Benefits

The Wells Fargo Attune offers a range of exclusive advantages that make the card not only a convenient option for everyday use but also a powerful ally during travel. In addition to its attractive rewards, it provides several benefits tailored to those looking for better financial control and a more rewarding consumption experience. Discover how these benefits can optimize your usage both for everyday shopping and while traveling.

Advertisements

- Cashback in Various Categories: With the Wells Fargo Attune, you earn cashback in various categories, including grocery shopping, fuel purchases, and more. This benefit allows you to save constantly and make smarter purchases on a daily basis.

- Travel Perks: If you travel frequently, you’ll love the exclusive travel benefits, such as fee waivers on international transactions and access to discounts on hotels and car rentals. This makes your trips more cost-effective and convenient.

- Payment Flexibility: With customizable payment options, the Wells Fargo Attune gives you greater flexibility in managing your finances. Whether it’s paying in installments or clearing the full balance, you have complete control over your expenses.

- Access to Exclusive Offers: The card also provides personalized offers based on your spending profile. These exclusive deals can include discounts and promotions from partner stores, giving you a more rewarding shopping experience.

How to Apply for the Wells Fargo Attune Card

Applying for the Wells Fargo Attune card is quick and easy. Follow the steps below to ensure approval and start enjoying its benefits:

- Visit the Wells Fargo website: Go to the official Wells Fargo website to start the application process.

- Fill out the online form: Complete the form with your personal and financial information. Make sure all fields are filled out correctly.

- Submit the required documents: Submit any requested documents, such as proof of income or identity, if necessary.

- Track the application status: Monitor the status of your application on the website until approval.

- Receive and activate your card: Once approved, receive your card and follow the instructions to activate it.

With these simple steps, you’ll be ready to enjoy all the exclusive benefits of the Wells Fargo Attune card. Don’t miss out on getting a card that offers attractive rewards and a practical financial experience, both for daily purchases and travel. Apply for yours today and start enjoying the perks.

Wells Fargo Attune Card Fees and Charges

When applying for the Wells Fargo Attune card, it’s essential to understand the main fees and charges associated with it. Below, we highlight the most relevant fees, explaining how each one works and how it may affect your finances both in everyday use and while traveling.

- Annual Fee: The Wells Fargo Attune card comes with a competitive annual fee, usually lower compared to other credit cards. This means you can enjoy all the card’s benefits without worrying about a high annual fee. The annual fee may vary depending on the account type or credit profile.

- Cash Advance Fee: If you need to withdraw cash using the card, a cash advance fee will be charged. This fee is typically a percentage of the amount withdrawn, along with high interest starting from the date of the withdrawal. It is recommended to avoid cash advances whenever possible to prevent additional costs.

- Currency Conversion Fee: When making international purchases, the Wells Fargo Attune charges a currency conversion fee, which is a percentage of the total transaction amount. This fee is applied to cover the costs of converting your currency into the local currency, making the card convenient for international travel but with an additional cost.

- Late Payment Fees: If you fail to pay your statement by the due date, the Wells Fargo Attune will apply interest on the outstanding balance. Late payment interest is charged daily, so it’s important to stay on top of payment deadlines to avoid accumulating extra charges.

Wells Fargo Attune Card Rewards Program

The Wells Fargo Attune card offers a rewarding program that allows users to earn cashback or points on their everyday purchases. This program is designed to make your spending smarter and help maximize your benefits, whether through cash rewards or exclusive perks. Here’s how you can make the most of this benefit.

- Earning Cashback or Points: Earn cashback or points on every purchase. Cashback is returned directly to your account, and points can be redeemed for prizes or discounts.

- Reward Categories: Earn rewards in categories like groceries, fuel, and travel. The more you spend, the more rewards you accumulate.

- Easy and Flexible Redemptions: Easily redeem your rewards for travel or to pay down your balance. The process is fast and accessible.

- Exclusive Perks: In addition to cashback and points, enjoy exclusive promotions and offers from partner events and stores.

How to Increase Your Credit Limit

Increasing the credit limit on your Wells Fargo Attune card can be a great way to enhance your purchasing power and have more financial flexibility. However, this process is not automatic and depends on several factors. To secure a credit limit increase, it’s important to follow some responsible financial practices and show the bank that you are a reliable borrower. Below are the key tips to increase your credit limit.

Pay your bills on time

Keeping your payments up to date is one of the most effective ways to show the bank that you can manage credit responsibly.

Use credit in moderation

Avoid using your entire credit limit. Using a percentage of your available credit responsibly can demonstrate to the bank that you handle your spending well.

Contact the bank

If you want to request an increase, contact Wells Fargo and explain your situation. The bank may review your profile and offer you an opportunity to increase your credit limit.

Increase your income

If possible, increase your monthly income, either through a new job or side activities. A higher income can positively influence the bank’s decision to approve a credit limit increase.

How to Use the Wells Fargo Attune Abroad

Using the Wells Fargo Attune card abroad is a convenient and secure option, allowing you to make purchases and pay for services in various countries. The card is widely accepted worldwide, ensuring that you can easily use it at millions of locations around the globe. Additionally, Wells Fargo Attune offers benefits that make using the card abroad even more advantageous, including waivers on currency conversion fees in certain cases.

- Global Acceptance: The Wells Fargo Attune is accepted at millions of point-of-sale locations worldwide, from physical stores to online purchases. It is compatible with most international payment systems like Visa and MasterCard, ensuring a borderless shopping experience.

- Currency Conversion Fee Waiver: When making purchases in foreign currencies, Wells Fargo Attune may offer a waiver on currency conversion fees, depending on your profile or the type of transaction. This means you can save when shopping abroad without the extra cost of currency conversion.

- Secure Transactions: With cutting-edge security technology, such as EMV chip and 24/7 monitoring, Wells Fargo Attune ensures secure transactions wherever you are in the world. This provides peace of mind during your international travels.

How to Download the Wells Fargo Attune App

The Wells Fargo Attune app is a convenient and efficient tool for managing your credit card from anywhere, making it easier to control your finances. With the app, you can track your spending, make payments, check your balance, and more, all from the palm of your hand. Follow the steps below to download and start using the app.

- Access the App Store: If you’re using an Android device, open the Google Play Store. For iPhone users, go to the App Store. In the search bar, type “Wells Fargo Attune” to find the official app.

- Download the App: Click the download button to install the app on your device. The installation process is quick and easy, and in just a few minutes, the app will be ready for use.

- Log In: After installation, open the app and log in with your Wells Fargo account. If you don’t have an online account yet, you can create one directly in the app by providing your personal details and setting up a password.

- Manage Your Finances: Once the app is installed and you’re logged in, it’s time to explore its features. You can view your statements, pay your bill, request a credit limit increase, check rewards, and much more, all in a convenient and secure way.

- Receive Notifications and Alerts: Enable notifications to receive alerts about payments, due dates, rewards, and other important updates regarding your account. This helps you stay on top of your finances.

Contact

If you need assistance with your Wells Fargo Attune card, customer support is available to ensure your questions are resolved quickly and effectively. The bank offers various contact channels so you can choose the most convenient one, with high-quality service always at your disposal.

- Phone Support: Call the number on the back of your card or the official website. Support is available 24/7.

- Online Chat: Use the chat feature on the website or app for quick answers about your account.

- Email: Send an email to the address provided on the official website for more detailed inquiries.

- Social Media: Reach out via Facebook or Twitter, where the team responds quickly.

Contacting Wells Fargo Attune support is easy and convenient, with various options available to ensure your questions are answered quickly and efficiently. Whether by phone, online chat, email, or social media, the bank provides high-quality support that is always ready to assist you in making the most of your card. Don’t hesitate to seek help whenever needed!